Good morning team, Phil Rosen here. When I woke up yesterday, I would not have guessed that the day after a major US election (live updates here) I'd be leading the newsletter with cryptocurrency — but the world of deal-making waits for no one.

Here's the short of it: The once-top-dog crypto firm, FTX, helmed by 30-year-old billionaire Sam Bankman-Fried, is being bought by Binance amid significant liquidity issues and rumors of insolvency.

Lots of moving parts — but I'm here to walk you through it one step at a time.

If this was forwarded to you, sign up here. Download Insider's app here.

FTX

1. So, let's unpack that stunning acquisition of Sam Bankman-Fried's FTX. The move will definitely change the landscape of the trillion-dollar crypto industry, which is in the midst of a brutal bear market.

But Binance CEO Changpeng "CZ" Zhao seemed to think saving a floundering FTX was worth the risk of any future downside.

"This afternoon, FTX asked for our help," Zhao tweeted. "There is a significant liquidity crunch."

The two firms are (were?) competitors — rivals even — but Bankman-Fried issued an emphatic "thank you" via Twitter to Binance and its CEO.

"Our teams are working on clearing out the withdrawal backlog as is," Bankman-Fried tweeted Tuesday. "This will clear out liquidity crunches; all assets will be covered 1:1. This is one of the main reasons we've asked Binance to come in."

Over the last day, Bankman-Fried has seen his wealth evaporate, with his net worth shedding 94% for the biggest one-day collapse ever for a billionaire.

Let's go back a week. CoinDesk published a revealing report on November 2 about the crypto trading firm Alameda Research, another branch of Sam Bankman-Fried's empire.

Some eccentricities emerged. It turns out that the trading firm held billions of dollars' worth of FTX's native token, FTT.

Odd, right? Here's how CoinDesk put it:

"While there is nothing per se untoward or wrong about that, it shows Bankman-Fried's trading giant Alameda rests on a foundation largely made up of a coin that a sister company invented, not an independent asset like a fiat currency or another crypto."

That write-up fueled rumors about FTX's insolvency, and those concerns amplified later when users reported difficulties withdrawing cash funds from the exchange.

And remember CZ? Well he stirred the pot further with a tweet announcing that Binance was liquidating roughly $530 million in FTT token.

One thing led to the next — FTT cratered 32%, Binance agreed to purchase FTX, then the token rallied skyward 20%.

"Binance's acquisition of FTX probably stopped a lot of market contagion from happening, and this is a good thing," Brent Xu, chief executive and cofounder of Umee, a decentralized finance firm, told me after the news broke.

"People just didn't know what assets FTX had on their books, and so the result was an effective bank run that really shook the industry," he added. According to Reuters, in the 72 hours leading up to Tuesday morning's announcement that FTX would be acquired, the exchange saw $6 billion in outflows.

As the dust settles, there are likely some big money investors who backed FTX that are still scratching their heads this morning, wondering what it all means for them.

Sequoia Capital last October had invested in FTX and helped give it a $25 billion valuation. Later, other big names piled in, pushing the firm to a $32 billion valuation.

All those venture capitalists are probably thinking hard today about their investments. Anthony Georgiades, co-founder of blockchain company Pastel Network told me he doesn't think Binance is too concerned about making those investors whole again at this point.

"I would be very surprised if Binance was paying anywhere near the book-value of the underlying assets of FTX," he said. "Binance is likely coming in and saying they will cover the liabilities for FTX, and then effectively have FTX hand over the rest of their assets."

With Binance taking over another major competitor in crypto, what do you think this will bring next for the digital asset sector?

Let me know on Twitter (@philrosenn) or email me ([email protected]).

In other news:

Elizabeth Frantz/Reuters

2. US stocks are trading mixed early Wednesday, and Meta announced it would layoff more than 11,000 workers. Shares of the Facebook parent jumped roughly 3.7% in premarket trading amid the company's first-ever broad restructuring plan. Mark Zuckerberg's social media giant will see a roughly 13% cut in its workforce.

3. Earnings on deck: Roblox, Honda Motor, Siemens Healthineers, all reporting.

4. A former BlackRock stock chief broke down which companies he's bullish on right now. Crossmark's Bob Doll is warning that the market is due to retest recent lows, thanks to the Fed's persistent hawkishness. But these nine stocks are poised to weather the storm.

5. The Fed, the Bank of England, and Brazil's central bank are among those signaling less aggressive rate-policy paths. Together, they could deliver a "Santa Pause" rally for global stocks this year, analysts at Charles Schwab said Monday: "Stock markets outside the US that are outperforming the S&P 500 Index this year include many countries where the central banks are stepping down."

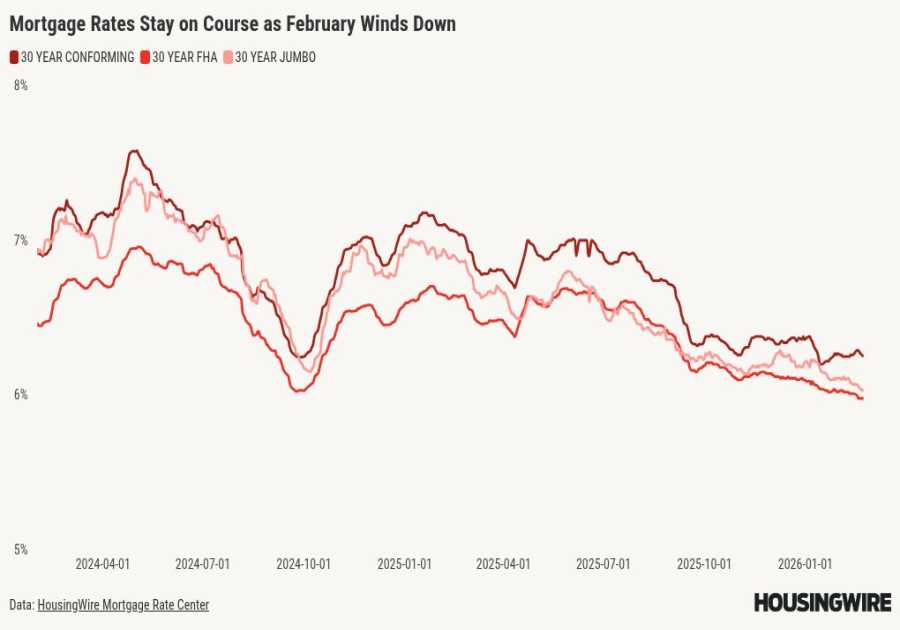

6. Mortgage rates are climbing, but higher credit quality means there likely won't be a default crisis like the 2008 crash. That's according to Goldman Sachs analysts, who wrote in a note that a surge in delinquency rates isn't likely to happen within the next year.

7. Wharton professor Jeremy Siegel predicted that the Dow could surge 2,000 points once the Fed pivots to cutting rates. He thinks if policymakers make the decision by next summer, asset prices could soar — and the US economy would still be able to escape a recession.

8. One of the richest self-made women in US real estate said it's still a good time to buy. If buyers understand the current property market, they have certain advantages to use to their benefit, she explained. She broke down the top five things for buyers to gain a competitive edge amid the uncertainty.

9. This $200 million hedge fund manager predicted the oil market's twists and turns. He shared how to protect your portfolio from an inescapable energy crisis in 2023 caused by "embarrassingly stupid" policies. "If Biden wants to create an energy crisis, I think he'll succeed beyond his wildest dreams."

Markets Insider

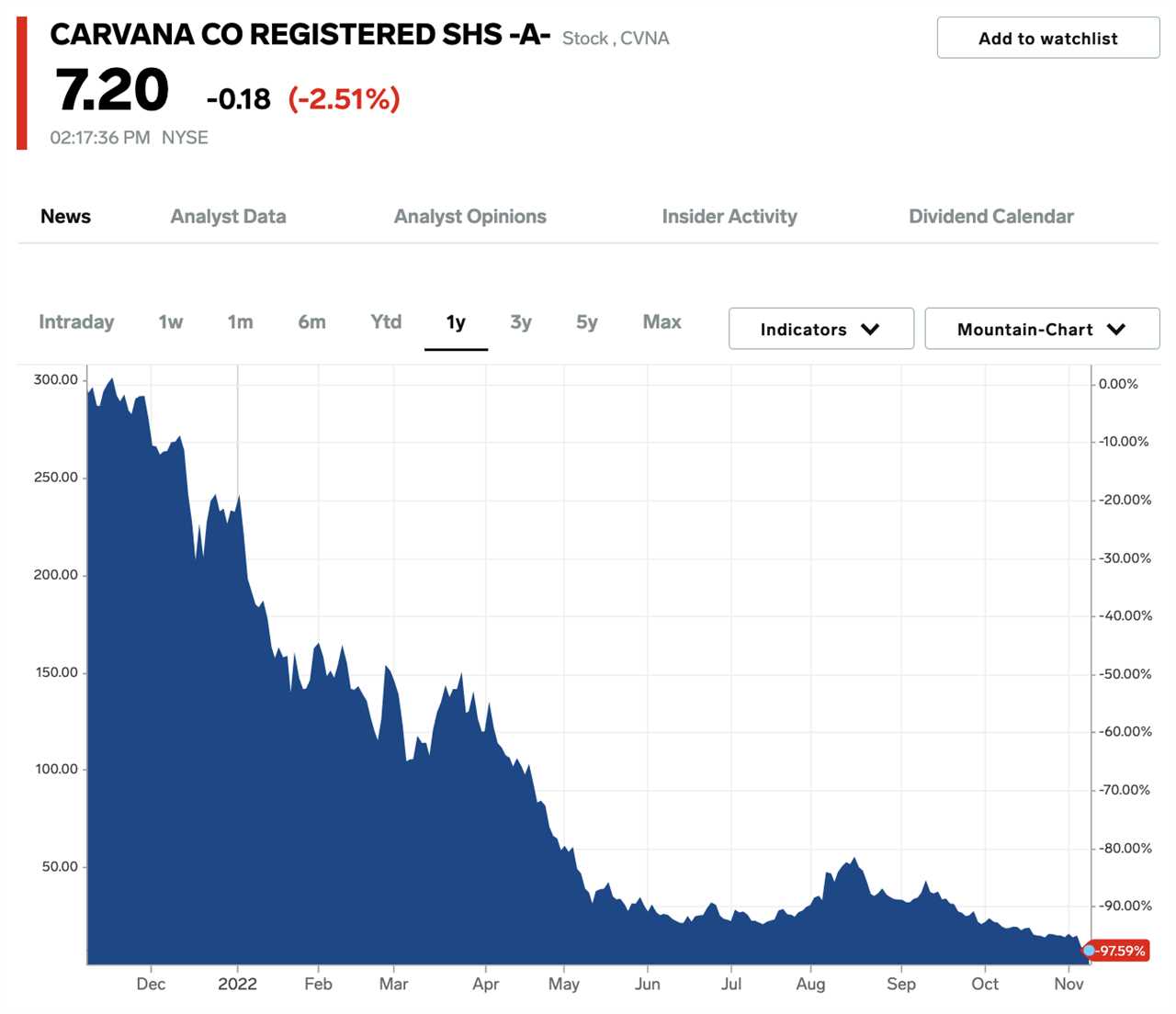

10. Morgan Stanley made a brutal call for Carvana. The firm said the slowing used-car market could drag the stock all the way down to $1 a share. Analysts said there's "material risk" in the company's outlook, which is facing pressure from a volatile interest rate market.

Keep up with the latest markets news throughout your day by checking out The Refresh from Insider, a dynamic audio news brief from the Insider newsroom. Listen here.

Curated by Phil Rosen in New York. Feedback or tips? Tweet @philrosenn or email [email protected]

Edited by Max Adams (@maxradams) and Lisa Ryan (@lisarya) in New York.

Read More

By: [email protected] (Phil Rosen)

Title: Binance just bought FTX. Here's how rumors of insolvency and fears of contagion led Sam Bankman-Fried into a deal.

Sourced From: www.businessinsider.com/binance-buys-ftx-crypto-deal-everything-markets-economy-sam-bankman-2022-11

Published Date: Wed, 09 Nov 2022 11:54:55 +0000

.png)