How can AI and automation help small accountancy practices provide a better service?

2023 is the year when AI leapt from Californian software labs to our homes. The masses are suddenly using tools like Google Bard and ChatGPT for anything from homework to writing code.

The commodification of AI is also happening in accountancy: small and medium-sized firms are beginning to embrace the technology, which was previously the preserve of the Big Four.

Some may already be unknowingly using AI built into software packages like Xero, Dext and Hubdocs. Others, such as SKS, have developed proprietary AI and automation tools to better serve the specific needs of their customers.

How can AI and automation help small accountancy practices?

According to a report by ICEAW, machine learning – a branch of AI in which computer systems can autonomously learn and adapt – can help accountants in the following areas:

- Coding accounting entries and improving accuracy

- Improving fraud detection

- Forecasting revenues using predictive models to foresee events such as bankruptcy

- Improving access and analysis of unstructured data, such as contracts and emails

Will AI replace accountants?

AI and automation are tools to support (rather than replace) accountants. The benefits are broad. Firstly, they generate cost savings, as practices can operate with fewer people. Secondly, they free accountants to work on projects, such as tax planning, pension advice, and financial strategy. Finally, clients benefit from higher accuracy, cheaper fees, and faster turnaround times.

Why we designed our own automation and AI software

As mentioned, several prominent players, such as IRIS and Xero, have incorporated AI and automation into their tools. However, we wanted to include functionality that would help us better serve our customers – SMEs and accountancy firms that outsource their work to us.

Five ways our software helps small accountancy practices

1. Halving time spent on year-end auditing

There is a secret that accountants hate to admit: just one-third of year-end auditing takes real skill and knowledge – adjustments aside, the rest comprises repetitive tasks. And where there are repetitive or predictive tasks, there is automation (and where there is automation, there is potential for AI).

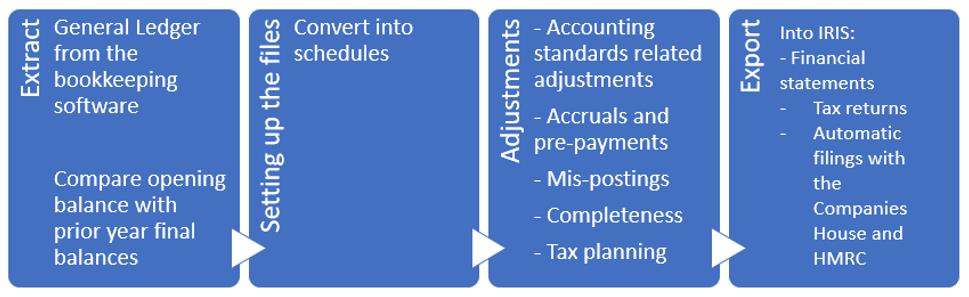

A typical year-end compliance job comprises four stages: data extraction, setting up the files, adjustments and exporting. Automation and AI can slash processing times across all of these – though less so in the adjustment stage, where expert human advice adds the most value.

SKS’ proprietary software halves the time it takes to carry out a year-end compliance pack, including audit. One of the ways it does this is by using machine learning to categorise new transactions. For example, it will automatically classify invoices from water companies under ‘rates’.

2. Removing the pain from ‘plastic bag’ accounting

The Big Four rarely have to deal with what we call ‘plastic bag accounting’ – where a client will present a shopping bag of receipts and sales invoices alongside a handwritten ledger. Our software takes the manual work out of matching these three sources, learning at each iteration.

3. Spotting inaccuracies and writing off debt

While systems such as QuickBooks or Xero will display your raw profit and loss data, our system also identifies anomalies. For example, it will categorise expenses for comparison. This enables it to identify significant differences in year-on-year spending, unexpected amounts or missing accruals. Our technology also categorises a company’s debtors list by due date, automatically creating provisions for older debts.

4. Revolutionising workflow through automation

Most workflow management packages treat the preparation of year-end compliance as a linear process. Our software allocates tasks, such as VAT, PAYE, corporation tax, debtors, creditors, etc to respective specialist teams. This improves processing time and accuracy. It also makes our staff training more effective, as employees master one skill at a time rather than five at once!

5. Creating clear communication and case management

Accountants and clients should focus on core tasks rather than chasing emails. An online client dashboard offering real-time job progress is a must. Our CRM system also ensures incoming client emails are assigned a job number and filtered to the correct expert.

What about AI scare stories?

Following the widespread release of tools such as ChatGPT. Midjourney and Bard, there have been lots of scare stories about AI getting things wrong (not to mention taking over the world). However, with a tightly controlled environment, solid data set, and humans doing the final sign-off, it has the potential to make accounting more efficient for both accountancy practices and their clients.

The post AI and automation in accountancy – delivering better value for clients appeared first on Accounting Insight News.

------------Read More

By: Sanjay Swarup, CEO, SKS Business Services

Title: AI and automation in accountancy – delivering better value for clients

Sourced From: www.accountex.co.uk/insight/2023/06/13/ai-and-automation-in-accountancy-delivering-better-value-for-clients/

Published Date: Tue, 13 Jun 2023 08:29:18 +0000

Did you miss our previous article...

https://trendinginbusiness.business/finance/capify-wins-sme-lender-of-the-year-award

.png)