Qi Yang/Getty Images

- China's "stalling" economy is putting some US companies at risk, according to Bank of America.

- High rates of youth unemployment and recent property defaults have put pressure on the Chinese economy.

- The bank highlighted the top 10 stocks that have the most revenue exposure to China.

China's economy has been floundering since it reopened from the COVID-19 pandemic, and that represents a big risk for US companies that have a lot of exposure to the region.

Elevated rates of youth unemployment and recent property developer defaults are just a couple reasons why China's economy has been "stalling" in recent months, according to Bank of America.

The bank doesn't think China represents a big risk for the US stock market, given that the S&P 500's direct China revenue exposure is less than 5%. But it did highlight companies that are overly exposed to the region.

"Investors are waiting for a policy response from China," BofA's Savita Subramanian said in a Thursday note. But so far, China's stimulus efforts have had little impact in turning around the economy.

These are the 10 companies that are most at risk of China's ongoing economic slowdown, according to Bank of America.

10. Applied Materials

Reuters

Ticker: AMAT

Market value: $122.6 billion

Revenue exposure to China: 33%

9. Lam Research

Markets Insider

Ticker: LRCX

Market value: $89.5 billion

Revenue exposure to China: 35%

8. Broadcom

Reuters

Ticker: AVGO

Market value: $373.8 billion

Revenue exposure to China: 36%

7. NXP Semiconductors

REUTERS/Steve Marcus

Ticker: NXPI

Market value: $51.5 billion

Revenue exposure to China: 38%

6. IPG Photonics

Markets Insider

Ticker: IPGP

Market value: $4.9 billion

Revenue exposure to China: 38%

5. Wynn Resorts

Reuters

Ticker: WYNN

Market value: $10.7 billion

Revenue exposure to China: 40%

4. Western Digital

360b/Shutterstock

Ticker: WDC

Market value: $13.7 billion

Revenue exposure to China: 47%

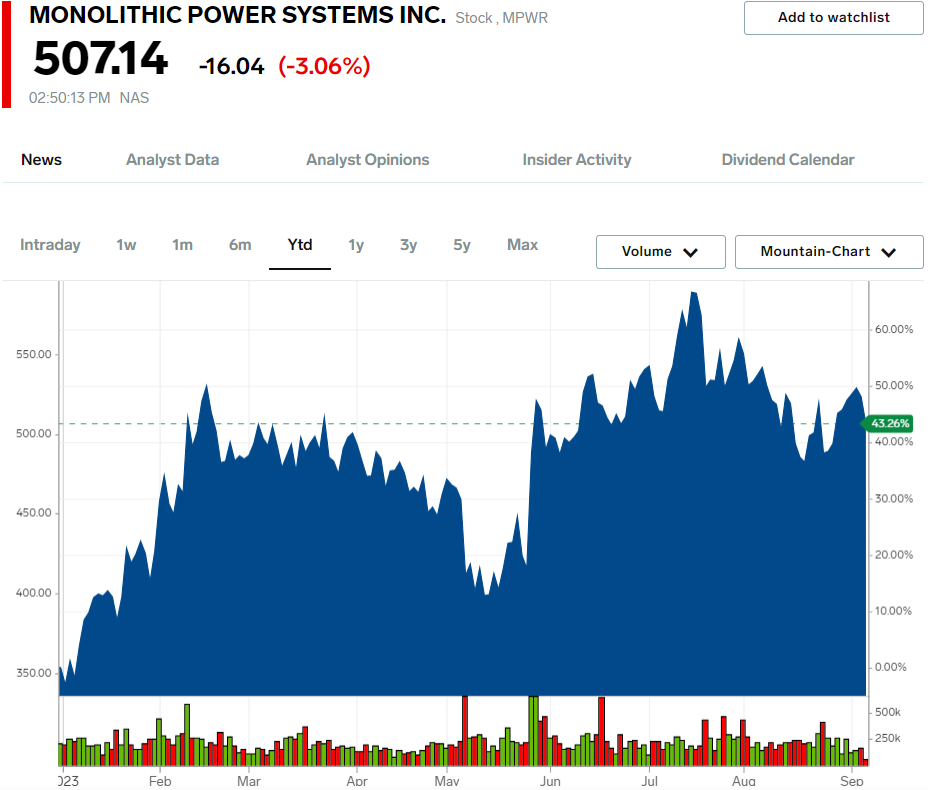

3. Monolithic Power Systems

Markets Insider

Ticker: MPWR

Market value: $24.0 billion

Revenue exposure to China: 58%

2. Qualcomm

Aly Song/Reuters

Ticker: QCOM

Market value: $117.8 billion

Revenue exposure to China: 67%

1. Las Vegas Sands

Reuters

Ticker: LVS

Market value: $38.2 billion

Revenue exposure to China: 67%

Other companies that have considerable revenue exposure to China include: Intel (27%), Tesla (26%), and Nvidia (26%).

Read More

By: [email protected] (Matthew Fox)

Title: These 10 stocks have the most exposure to China's 'stalling' economy, BofA warns

Sourced From: markets.businessinsider.com/news/stocks/china-economy-stocks-most-exposure-qualcomm-broadcom-nxp-wynn-lvs-2023-9

Published Date: Fri, 08 Sep 2023 10:45:01 +0000

.png)