Spencer Platt/Getty Images

- The secular bull rally in the stock market is still alive and well, according to Ned Davis Research.

- From positive GDP growth to an incredibly low unemployment rate, investors should prepare for more gains in stock prices.

- These are the seven charts that suggest the secular bull rally in stocks still has room to run, according to NDR.

While everyone is waiting for a recession to hit the US economy, there are growing signals that suggest the stock market's secular bull rally is actually here to stay.

In a note on Friday, Ned Davis Research highlighted various technical and economic indicators that suggest things are relatively ok for both the stock market and the economy. From positive GDP growth to an incredibly low unemployment rate, investors should be prepared for more gains in stock prices, according to the firm.

"In a continuing secular bull, the major benchmarks could be expected to keep trending upward on their way to record highs, which are currently 16% and 14% away respectively on the S&P and ACWI," NDR's Tim Hayes said.

These are the seven charts that suggest the secular bull rally in stocks still has room to run, according to NDR.

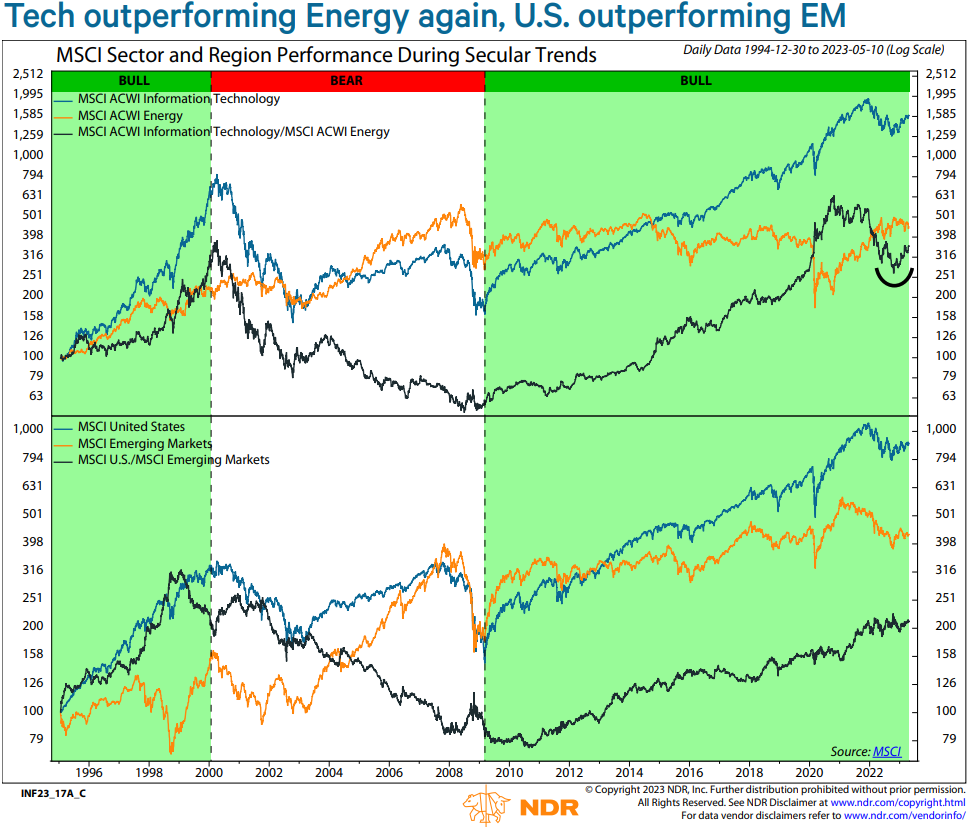

1. Tech stocks are outperforming energy stocks.

Ned Davis Research

"Starting in 2020, Tech began to underperform Energy as indicated by the dropping Tech/Energy ratio in the chart's top clip. Currently, however, Tech and the U.S. are outperforming again, trends likely to continue with the secular bull remaining intact," NDR said.

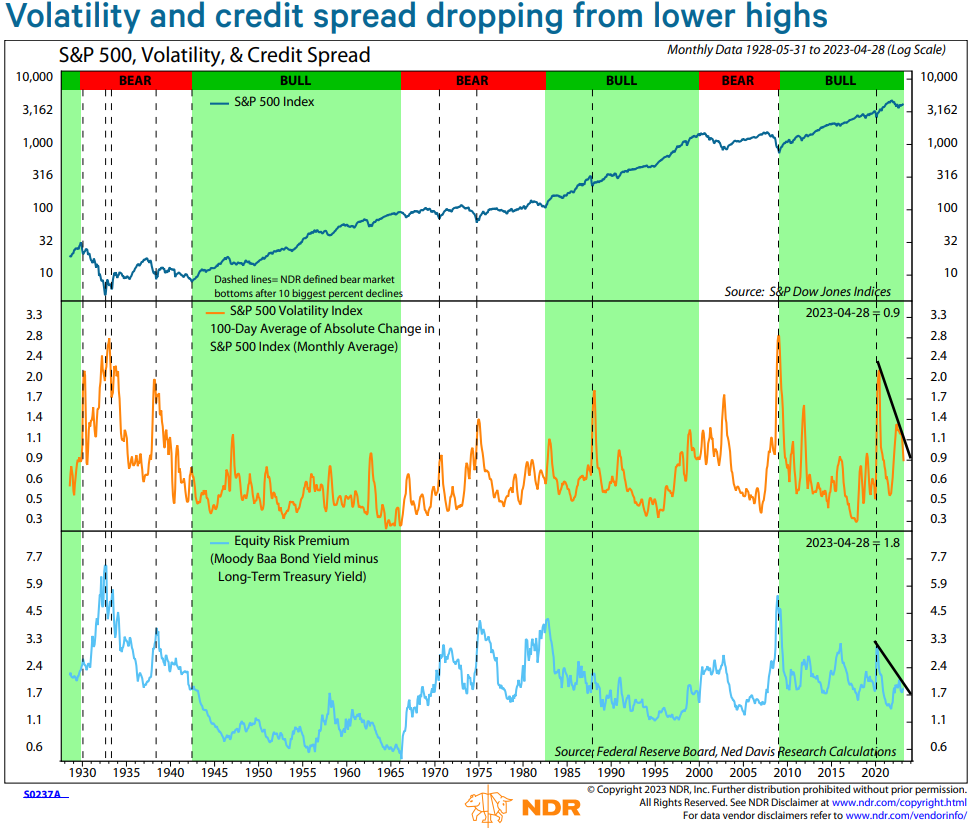

2. Volatility and credit spreads are declining.

Ned Davis Research

"The secular bear evidence would increase if market volatility would continue trending higher with credit spreads, both reflecting rising economic pessimism. What we now can see is that the S&P 500 Volatility Index has reached

a lower high (middle clip) along with the spread between the Moody Baa bond yield and 10-year Treasury yield (bottom clip)," NDR said.

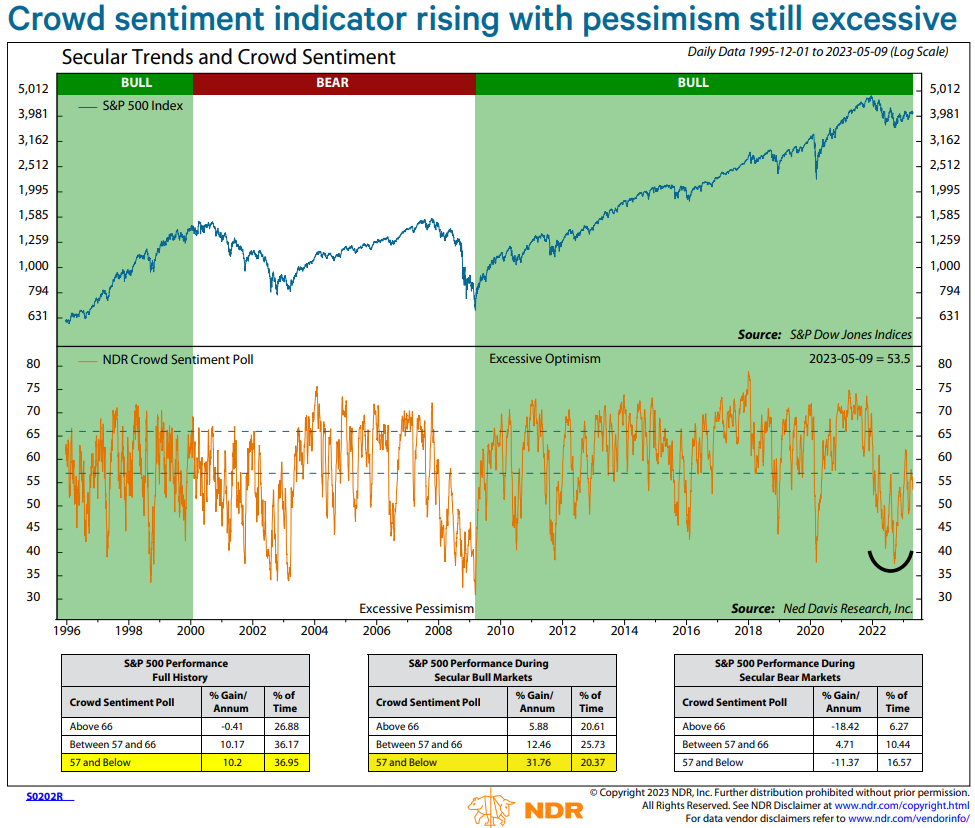

3. Investors are bearish.

Ned Davis Research

"Since the extreme in pessimism reached at the end of September, confidence has gradually returned but the indicator is far from excessive optimism levels. The chart's middle mode box indicates that the S&P 500 has gained 32% per annum when sentiment has been in its current pessimism mode during a secular bull market," NDR said.

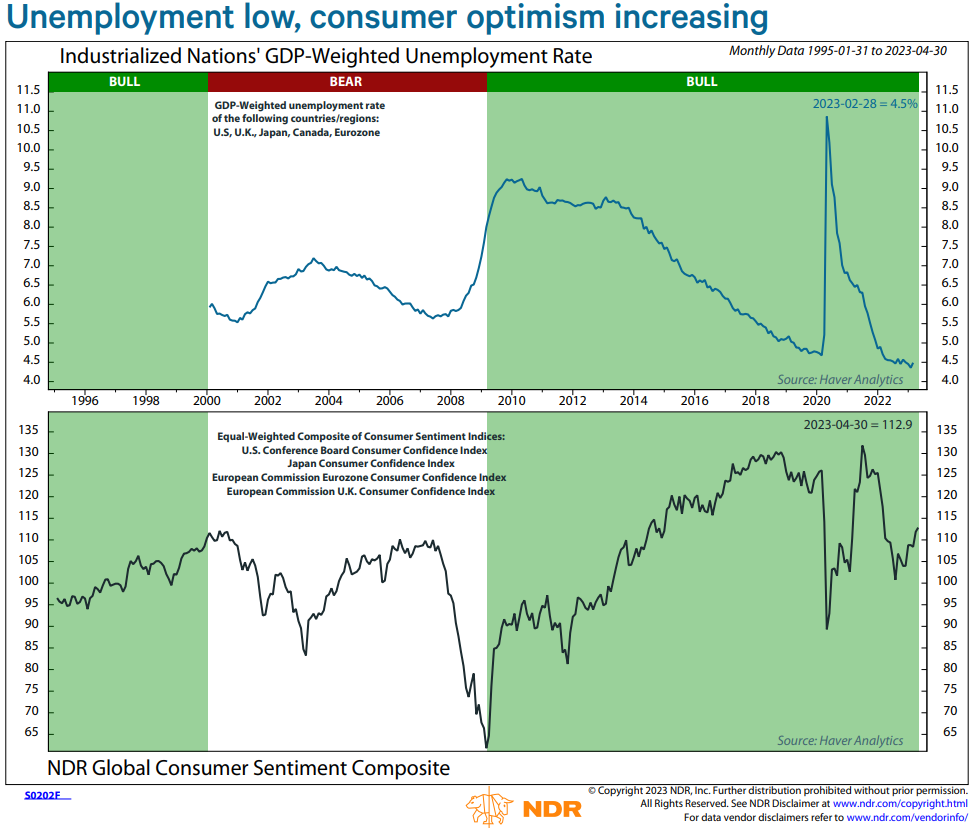

4. Unemployment is still low.

Ned Davis Research

"Our Global Consumer Sentiment Composite has continued to recover from the lows reached late last year (bottom clip), with the sentiment supported by the low unemployment rates in major economies (top clip). Consumer sentiment trended higher during the second half of the 1990s and has done so during most of a secular bull that's now in its 15th year," NDR said.

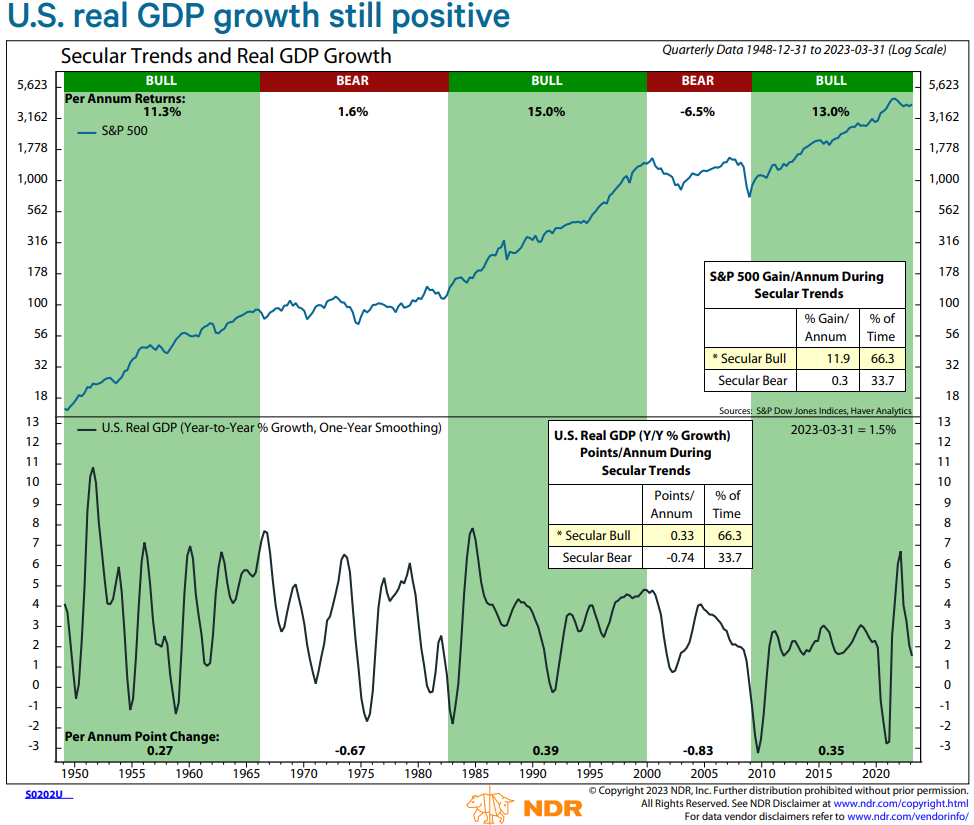

5. US GDP growth is positive.

Ned Davis Research

"The growth is still positive and currently more than four percentage points higher than it was at its lows in 2009. The per annum point changes reflect the tendency for real economic growth to rise over the course of secular bulls and decline during secular bears," NDR said.

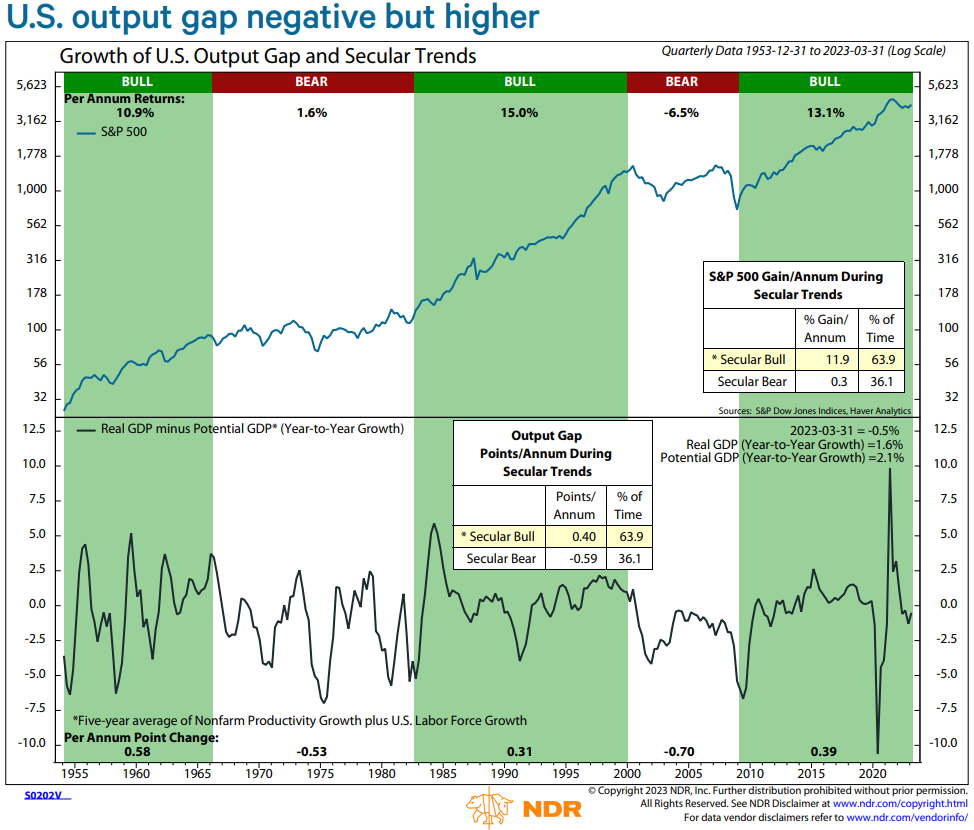

6. US economic output gap is rising.

Ned Davis Research

"If inflation continues to recede, downward pressure on real GDP growth will lift, and that would also make it easier for the U.S. output gap to grow. The output gap compares real GDP growth to potential GDP growth, as measured by the five-year average of nonfarm productivity growth and U.S. labor force growth. As with real GDP growth itself, the per annum point changes show that the gap has tended to widen during secular bulls and shrink during secular bears," NDR said.

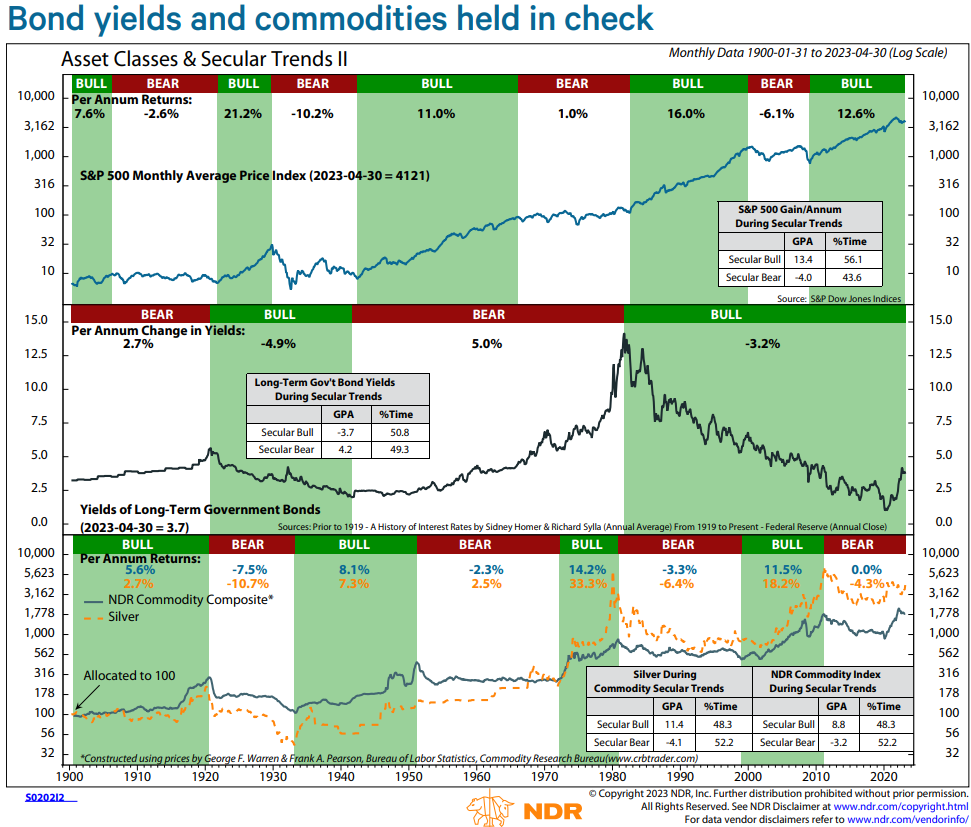

7. Bond yields and commodities are cooperating.

Ned Davis Research

"As inflation expectations have trended lower, bond yields and commodities have been held in check, making the secular bear of the 1970s less comparable. Commodities thus remain in a secular bear that has coincided with the secular bull in equities, consistent with the tendency during previous commodity bears. The current consistency is aligned with the other indications that equities remain in the secular bull that has persisted since 2009," NDR said.

Read More

By: [email protected] (Matthew Fox)

Title: These 7 charts show that the stock market's secular bull rally is still alive and well

Sourced From: markets.businessinsider.com/news/stocks/stock-market-analysis-outlook-secular-bull-rally-alive-charts-sp500-2023-5

Published Date: Sun, 14 May 2023 12:30:00 +0000

Did you miss our previous article...

https://trendinginbusiness.business/business/the-role-of-personal-injury-laws-in-holding-negligent-parties-accountable

.png)