Warner Bros. Pictures/Roadshow Entertainment

- UBS's head of asset allocation in the US said AI could fuel a new Roaring '20s.

- The question may not be whether there's a Goldilocks scenario, but a red-hot AI-fueled economic surge.

- Nvidia's earnings call in particular could mark an inflection point, he said.

Nvidia may not only be the "most important stock in the world," as Goldman Sachs says, but its financial results could mark the turning point for the broader economy to enter a new Roaring '20s, according to Jason Draho, head of asset allocation Americas for UBS Global Wealth Management.

In a Monday note, Draho said AI megatrends and an absence of negative supply shocks could generate higher productivity without sparking a rebound in inflation. Nvidia's earnings beat last week in particular could push the economy past a mere Goldilocks, no-recession scenario and into a new boomtime.

"It wasn't simply that the company beat expectations, it was the possibility of an even faster-than-expected AI-related spending and adoption ramp up," Draho said, highlighting Jensen Huang's acknowledgment that demand for AI is surging worldwide.

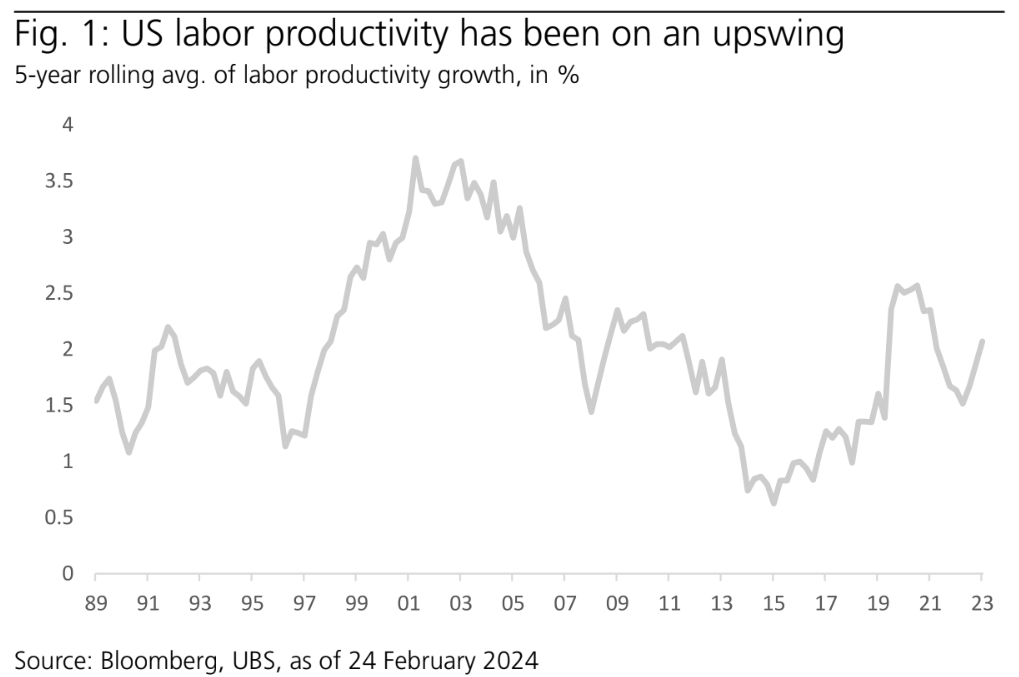

A ramp-up in AI spending supports the existing upbeat data for productivity growth. Labor productivity jumped 3.2% in the fourth quarter to cap off a strong year. The five-year rolling average of 2.1% puts it at the highest level in over a decade, per UBS, excluding stretches of the pandemic.

UBS, Bloomberg

"[T]he combination of a tight labor market, increased capex, and AI all directionally support this productivity surge continuing," Draho said. "If it does for at least another year, then the argument for structurally higher trend growth, i.e., a Roaring '20s regime, should strengthen, providing a tailwind for a market narrative shift."

Nvidia saw a 16% one-day gain last Thursday, the day after its huge earnings beat. It cost short sellers $3 billion in paper losses, data from S3 Partners shows, and the results fueled a market-wide rally. Wall Street firms continue to share what's effectively become a consensus bullish view on the stock, and that's helped power Nvidia's market cap to record highs.

To Draho's point, Wedbush's Dan Ives, who calls Jensen Huang the "godfather of AI," has reiterated his bullishness on the stock over recent weeks and its impact on the macroeconomic landscape.

"[T]his is a 1995 Moment as now the AI Revolution and $1 trillion of incremental spending over the next decade is hitting the software ecosystem and rest of tech sector," Ives wrote in a recent note. "Nvidia and the golden GPUs are the start of the spending wave."

Shifting market expectations

The distinction between a Goldilocks scenario — strong growth and disinflation — and a Roaring '20s — above-trend growth and disinflation — may seem subtle, but markets are starting to reflect a shift toward the latter, in Draho's view.

The market-implied neutral fed funds rate has climbed 40 basis points since December and it's now hovering near levels last seen in the early 2010s. It's also 100 basis points above the Fed's own estimate for the long-term neutral rate of 2.5%, Draho said, which suggests that investors are indeed "warming up to a Roaring '20s outcome."

"If they weren't, it would be hard to square the market pricing a higher neutral rate with growth returning to pre-pandemic levels," he explained.

Draho believes both a Goldilocks and Roaring '20s outcome remain possible, but the latest upside earnings surprise from Nvidia affirms the momentum in generative AI and raises the likelihood for multi-year, above-trend growth.

"Consequently, the Goldilocks market narrative is likely to prevail for the time being, assuming the data cooperates," Draho said. "But it may have to acquiesce to the Roaring '20s sooner rather than later if AI developments continue to accelerate."

Read More

By: [email protected] (Phil Rosen)

Title: Nvidia's earnings could mark the start of the Roaring '20s for the US economy

Sourced From: markets.businessinsider.com/news/stocks/economic-outlook-nvidia-stock-earnings-roaring-20s-wall-street-markets-2024-2

Published Date: Mon, 26 Feb 2024 20:38:32 +0000

Did you miss our previous article...

https://trendinginbusiness.business/business/toyota-was-right-about-hybrid-cars-all-along

.png)