Bob Henry/UCG/Universal Images Group via Getty Images

- The boom in luxury goods is over as consumers pull back on their multiyear high-end spending spree.

- That's evidenced by the rout in LVMH stock, which has fallen about 20% over the past six months.

- Luxury companies may not be able to depend on the ultra-rich to boost sales amid a shaky economic outlook.

Consumers' spending spree on high-end goods that kicked off during the pandemic has petered out.

Luxury retailers that enjoyed bountiful profits during in recent years are beginning to feel some pain in 2023 as financial conditions tighten and consumers appear to pull back on ultra-high-end purchases.

LVMH stock fell to a fresh 2023 low in trading in Paris on Thursday, slipping to 675 euros after the firm reported weaker than expected quarterly revenue growth. Sales grew 9% in the quarter, down from the 17% increase reported in the prior three months. Shares of the European luxury giant have fallen about 20% over the past six months, and according to Bloomberg, LVMH has led a sell-off that's erased $245 billion in value from Europe's seven biggest luxury firms in that time.

"Today's news that LVMH's revenue growth has slowed dramatically likely marks the end of a global luxury bubble," DataTrek cofounder Nicholas Colas said in a note on Thursday. "LVMH is a very well-managed business, and investors have gotten used to seeing it post strong double-digit top line increases."

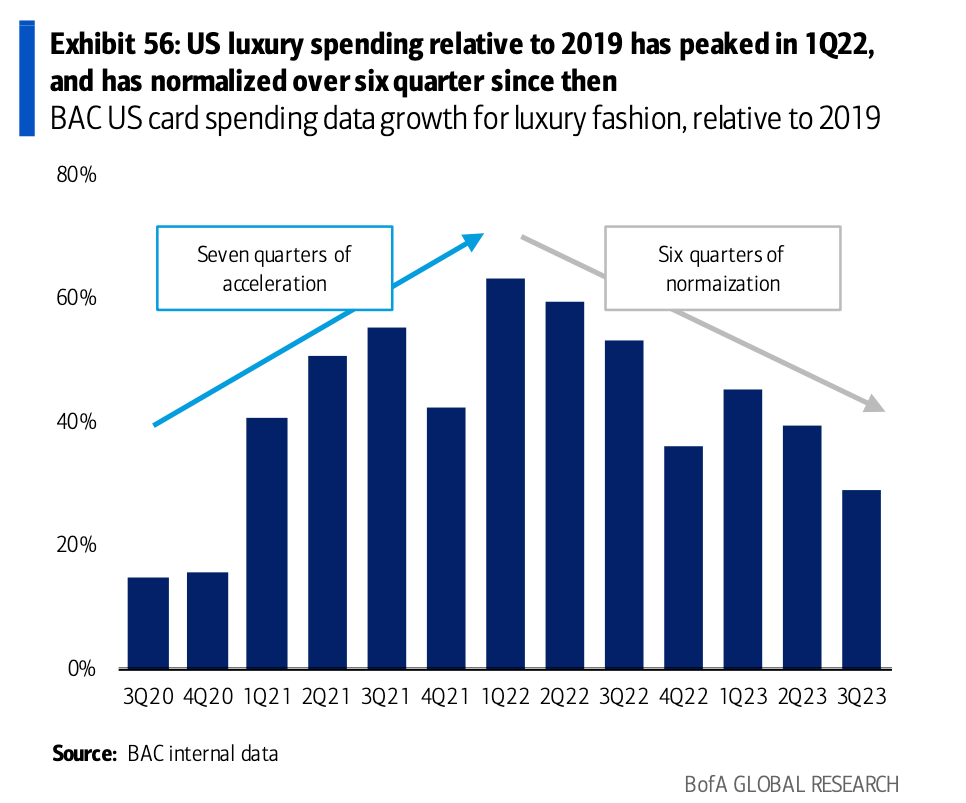

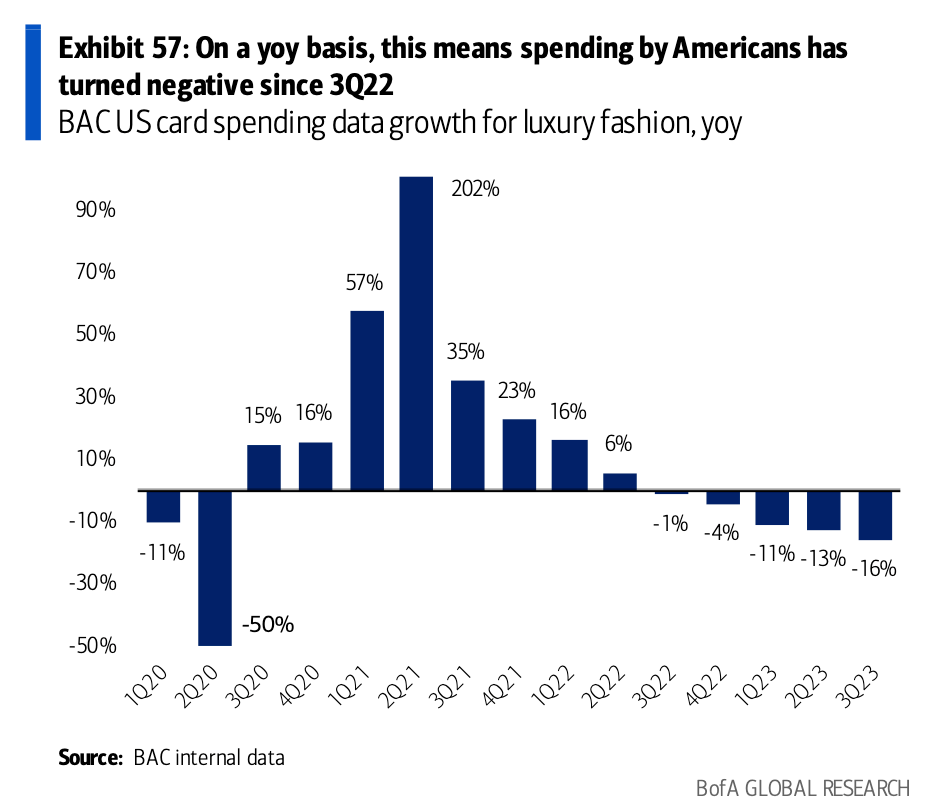

In the US, card spending for luxury fashion has been on the decline for six quarters in a row, with luxury fashion spending down 16% year-over-year over the past quarter, Bank of America card data shows.

Bank of America

Bank of America

In the US, Tapestry and Ralph Lauren, the two luxury brands in the S&P 500, have also slid considerably in 2023, and luxury stocks overall are down 17% from their most recent peak, Bank of America estimated.

Industry experts have cautioned that luxury brands — which have previously enjoyed a reputation as being "recession-proof" — are now unable to rely on high-income consumers to keep boosting profits during uncertain economic times.

That's due in large part to China's economic woes in 2023. Consumers in the world's second largest economy have previously been huge buyers of US and European luxury items, but that's slowed as the country deals with an array of economic problems, including sluggish consumer demand.

Experts also warn Americans' incredibly resilient spending habits may be about to reverse course, particularly as student loan payments restart and shoppers blow through excess savings they piled up during the pandemic. The San Francisco Fed predicted earlier this year that US consumer would run out of savings by the end of last quarter, and analysts have sounded the alarm on the potential impact to retail stocks.

But the rout in luxury brands' shares could have one beneficiary: the US tech sector. That's because European investors often say tech stocks are a competitor to luxury stocks in their portfolios, Colas said.

Tech names are also riding a wave of investor excitement as firms enter an arms race in the artificial intelligence space.

"The difference is that Tech is constantly creating 'new new' products at all price points, where luxury brand portfolios are largely stacked with many similar products at very high price points. A Kelly bag in a new, rare leather does not count as disruptive innovation," he said.

Colas added that tech, healthcare, and luxury retail have been among the few true growth industries in recent years. As luxury brand stocks stumble amid the spending pullback around the world, and healthcare remains better suited for defensive plays, the only obvious option for investors looking for growth stocks is tech.

Read More

By: [email protected] (Jennifer Sor)

Title: Shares of luxury brands are tumbling in a sign consumers' high-end spending spree is over

Sourced From: markets.businessinsider.com/news/stocks/luxury-recession-boom-consumer-spending-lvmh-stock-price-us-economy-2023-10

Published Date: Sat, 14 Oct 2023 12:45:01 +0000

Did you miss our previous article...

https://trendinginbusiness.business/business/an-astonished-family-discovered-that-a-painting-that-decorated-their-living-room-for-decades-was-a-van-dyck-that-could-be-worth-millions

.png)