ING Economics

- Inflation is poised to hit the Fed's long-term 2% target by April of next year, according to ING Economics.

- ING said falling oil, rent, and vehicle prices are set to drive a continued period of disinflation.

- The ongoing decline in inflation suggests that the Fed is done hiking interest rates.

Our Chart of the Day is from ING Economics, which shows that inflation is set to hit the Federal Reserve's long-term target of 2% by April of next year and fall below 2% not long after that.

The research firm said falling oil, rent, and vehicle prices should drive further disinflation in the coming months, helping cut the current 4% inflation rate in half to 2%. Also helping drive inflation lower is a reduction in pricing power among businesses, which for the past two years relied on steady price hikes to fuel growth.

That means the Fed's interest rate hikes are likely over, with July representing the last hike of the current cycle, if ING Economics' analysis is correct.

"The Fed is still officially forecasting one further 25bp interest rate rise this year, but we doubt it will follow through. The Fed last hiked rates in July and since then financial and credit conditions have tightened," ING Economics said, citing higher borrowing costs for mortgages and credit cards.

More evidence of tightening financing conditions is the Fed's Senior Loan Officer Opinion survey, which shows that banks are increasingly hesitant to lend money out to businesses and consumers.

"This combination of sharply higher borrowing costs and reduced credit availability tends to be toxic for growth," ING Economics said, and that should be enough to help drive inflation lower from here, as well as a possible slowdown in the US economy.

"With real household disposable incomes falling for the past four months amid evidence of increasing numbers of households having exhausted pandemic-era savings, we expect to see GDP contract in at least two quarters in 2024," ING Economics said.

The dynamic of falling inflation and a decline in economic growth represents the push and pull the stock market will likely face in the next year. While a more dovish Fed is typically bullish for stocks, slow or negative economic growth could ultimately weigh down investor sentiment and ultimately stock prices.

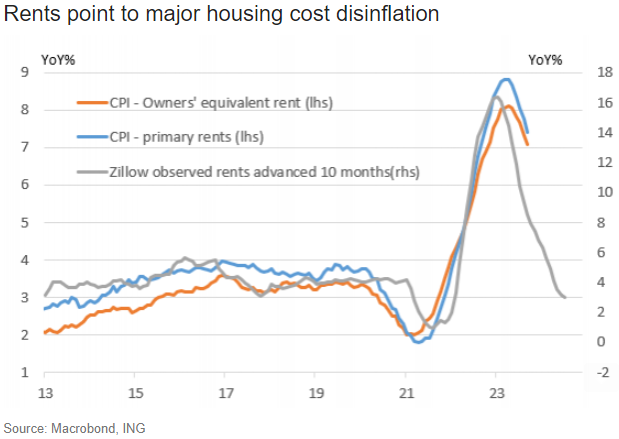

The ideal scenario for the economy is one in which the biggest inflation driver, housing/rent costs, continues to move lower while the rest of the economy holds firm. This would help drive a continued trend in disinflation without sacrificing a slowdown in the economy.

ING Economics

ING Economics highlighted that rent makes up 32% of the core CPI index, and rent data from Zillow shows that year-over-year growth in observed rent prices have moderated back to pre-pandemic levels. The official measures of rent in the CPI index should follow the same trend, albeit at a lag.

All of this suggests to ING Economics that not only will inflation fall back to the Fed's 2% target by April of 2024, but that it will continue to dip even lower to about 1.5% during the summer months of next year. And if that's the case, it's mission accomplished for the Fed.

Read More

By: [email protected] (Matthew Fox)

Title: CHART OF THE DAY: Inflation will hit the Fed's 2% target by April and keep falling, analyst says

Sourced From: www.businessinsider.com/falling-inflation-outlook-fed-target-interest-rates-rent-prices-oil-2023-11

Published Date: Thu, 09 Nov 2023 15:37:48 +0000

.png)