BI

- This post originally appeared in the Insider Today newsletter.

- You can sign up for Business Insider's daily newsletter here.

Happy total solar eclipse day! More than 30 million people can see the moon obscure the sun today. Here's a guide for where you need to be and when to get the best view.

In today's big story, we're looking at how China's plan for reinvigorating its economy has the rest of the world worried.

What's on deck:

Markets: Nvidia's skyrocketing stock price might finally slow down.

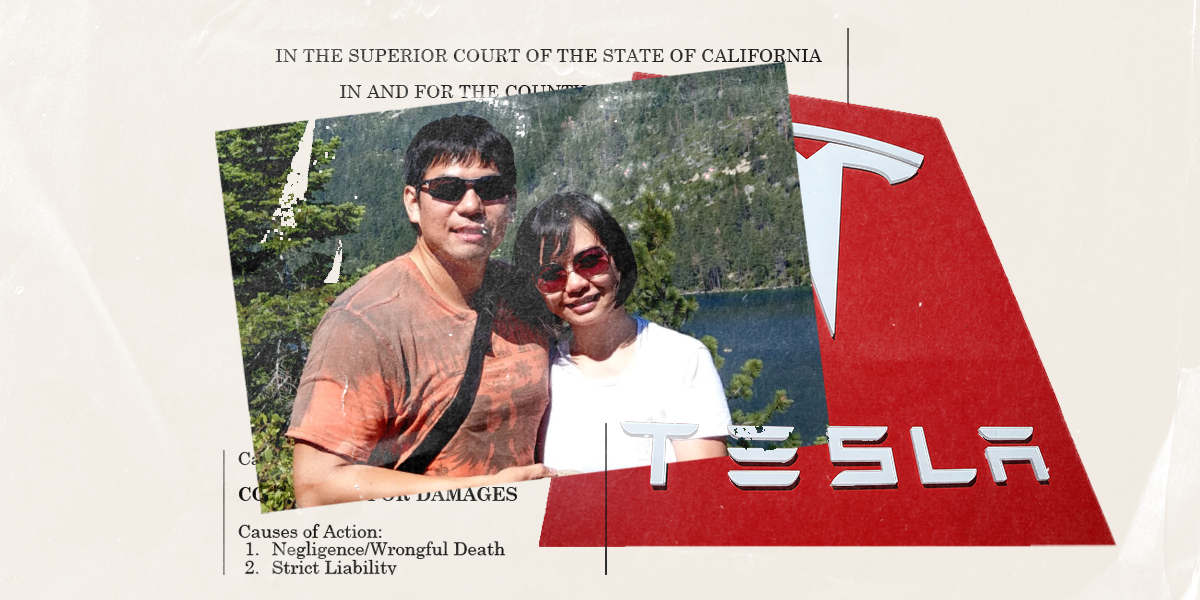

Tech: A wrongful death lawsuit against Tesla starts today.

Business: Sneaky new credit card fees could be on the horizon.

But first, it's a building bonanza.

If this was forwarded to you, sign up here.

The big story

The return of China shock

Chelsea Jia Feng/BI

If you build it, they will come. Even if they don't, just keep building.

That's the West's major concern with China these days. The country is overproducing goods and then flooding global markets with them to save its struggling economy, writes Business Insider's Huileng Tan.

We've seen this strategy before in China. Decades ago, as the country opened up its economy, China underwent rapid industrialization, allowing it to produce cheap goods.

The US and other countries cheered China on, profiting handsomely along the way from the lower production costs. But the result was US communities that relied on manufacturing jobs were decimated.

The process was known as "China shock," and the rest of the world isn't interested in a sequel, Huileng writes.

China shock 2.0 isn't a total repeat. This time, China's focused on green energy, which involves making electric vehicles, solar cells, and lithium-ion batteries. And it's also building out a supply chain to get the materials to produce the stuff, which is also concerning for the West.

US Treasury Secretary Janet Yellen has already warned China shock 2.0 could destabilize the global economy, specifically impacting green-energy exports. And a New York Federal Reserve report suggests this could ultimately lead to higher inflation in the US.

PhonlamaiPhoto/Getty, Tyler Le/BI

Even as it faces global pressure, some believe China remains a good investment.

Most notable among them is Ray Dalio. The billionaire founder of Bridgewater Associates has been a long time investor in the country, and that's not going to change anytime soon. He acknowledged China faces some major challenges, describing it as a "100-year storm." But he's not looking to exit. Instead, he believes it's the best time to invest in China, citing the adage "the time to buy is when there is blood in the streets."

Dalio's not alone in his optimism. Economist Nicholas R. Lardy believes experts are misreading the data. He pointed to China's GDP growth outpacing the US when the numbers are adjusted for disinflation and inflation in each country, respectively.

Regardless of which side you fall on, it's a topic that'll remain relevant for the foreseeable future.

US-China relations will be a focus in the lead-up to the presidential election. And while former President Donald Trump has been more vocal about ramping up the trade war, both candidates are expected to address it head-on, if elected.

News brief

Your Monday headline catchup

A quick recap of the top news from over the weekend:

The US-China relationship appears to be warming up, but Russia could still be a sticking point.

Coach Dawn Staley and the Gamecocks won the NCAA women's championship. Here's how much she makes.

'All That' star Giovonnie Samuels says Dan Schneider reached out to her before 'Quiet on Set' aired and asked her to publicly support him.

Russia is losing close to 1,000 soldiers in Ukraine every day, but it won't stop relying on mass assaults to brute-force frontline advances: UK intelligence.

Mark Zuckerberg owns over 1,200 acres of land. Here's a look at his properties across the US, from a Hawaiian doomsday bunker to Lake Tahoe estates.

Meet Sam Altman's family.

Saudi Arabia's futuristic $500 billion Neom megacity just got a lot smaller ... for now, report says.

3 things in markets

Michael M. Santiago/Getty, Tyler Le/BI

Nvidia's hot streak could be ending. Some Wall Street analysts are cooling on the stock market's golden child, suggesting it can't keep its rapid pace of growth. There's also the risk companies start building chips to run specific AI workloads in-house.

The nightmare of no rate cuts this year could become a reality. What once seemed like an impossibility — interest rates remaining untouched in 2024 — could now be where things are headed, according to some experts.

Angus Deaton is having a rethink. The Nobel Prize-winning economist told BI that his views on unions, free trade, and immigration have shifted in recent years. "I think the country is in sort of a bad way, in spite of all this hoopla that's going on about how well we're doing economically. And so I'm an economist now sort of thinking, 'well, how should I change my practice of economics a little bit?'" he said.

3 things in tech

Sevonne Huang; Justin Sullivan/Getty Images; Alyssa Powell/BI

Tesla is going on trial over a deadly 2018 Autopilot crash. Apple engineer Walter Huang died when his Tesla Model X SUV crashed into a concrete barrier while in Autopilot mode. The EV maker is heading to court today over a wrongful death lawsuit filed by his family.

Apple is falling far from the tree. It's been a rough 2024 for the tech giant, with a slump in iPhone sales, stalled EV plans, and a massive antitrust lawsuit. Worst yet: Last week, the company laid off 600 staffers.

Wall Street has a new tech obsession. Analysts can't stop talking about Salesforce competitor Hubspot. Its stock surged last week after Reuters reported that Google parent Alphabet had discussed making an offer to buy the $34 billion software company.

3 things in business

Mikel Jaso for BI

The biggest secret at work: your office crush. Throughout the years, workplace crushes have remained remarkably common. It makes sense — we spend half of our waking lives at work. These crushes have the power to bring out our best work and even make the office experience fun. But they can also make it a soul-crushing one.

Get ready for sneaky new credit card fees. While some fees may soon be getting smaller, it just means that companies are about to find new ways to get money out of you.

Younger generations are splashing the cash on groceries. McKinsey polled 4,000 people and found that groceries are the hottest new splurge category for millennials and Gen Zers. That's been good news for companies like the flashy canned water brand Liquid Death, recently valued at $1.4 billion.

In other news

There is no loneliness epidemic.

Apollo's Leon Black says he is so wealthy he didn't know he'd paid Jeffrey Epstein $158 million.

Google's executive productivity advisor says these 2 common 'pitfalls' are making people less efficient at work.

Instagram makes more ad money than YouTube, new court filings reveal.

If you've been laid off or fired, here's what you should tell employers in your next job interview.

Job growth surged far more than expected in March.

Meet the world's richest self-made woman — a shipping magnate worth $33 billion.

What's happening today

The first total solar eclipse will be visible to the US since 2017.

The NCAA's men's basketball championship game will take place in Glendale, Ariz.

The Insider Today team: Dan DeFrancesco, deputy editor and anchor, in New York. Jordan Parker Erb, editor, in New York. Hallam Bullock, editor, in London. George Glover, reporter, in London. Grace Lett, associate editor, in Chicago.

Read More

By: [email protected] (Jordan Parker Erb)

Title: China's plan for reinvigorating its economy has the West worried, but others still see an opportunity

Sourced From: www.businessinsider.com/china-shock-economy-infrastructure-green-energy-janet-yellen-exports-us-2024-4

Published Date: Mon, 08 Apr 2024 13:44:00 +0000

Did you miss our previous article...

https://trendinginbusiness.business/business/digital-detox-unplugging-for-mental-clarity-and-wellbeing

.png)