Hello Dinks,

Its halfway through the summer, so here are some ideas to help you with your cash stacking this year. We’ve touched on these in other postings on this site, but the ideas are good, so they bear repeating. Here are some free and mostly low cost ways to stack some extra cash.

Use Rebate Site When Stacking Cash

First, rebate sites. Use them. Here’s how they work: you sign up for an account and then browse the site for participating retailers. When you find a retailer you want to shop with, you click through to their site and make your purchase. Once the purchase is complete, the retailer pays the rebate site a commission, which the site splits with you.

Here is a quick list of some of the better ones:

dollardig.com

rebatefanatic.com

rebatesme.com

mrrebates.com

befrugal.com

Be sure you stack what the rebate site gives you with a credit card that gives you points or cash back. There is nothing immoral or unethical about this kind of double dipping, so do it.

Get some Extra Cash from Receipt Scanning

Second, consider scanning your receipts. There five or six good receipt scanning apps. They all generally work in the same way. First, you take a photo of your receipt. The app then uses optical character recognition to extract the relevant information, such as the date, time, store name, and purchase amount. The app company then bundles the information and sells it to major retailers to help them improve their marketing. In return the app gives you cash or store rewards cards for your data.

Here are some good ones:

Frisbee

Fetch

Ibotta

Receipt Hog

Amazon Shopper Panel

Receipt scanning apps are a slow money maker, but they are a good way to save some extra dollars.

Of these, Frisbee and Amazon Shopper Panel are the best. Frisbee has generous payouts in the form of Amazon giftcards and the Amazon Shopper Panel gives you $1 in Amazon credit (up to $10) for each receipt you scan. The others are less valuable from a time invested/income received standpoint.

Need Money When Stacking Cash? Cut Your Costs

Third, regularly cut your costs. Ever few months or so, you should look at your fixed expenses and see where you can cut back. Things like your Netflix bill, your utilities, your rent, etc. – all have a habit of creeping up. For example, sometimes companies regularly increase their rates and charge their customers credit cards. Or, you might sign up for more than one streaming service and forget to cancel it. You should periodically review all your bills and see where you can cut them.

Utilize Your Unused Computing Resources

Old laptops or desktops have economic value beyond just resale. You can use them to sell your internet bandwidth, sell your personal data, help mine crypto, or be part of a distributed computing network. The only real limitation here is your ability to learn quickly.

If you want to sell your spare bandwidth, there are a couple of decent apps that work reliably. These are:

- Earn App

- Honeygain

I’ve been running both on my computer for a year. So far, its been good for a couple of bucks a month with no issues with my computers performance or ISPs.

Buy CDs, Bonds and Stocks

There are a number of ways to stack cash, but some methods are more effective than others. One popular method is to invest in short-term CDs or money market accounts. These accounts tend to offer higher interest rates than traditional savings accounts, which can help you earn more money on your deposited funds. Another option is to purchase high-yield bonds, which offer higher returns than most other types of bonds. Finally, you could also consider investing in stocks, which can provide both income from dividends and appreciation over time. If you want a listing of which dividend paying stocks to look at suredividend.com has a good curated list.

While there are no guarantees when it comes to investing, these are all potentially good options for those into stacking cash.

Small Savings Add Up, Especially When You Invest

Small savings add up to large amounts.

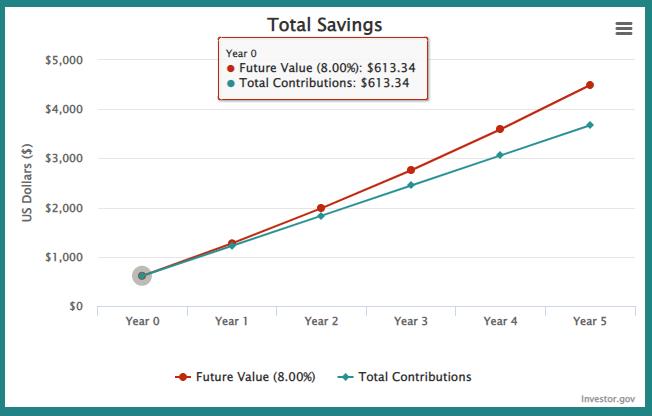

According the Bureau of Labor statistics, in 2020 the average American spent about $61,334 per year (here). If you were able to reduce this by 1 percent, and you were aggressive about stacking cash once you’d saved it, you’d have $613.34 to invest. If you did this consistently for five years and you invested the money, you’d have about $4,491.56. This is enough for a car down payment or a nice trip. So, when it comes to stacking cash, even small amounts add up over time.

Source: Investor.gov. Accessed August 2nd, 2022. Assumes compounding at 8% annually for 5 years.

Have you tried any of these methods to stack cash? Let us know in the comments below how it went.

For more great dinks articles, read these:

Savings And Side Ideas You Probably Haven’t Considered

Key Differences Between The Rich and The Poor

Here Are The Streams of Income Of The Wealthy

Here Are Some Ways To Make Extra Money That You Can Do Today

And for our Canadian readers, here is a great list of ways to make passive income.

------------Read More

By: James Hendrickson

Title: Stacking Cash, Some Free and Low Cost Ideas To Get Extra Money

Sourced From: www.dinksfinance.com/2023/08/stacking-cash-ideas-to-get-extra-money/

Published Date: Tue, 08 Aug 2023 11:11:36 +0000

Did you miss our previous article...

https://trendinginbusiness.business/finance/3-minutes-with-bev-flanagan

.png)