This posting is for readers who want some solid data on which streams of income the wealthy actually have. This is a non-trivial question because if you’re building wealth, you’ll want to see what’s been done successfully in the past. And, most articles on this topic rely less on fact and more on speculation and anecdotes.

So, what streams of income do the wealthy actually have?

To help answer this question, I asked an expert and looked at the academic research.

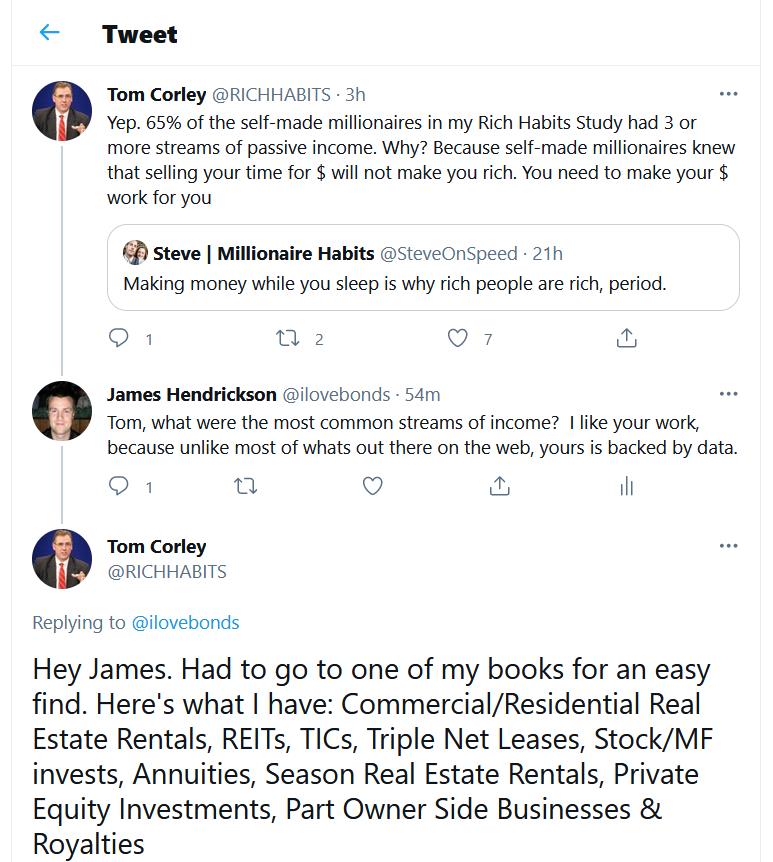

Tom Corley On The Streams of Income Of The Wealthy

If you write about finance long enough, you end up getting connected with others in the business. Here is a quick exchange with Tom Corley, author of “Rich Habits: The Daily Success Habits Of America’s Wealthy“. Corley is an expert in the behavior of the rich, so his comments bear weight on this topic. In it, he pulls some information about exactly which streams of income the wealthy have. Per Corley, they are:

- Commercial/residential real estate rentals

- REITS

- TICs (tenancy in common)

- Triple Net Leases

- Stock/Mutual Fund assets

- Annuities

- Seasonal real estate rentals

- Private equity

- Part ownership of side businesses

- Royalties

For more on Corley’s thoughts on what you need to do to build income, read his CNBC article on creating multiple income streams.

His website is here.

IRS Data On The Streams of Income Of The Wealthy

The one good exception to the lack of fact-based discussions of this topic is an IRS working paper. In 2014 Jenny Bourne and Lise Rosenmerkel analyzed historical return data for 6,053 tax filers who had died between 1996 and 2002. They compared taxpayers who filed form a F706 (decedent estate) versus those who didn’t file form F706. What they found was F706 filers had higher levels of income than non-filers in the following areas:

- Dividends

- Rental real estate, royalties, partnerships, S corporations, estates, trusts,

and real estate mortgage investment conduits - Wage income

- Taxable pensions and annuities

- Tax exempt interest income

- Business income from sole proprietorships

Whats interesting about the IRS study, is unlike most discussions on the internet, the IRS also tells you which source of income was most strongly related to wealth. The answer is:dividends.

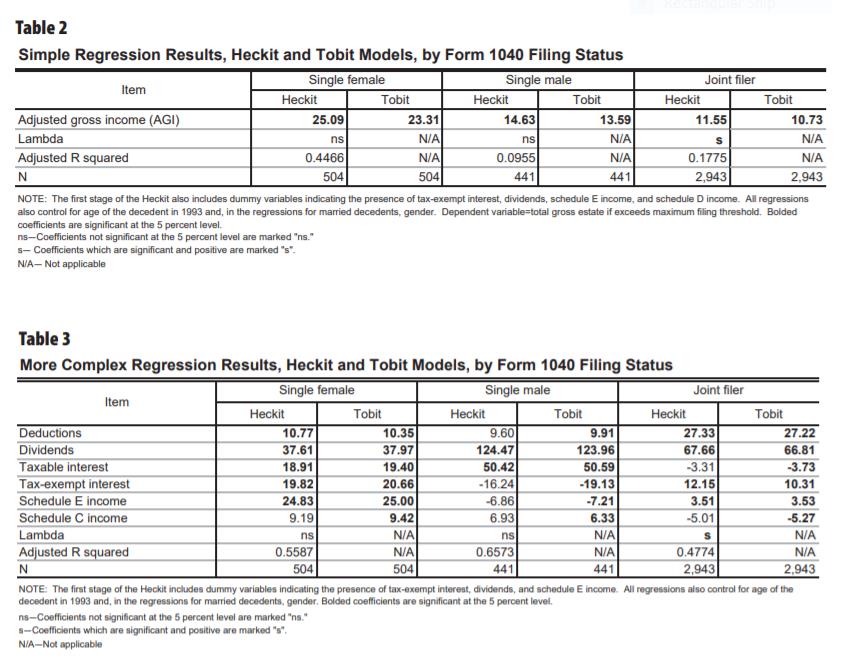

The photo below shows some statistical models from the Bourne and Rosenmerkel paper. Without going into too much detail, they basically show that income is positively associated with wealth (table 2) – and of the various types of income reported in IRS filings, dividends had the biggest effect on estate value at death (table 3).

So, according to IRS data, the wealthy have a broad income streams, of these wage income and dividends are the most important.

Here is a link to the original IRS paper.

Whats nice is both sources show similar streams of income of the wealthy. Real estate, business income, dividends and annuities are common in both lists.

For more great dinks articles on building wealth, read these:

Building Wealth on $600 Per Month

Better Models For Building Wealth

What Building Seven Streams of Income Really Looks Like

Save, Invest and Reinvest to Build Wealth

P.s. If you have a few spare moments, you might consider reading Moneysavedmoneyearned’s article on being independently wealthy, here.

------------Read More

By: James Hendrickson

Title: Streams of Income Of The Wealthy

Sourced From: www.dinksfinance.com/2023/08/streams-of-income-of-the-wealthy/

Published Date: Tue, 29 Aug 2023 02:47:57 +0000

Did you miss our previous article...

https://trendinginbusiness.business/finance/the-significance-of-swift-execution-in-mt45-bridge-connections

.png)