Welcome back, readers. I'm Phil Rosen, writing to you from New York.

Now that it's April, we can say a spate of banks collapsed last month, but the repercussions of the crisis continue to unfold as if it all happened yesterday.

The chatter now centers around a looming credit crunch — but the troubling part is that red flags were flying well before we heard a peep from Silicon Valley Bank.

If this was forwarded to you, sign up here. Download Insider's app here.

LumiNola/Getty

1. Before March, the number of small- and mid-sized businesses filing for bankruptcy was already on the rise, meaning the bank turmoil only exacerbates an existing trend.

UBS strategists wrote in a note last week that those companies have been facing pressure from rising rates, sticky inflation, and slowing growth.

Already in 2023, the number of private bankruptcies has surpassed the previous peak set in the early stage of the COVID-19 pandemic, my colleague Carla Mozeè writes.

Bankruptcy hot spots right now, according to UBS, include the real estate industry, which has led this year's increase in filings, but the healthcare sector could follow suit as credit stress seeps into the labor market.

The FDIC is facing more than $20 billion in costs as a result of the tumult, and the failures last month have stoked concerns that other vulnerable banks will soon be forced to pull back on lending as they see lower deposit rates and tighter financial conditions.

Those smaller regional and community banks are particularly critical as a source of credit to small and mid-sized businesses, UBS said, as they hold 40% of the loans and debt to those companies.

"The YTD spike is nevertheless stark — outright and relative to public filings — and a clear indication that a fulcrum of credit stress this cycle is in smaller corporates," strategists said.

All this is to say Wall Street's pain could eventually become a Main Street credit crunch.

With trillions of dollars worth of deposits flying out of US banks since the Fed began tightening policy, and much of that coming out since SVB failed, individuals as well as businesses could soon find it harder to get a loan from their bank.

What risks are you watching as far as a credit crunch in the US for the coming months? Tweet me (@philrosenn) or email me ([email protected]) to let me know.

In other news:

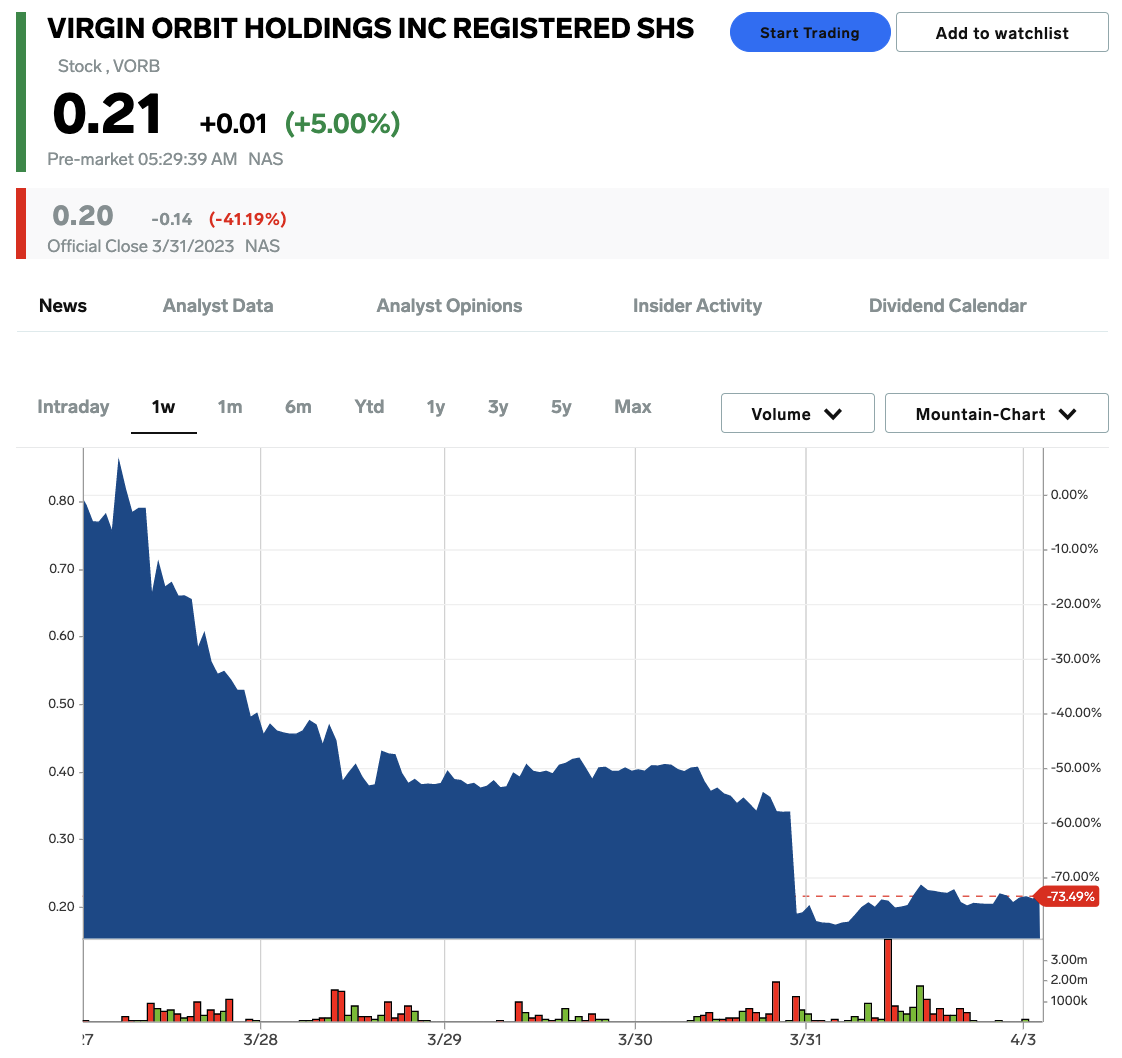

Virgin Orbit

2. Oil prices rise early Monday after OPEC+ surprised traders by announcing a production cut of 1.16 million barrels per day, squeezing global crude supplies and reviving concerns about inflation. Here are the latest market moves.

3. On the docket: Broadcom, Walt Disney, and more, all reporting.

4. Goldman Sachs strategists recommended this batch of stocks that are priced right and set for strong growth. An uncertain economy will weigh on equities, but certain high-quality growth names could still outperform in a downturn. See their list of 32 stocks.

5. First Citizens, the company that bought Silicon Valley Bank's assets, is run by a family that's no stranger to buying failed banks. The bank is run by a billionaire North Carolina family that's bought over 20 small failed banks since 2008. With the recent takeover, it's poised to stand among the largest 20 banks in the US.

6. Nouriel Roubini thinks Fed rate hikes pose a "megathreat" to the economy. The economist, known as "Dr. Doom", says rate hikes along with mountains of debt will eventually send the US into a financial crisis. He described three obstacles markets are staring down now.

7. The US dollar has slipped against rivals over the last five weeks. The greenback had a banner year in 2022, but recent dips could be a sign of things to come. One analyst said the currency is about to "stare into the abyss."

8. The global investment strategist at a $124 billion firm broke down why the banking crisis could spread to other sectors. Hartford Fund's Nanette Jacobson said March's uncertainty could continue — and worsen a recession that hits sooner than anyone expects.

9. A bond-market indicator shows there's trouble brewing in the banking system. Market researcher Jim Bianco said there's still turmoil ahead, and it's not just the yield curve that's raising concern. He thinks investors are underestimating the risk posed to the economy.

Markets Insider

10. Shares of Richard Branson's Virgin Orbit crashed on Friday. The satellite company announced it would cease operations "for the foreseeable future," as it hasn't secured adequate funding to move forward. Get the full details.

Curated by Phil Rosen in New York. Feedback or tips? Tweet @philrosenn or email [email protected].

Edited by Max Adams (@maxradams) in New York and Hallam Bullock (@hallam_bullock) in London.

Read More

By: [email protected] (Phil Rosen)

Title: Small businesses are filing for bankruptcy at a higher rate than at the peak of the pandemic - and a looming credit crunch could make things worse

Sourced From: www.businessinsider.com/us-credit-crunch-bankruptcy-bank-crisis-svb-fed-inflation-markets-2023-3

Published Date: Mon, 03 Apr 2023 10:05:00 +0000

.png)