Everyone needs to eat, but eating doesn’t have to break the bank. One of the easiest expenses to reduce is the amount you spend on food. Reducing your grocery bill may mean eating more homemade food, but it generally means that you have more money in your pocket and better control of your diet and your finances. Here are eight sure-fire ways to cut down on the amount you spend on food.

1. Buy the house brands.

The last time we went shopping we picked up a 1 lb of Safeway brand peanut butter – it was like a buck cheaper than the Smuckers brand on the shelf above it. Always check the unit price to compare sales as well.

2. Make bulk meals.

If you double the recipe and store the extra half, you’ll be less tempted to buy prepared food or get take out. After all, you’ll just need to pop your leftovers in the microwave to get fed. This can be great especially for lunches – for example check out this posting over at Cleverdude.com. This guy managed to make a months worth of sandwiches for something like $6.99. Brilliant. There are also lots of brilliant recipes to turn one meal into another from the left overs.

3. Buy in bulk.

You can shave a few bucks off your budget if you buy in bulk. This is especially true for staples like toilet paper, toothbrushes & toothpaste, liquor (if you want to go full alcoholic), rice, batteries, light bulbs, bread, meat (you gotta freeze it) and batterie

s. It doesn’t make sense to purchase perishables like fresh vegetables, berries or flour that can go bad, but it does make sense to freeze these items at the peak of their season or to buy frozen fruit/veg.

Buy apples, oranges, or other bagged fruit while in season and on sale. If you eat it regularly, salsa is a great one to buy in bulk, the price is about a third in a large container versus a medium one. Also buy in bulk when items you frequently buy are on sale. This can help a lot with cereals, breads, soups, and the like.

4. Pack a lunch instead of eating out.

If you are still working outside of your home, pack a lunch. Eating out is hugely expensive over time. For example, if you spend 10 bucks a day eating out, after a month you’ll have spent $200 bucks. After three months, you’ll have spent $600 dollars, or $2,400 a year. Even if you make lunches twice a week you’ll save an estimated $960 a year! Need some lunch ideas? Soups, either homemade or healthy canned versions are very cost-effective. Do it yourself salads save a lot also. I have a friend who brings a bag of spinach to the office and then adds in berries, nuts, and protein. Hummus with veggies to dip can make a great healthy and filling meal as well. The options are endless and you’ll probably be happier not forking over cash everyday for lunch.

5. Minimize prepared foods.

Fried chicken, frozen meals and deli macaroni and cheese all taste great, but they also carry a price premium. According to a study in Family Medicine Magazine, the cost per calorie for a convenience diet was 24% higher than for a healthy diet (1). Salad dressings are another great one to skip on. Making your own is easy and much, much cheaper. One good secret ingredient hack is to add red chili pepper flakes (the kind you use on pizza) with oil and vinegar. Adding a bit of onion dip mix to oil and vinegar is also very tasty and easy. Once you make your own dressing you’ll never want to go back.

6. Clip coupons.

Although coupon clipping is falling a bit of out of favor as the economy goes electronic (here), some people really good at saving money by using coupons. I typically use a few key coupons on each shopping trip, only on items I buy in any case, and likely shaves about $5 a month off my grocery bill. Its not a lot, but the savings add up over time.

Pro-tip: if you forget to bring your paper coupons to the grocery store, all is not lost. Come back the next day and bring your receipt and your coupon. Usually the customer service people will give you a credit or cash for the coupon.

7. Save money on alcohol.

If you enjoy an occasional libation, consider drinking less or buying less expensive beer, wine, or liquor. For example, some good craft beers go for pretty cheap (clicky) and you can always find good values on wine for under $15 dollars. You are better off sipping on your happy hour beverage than having several and then splurging to eat whatever. It is best to use a budget mentality when consuming, considering whether it is worth the value. Often times you are better off without the next drink.

8. Buy only what you need.

We all know it is easy to waste money on unused foods. Be honest with yourself about what you will and won’t eat. Consider what your plans are for the week, whether you will be going out of town soon, etc. Use what you have, eat your way through your freezer and dry goods. If you are looking at a full pantry and simply can’t find anything to eat, challenge yourself to come up with something. Shop with a list and don’t fall for unnecessary items. Coordinate menu items to reduce the need for excess specialty items. Shop the perimeter of the store and avoid isles you don’t need things on.

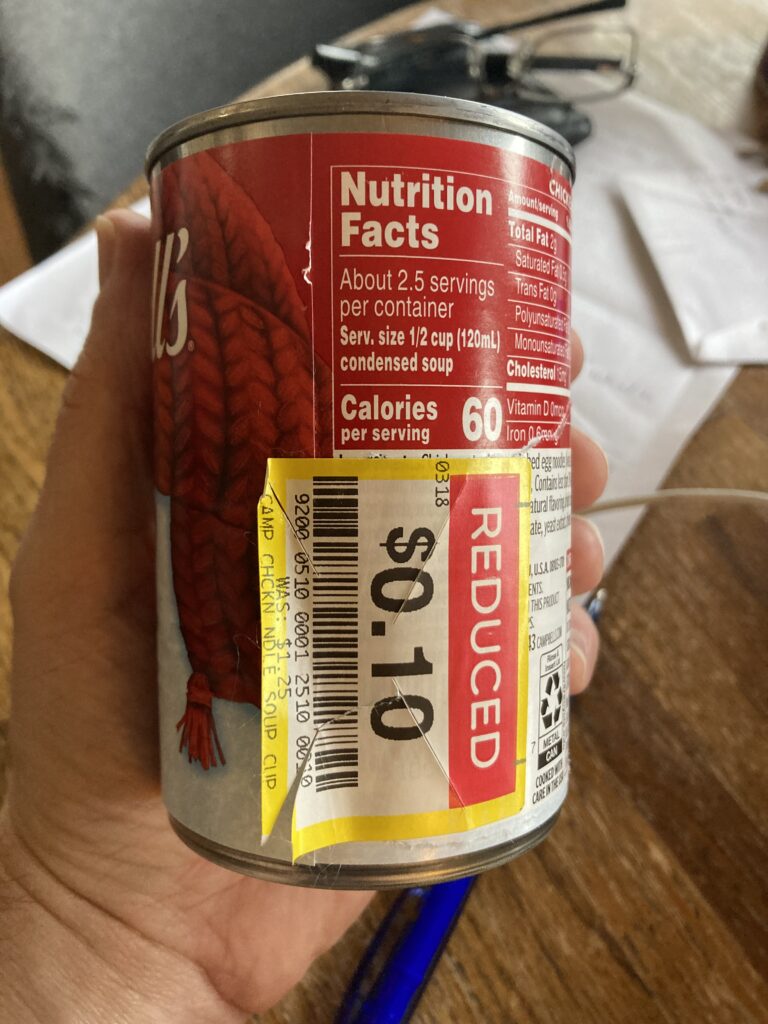

Case in point – I bought about 128 of these cans of Campbells soup at my local Kroger a year ago. The cans were on sale for 10 cents each. That was an unbeatable deal that I couldn’t pass up.

The only thing is I bought way more than I needed, so I ended up giving away most of the cans to a soup kitchen.

Saving money on groceries is actually easier than it seems. It takes mindful and a bit of discipline, but your bank account (and likely waist line) will thank you for it.

Happy shopping!

For more on this read:

Nine Sustainable Frugality Tactics To Make Your Budget Sing

Frugal Tip Of The Day – Don’t Order Drinks

Would You Be Frugal If You Were Rich?

------------Read More

By: James Hendrickson

Title: Eight Ways To Eat For Less And Save Like A Champion

Sourced From: www.dinksfinance.com/2023/10/eight-ways-to-eat-for-less/

Published Date: Thu, 26 Oct 2023 12:26:53 +0000

Did you miss our previous article...

https://trendinginbusiness.business/finance/fortex-xcloudiaas-empowering-financial-institutions-with-lowlatency-highfrequency-trading-solutions

.png)