Spencer Platt/Getty Images

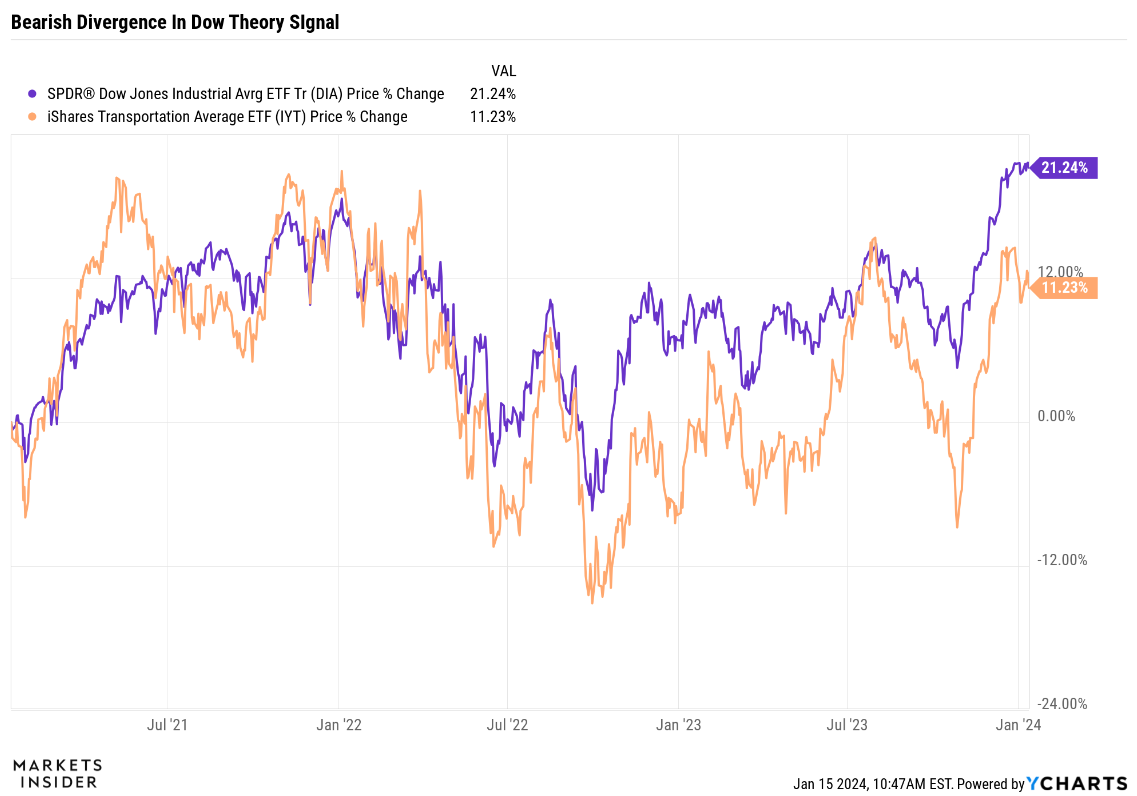

- Record highs in the stock market have yet to be confirmed by a more than 100-year-old indicator.

- The Dow Transportation Index hasn't reached new all-time highs, while the Dow Industrial average has.

- Dow Theory says both indexes need to move in tandem to confirm a bull market in stocks.

Record highs in the stock market have yet to be confirmed by a more than 100-year-old indicator: Dow Theory.

While the Dow Jones Industrial Average has been trading at new all-time highs over the past two weeks, the Dow Jones Transportation Average is still trading 9% below it's record closing high. When both are moving higher in lockstep, they provide a bullish signal for stocks, according to the theory.

The current divergence between the two major stock market averages represents a tactical risk for US equities in 2024, according to a recent note from Bank of America.

"The Dow Theory remains on its bullish signal from mid July, but this bearish divergence sets up a non-confirmation, which is a tactical risk for US equities entering 2024," Bank of America technical strategist Stephen Suttmeier said.

The thinking behind Dow Theory is that if the economy is doing well and consumers are buying goods, transportation firms should also be doing well because they are tasked with moving those goods, which is vital to ongoing economic growth. The theory was created by Charles Dow and is based on hundreds of his editorials published in The Wall Street Journal more than 120 years ago.

The continued weakness in the Dow Jones Transportation Average is a red flag because transportation stocks are viewed as a leading indicator for the stock market and economy. If transportation companies see a slowdown in growth and their stock prices fall, it could be a grim warning for the rest of the economy and the stock market.

Two major components of the transportation average are FedEx and UPS, which have both offered lukewarm outlooks for their businesses in recent months.

For the Dow Theory signal to confirm the bullish breakout in stocks over the past few weeks, the Dow Transportation Average would need to surge about 10% to close at record highs. On the flipside, any continued weakness in transportation stocks could spell trouble for the broader market rally.

YCharts

Read More

By: [email protected] (Matthew Fox)

Title: Record highs in the stock market are defying a 100-year-old indicator

Sourced From: www.businessinsider.com/stock-market-record-highs-outlook-dow-theory-indicator-transports-industrial-2024-1

Published Date: Mon, 15 Jan 2024 17:01:22 +0000

Did you miss our previous article...

https://trendinginbusiness.business/business/i-went-on-a-1000-5day-budget-trip-to-the-maldives-here-are-5-things-i-did-to-save-money

.png)