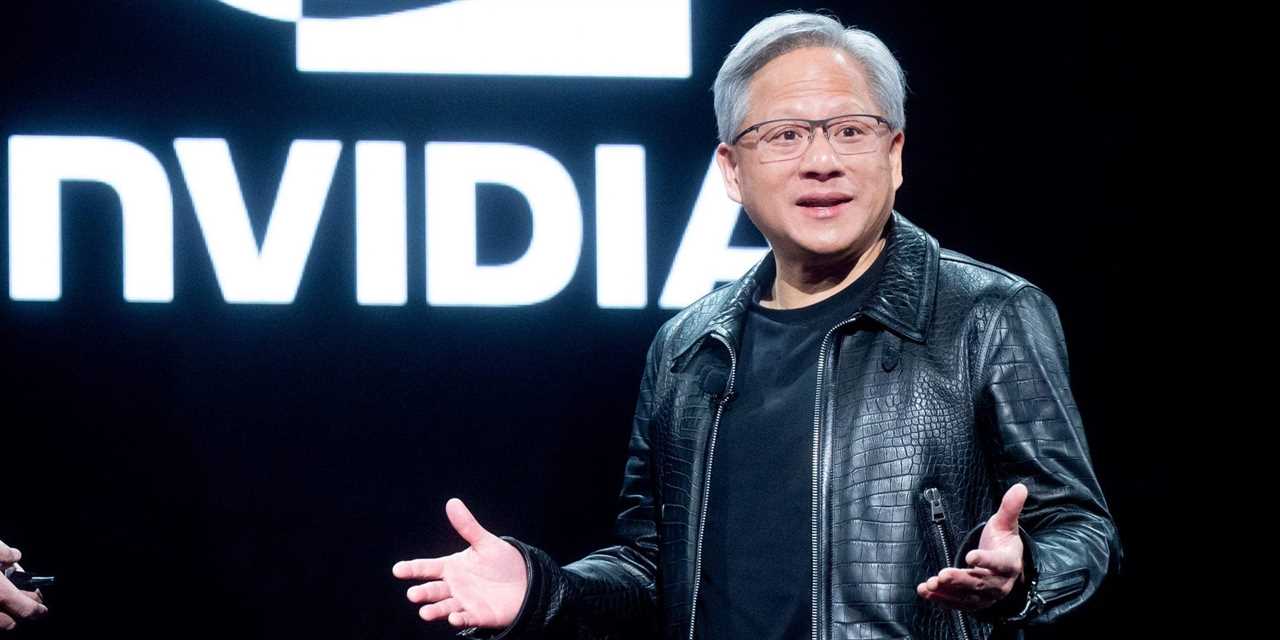

Noah Berger/Getty Images

- Nvidia stock could triple if it follows Cisco's path during the dot-com bubble, Jeremy Siegel said.

- The chipmaker could be worth more than $6 trillion and blow away Apple and Microsoft, he said.

- The Wharton finance professor said speculation is less extreme now than during the internet boom.

Nvidia could triple in value to become the world's first $6 trillion-plus company if it follows Cisco's trajectory during the dot-com bubble, Jeremy Siegel said.

The microchip maker's stock has surged by more than 500% since the start of 2023, including a near-90% jump in the past 10 weeks alone.

It's now worth $2.3 trillion, propelling it past Amazon and Alphabet and leaving only Microsoft ($3.1 trillion) and Apple ($2.7 trillion) ahead.

"The big question for Nvidia, and tech more broadly, is: are we in a 1996-97 hype cycle where these stocks are still going to get even crazier as we did 24 years ago during the internet mania?" Siegel wrote in his WisdomTree commentary this week.

The retired Wharton finance professor and author of "Stocks for the Long Run" gave the example of Cisco. The networking giant's stock skyrocketed 1,000-fold in the decade between its IPO and its dot-com peak in March 2000, making it briefly the world's most valuable company with a market cap of $569 billion.

"There could be 2-3x more upside in Nvidia if it follows Cisco's valuation path to its peak," Siegel said. "To be clear — this is not my prediction of what will happen — just to note as to what is possible in a mega bubble."

Siegel's comment suggests that if Nvidia is indeed the new Cisco, its stock could rocket above $2,500, valuing the company as high as $6.4 trillion. A market cap of that size would make it worth roughly two Microsofts, 12 Teslas, or 42 Nikes.

Sensible valuations

Ark Invest's Cathie Wood also likened Nvidia to Cisco in a recent investor letter. The comparison is far from flattering, as Cisco stock crashed about 90% once the internet bubble burst and has never come close to reclaiming its dot-com highs.

"Now we emphatically do not have 1999-2000 levels of speculation in the markets or tech," Siegel said. Growth stocks are trading around 30 times forward earnings — half their multiple in 2000 — and there are many more proven, profitable businesses with sensible valuations now versus 25 years ago, he noted.

Nvidia's stock has skyrocketed because there's insatiable demand for its graphics chips from artificial-intelligence companies such as Meta and Tesla. Booming sales sent its revenue up 265% year-on-year last quarter to $22.1 billion, raising its operating income by nearly 1,000% to $13.6 billion.

The chipmaker has also benefited from a broader rally in stocks, which has lifted the benchmark S&P 500 index to record highs this year.

Investors are betting the Federal Reserve will begin cutting interest rates this year, boosting corporate profits and bolstering the appeal of stocks as yields on bonds and savings accounts fall.

Read More

By: [email protected] (Theron Mohamed)

Title: Nvidia could be worth $6 trillion if it follows Cisco's dot-com trajectory, says Jeremy Siegel

Sourced From: www.businessinsider.com/nvidia-stock-price-cisco-siegel-dot-com-bubble-ai-tech-2024-3

Published Date: Wed, 13 Mar 2024 12:33:17 +0000

Did you miss our previous article...

https://trendinginbusiness.business/business/sending-cash-abroad-5-easy-ways-to-safeguard-your-money-transfer

.png)