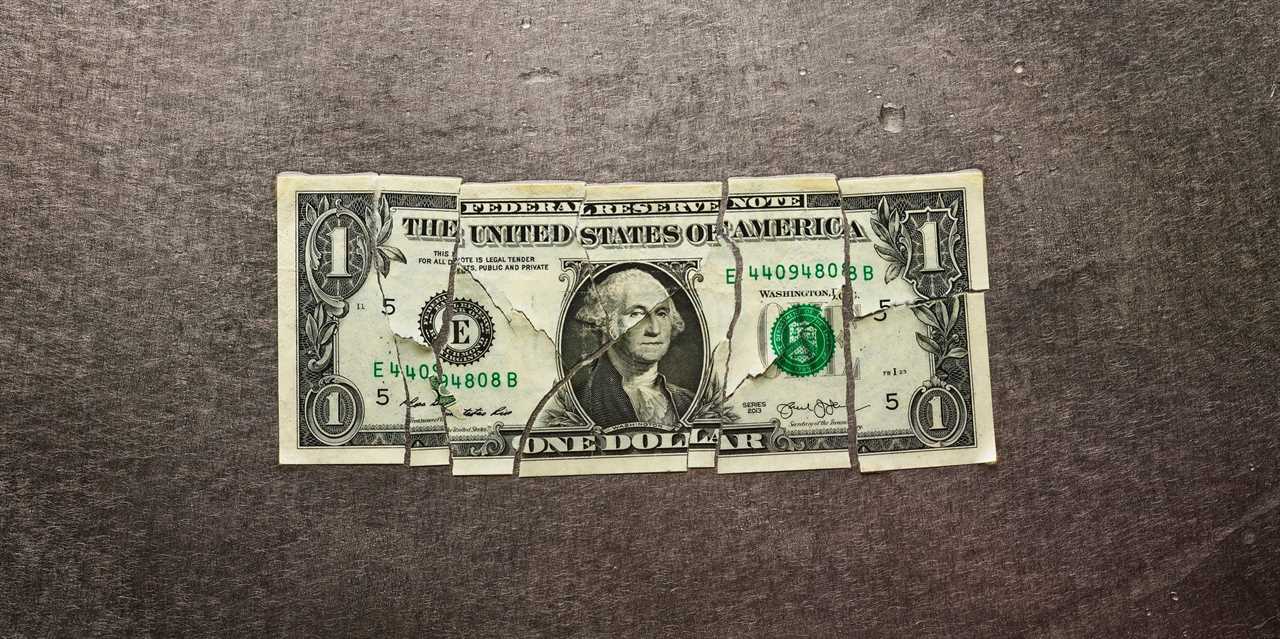

Getty Images

- China shouldn't reinvest its Treasury holdings, Yu Yongding said in a speech.

- The former central bank advisor cautioned China against increased exposure to US debt risk.

- If Beijing reduces its holdings, it will need to adjust to trade deficits.

It's time for Beijing to wean off the US Treasury, as American debt risks seem destined to worsen, a former Chinese central bank advisor said in a speech on Sunday.

The country, which is estimated to hold over $1 trillion in Treasury assets, shouldn't reinvest the proceeds once these bonds and notes mature, Yu Yongding said.

Instead, "China should accelerate the adjustment of its overseas asset and liability structure, improve returns on overseas net assets and lower the share of foreign exchange reserves in its overseas assets," he advised, quoted by Bloomberg.

Yongding's appeal against US debt follows alongside growing alarm on Wall Street that the country could stumble into a default at some point in the future. Part of the concern is that historically high US deficits are spurring an increase in Treasury liquidity, at a time of waning demand.

To attract buyers, Washington may have to lift interest rates on these assets, in turn forcing it to issue even more debt over the long run.

In his speech, Yongding noted that this will drive the country's debt-to-GDP ratio higher. The US's net overseas debt is already equivalent to around 70% of its GDP, and could eventually hit 100%, he said.

The situation has been unnerving to more than just Beijing, as the share of foreign Treasury buyers has fallen away this year.

"All foreign investors that I've spoken to recently are extremely concerned about the trajectory of US deficits," TD Securities analyst Gennadiy Goldberg told Business Insider last month.

Additionally, Washington's "weaponization" of the greenback is another reason to disinvest in American debt, Yongding said. It's the same argument that has prompted calls among emerging markets to de-dollarize.

Although some on Wall Street have argued that China has already been reducing its US debt holdings, a former Treasury official has pushed back that this isn't likely.

But if it was to stop buying Treasurys, Yongding advised that China will have to find ways to maintain trade and international payment balances. The country will have to come to terms with trade deficits, and move away from foreign demand as an economic crutch.

Read More

By: [email protected] (Filip De Mott)

Title: US debt and dollar risks mean China should cut its Treasury holdings, a former PBOC advisor says

Sourced From: markets.businessinsider.com/news/bonds/us-debt-deficit-dedollarization-greenback-china-treasury-sanctions-trade-yuan-2023-12

Published Date: Mon, 18 Dec 2023 15:04:13 +0000

.png)