Oscar Wong/Getty Images

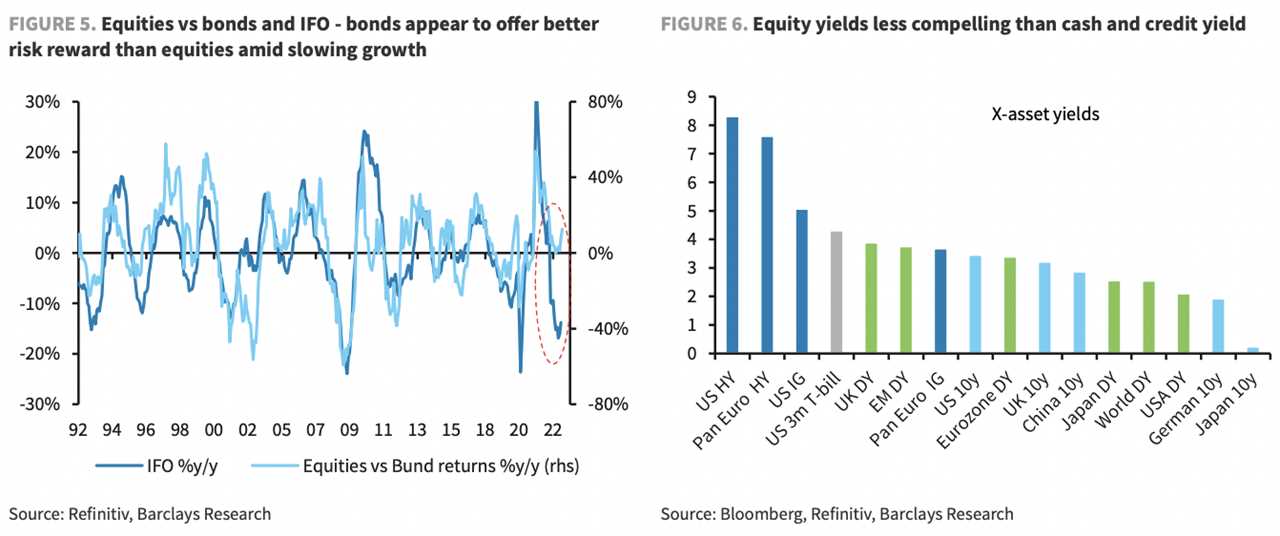

- "The risk/reward for equities vs. bonds/cash currently looks unexciting," with global economic growth prospects unlikely to rev up soon, Barclays said.

- While stocks deliver a yield, they face headwinds from further cuts in earnings projections, according to a note.

- A global economic downturn could accelerate with central banks voicing higher-for-longer stances on interest rates, analysts said.

Owning stocks looks less appealing than investing in bonds and cash because that asset class faces earnings downgrades as the threat of global recession looms in 2023, said Barclays.

The drop in stocks alongside mixed action in bond yields last week suggested investors are swinging attention to worries about economic contraction and fretting less about inflation, which is still raging at scorchingly high levels but showing signs of peaking.

Economic conditions have been faring better than anticipated but a slowdown could deepen, particularly with global central banks last week "doubling down" on higher-for-longer rhetoric about interest rates, Barclays' European equity strategists said to clients in a note late last week.

"If we really have seen the turn in inflation and the bulk of repricing higher in rates, owning cash or bonds at these yield levels feels arguably more attractive than owning equities," Emmanuel Cau, head of European equity strategy at Barclays, wrote in the team's last note of 2022.

Equities also deliver a yield but attached to them are earnings and recession risk and price volatility whereas bonds may "reprise their old role" of being a relative haven and their current yield provides some cushion, he said.

"The risk/reward for equities vs. bonds/cash currently looks unexciting to us then, with the economy unlikely to accelerate any time soon," Cau wrote.

'Little fundamental upside'

The Federal Reserve last week chopped down its 2023 GDP growth estimate to 0.5% compared with its 1.2% projection issued in September. Separately, the European Central Bank downwardly revised its growth guidance for next year to 0.5% from 0.9%. That would mean a potential slowdown from 3.4% in 2022.

The Fed, the ECB, and the Bank of England last week each downsized rate hikes to 50 basis points from 75 basis points. But policymakers, including Fed Chair Jerome Powell, indicated more increases are in the pipeline as inflation remains well above targets at or around 2%.

"We see little fundamental upside for equities at current levels, even after pricing in some form of P/E relief if we assume the threat of much higher rates recedes," said Cau, adding that earnings projections should keep coming down, a likely headwind for stocks.

"Q4 earnings may be the next reality check for equities, but we suspect the widely anticipated earnings reset may take longer to materialise than just one quarter," he wrote.

The near-term outlook for earnings "may not be that bad" partially because input costs are falling. "But as long as the growth-policy mix remains tricky, investors may not give it the benefit of the doubt," Cau said.

Last week's selloff in equities pushed the S&P 500's year-to-date loss of 19%. The MSCI Europe Index, which tracks more than 400 large and mid-cap stocks in the region's developed markets, has slumped 16%.

Data last week showed US consumer price inflation rose to 7.1% in November but marked the lowest reading since December 2021. Euro area annual inflation was 10.1% last month, down from 10.6% in October.

Barclays

Read More

By: [email protected] (Carla Mozée)

Title: Investors should own cash and bonds instead of stocks in 2023 as earnings-growth and recession risks flare, Barclays says

Sourced From: markets.businessinsider.com/news/stocks/stock-market-outlook-2023-bonds-earnings-economy-inflation-risks-cash-2022-12

Published Date: Mon, 19 Dec 2022 13:25:32 +0000

Did you miss our previous article...

https://trendinginbusiness.business/business/toyotas-ceo-isnt-fully-sold-on-electric-cars-mdash-and-he-says-a-silent-majority-is-on-his-side

.png)