Michael Nagle/Xinhua via Getty

- Investors can't stop piling up cash, with assets in money market funds ballooning to a record $5.3 trillion.

- The surge in cash comes amid a combo of high interest rates and depressed investor sentiment towards the stock market.

- But that massive pile of cash could be the fuel needed to drive the next bull market rally.

Investors are hoarding cash at record levels and there's no sign of the trend reversing amid high interest rates and depressed investor sentiment towards the stock market.

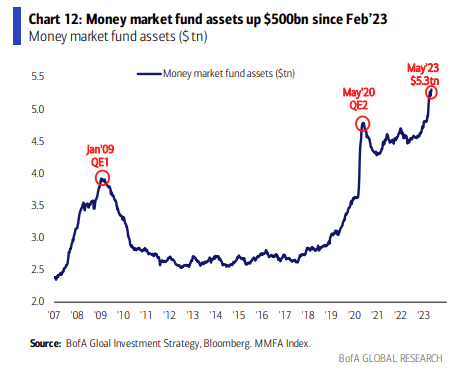

Money market fund assets have ballooned to a record $5.3 trillion, with inflows surging by $588 billion over the past ten weeks, according to a recent note from Bank of America.

That surge in cash held by investors came amid a flight-to-safety sparked by the regional banking crisis, in which three banks with combined assets of nearly $550 billion collapsed over a two-month period.

The recent fund flow surge into money market funds eclipsed the $500 billion fund inflows seen after the Lehman Brothers collapse in 2008, and was about half that of the $1.2 trillion that flooded money market funds during the onset of the COVID-19 pandemic.

Part of the reason why investors are stocking up on cash is to take advantage of a high risk-free rate of return of just over 4%. Another reason is because investors are downright bearish on stocks.

In AAII's most recent investor sentiment survey, which asks investors where they think the stock market will be in six months, bearish responses surged to 45% over the past week, which is a historically high reading for the 30+ year-old survey. The historical average for bearish responses is 31%.

Meanwhile, only 24% of respondents were bullish on stocks, which suggests that most investors are struggling to find a good reason to invest their money into equities amid the heightened uncertainty tied to the ongoing banking crisis.

And Fundstrat'sTom Lee agrees. That is, if the banking crisis continues to spiral out of control. In a Friday note, Lee told investors that "this is a tough time to argue adding risk" given the recent collapse of First Republican Bank and the extreme volatility seen in PacWest Bancorp and Western Alliance Bancorp.

"This raises too many tail risk issues including credit tightening, commercial real estate and wide economic implications," Lee said. And yet, Lee still sees a balanced risk/reward setup for the stock market as the banking sector shows signs of stabilizing and earnings results hold up better-than-expected.

And if ongoing developments in the banking sector, economy, and stock market turn better-than-expected, then there's a massive $5.3 trillion pile of cash that could act as fuel to drive the next bull market in stocks. That's because, according to Lee, much of the cash that's been built up over the past couple of years was withdrawn from the stock market.

"Retail liquidations of S&P 500 and Nasdaq stocks exceeds [retail's] purchases since 2019," Lee told Insider on Friday, referencing data from Goldman Sachs.

"I think stocks are flat vs. [a] year ago and sentiment far worse and there is way more cash on [the] sidelines. So there is definitely [a] flows story that could unfold," Lee said. Lee set his 2023 year-end price target at 4,750, about 15% higher than current levels.

If that massive cash pile starts to unwind, investors have few options on where to put it, and the stock market is likely a top choice.

Bank of America

Read More

By: [email protected] (Matthew Fox)

Title: There's a record $5.3 trillion is cash on the sidelines as investors get more bearish on stocks. Here's why that could mean big gains ahead.

Sourced From: markets.businessinsider.com/news/stocks/stock-market-outlook-5-trillion-sidelined-cash-dry-powder-bull-2023-5

Published Date: Sun, 07 May 2023 12:30:00 +0000

.png)