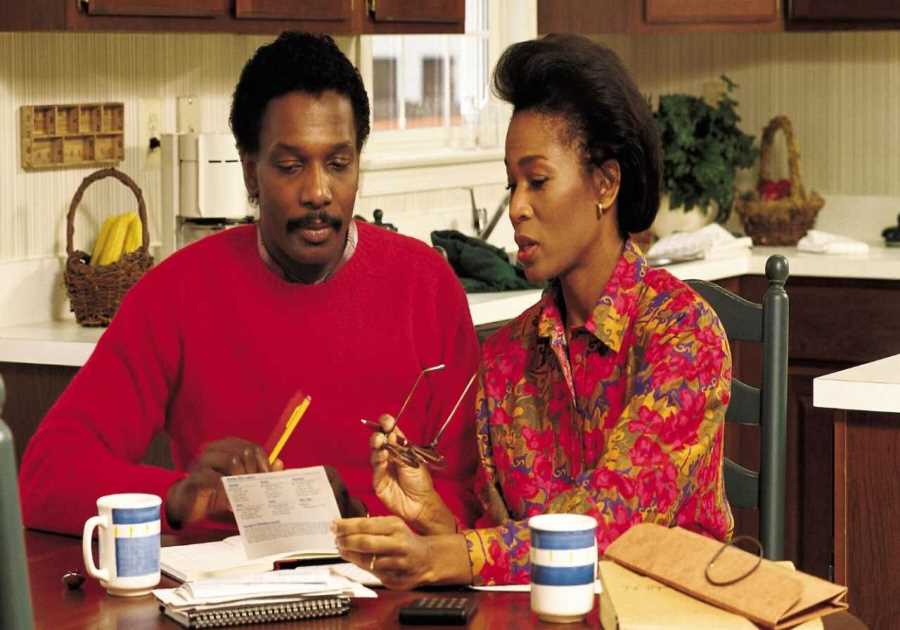

We all have been there when we wanted to sort out our financial problems but did not know ‘how.’ financial literacy clubs are all about this “how-to.” It is a crucial life skill for everyone, whether they are students striving to finance their studies or adults trying to create a balance between spending and savings. One of the most ignored subjects yet holds way more critical in our daily lives than any other. Despite this, according to survey “2018 Survey of the States” conducted by the Council for Economic Education, there are just 17 states which make it mandatory for students to take the financial literacy course before graduation, while the class is offered in only 22 states, the number is shockingly low.

Let alone this, if a person wants to take a class on personal financial literacy, they will probably end up disappointed because there is a severe gap between the demand and supply of personal financial literacy clubs. The same happened with Swati Patel, working in the financial service industry; she constantly questioned personal money management. She then started finding a club but ended up without seeing a single club. She says that our students know the concepts they are well educated on regarding corporate sector management but are not guided on how they should extend their knowledge to their personal lives. Moreover, she said many students end up in heavy debt because they don’t know ways to solve their financial problems. She then decided to start her financial literacy club.

She asked her friends through social media platforms and received an overwhelming response. After that, she reached out to the university administration to support her. She now runs a financial literacy club with 500 members on board, and it has associations with the university administration. Her recent session delivered a milestone speech by a keynote speaker, “CEO of Investopedia.”

She asked her friends through social media platforms and received an overwhelming response. After that, she reached out to the university administration to support her. She now runs a financial literacy club with 500 members on board, and it has associations with the university administration. Her recent session delivered a milestone speech by a keynote speaker, “CEO of Investopedia.”

Another student Jessica Gluck, at Maine’s Bowdoin College, after working on an internship, realized the importance of managing her finances; she then decided to start a financial literacy club to help students gain practical knowledge about the real world’s economic issues. To do this, she reached out to the administration at her school and the alums to help her. Her literacy club offered strategies for the students regarding savings for retirement and pattern of consumption.

If a person wants to start a financial literacy club, the following tip will help them attain their goals.

Talk to the university administration

Students can directly go to their faculty or administration; this would help them get legal support and power to start their idea. They will also be able to get funding through university; if not, then at least a person will have a physical structure to work out their idea. Not only this, but they can also get to talk with Alumni to make a distinction and inspire people.

Know what to do and when to do it

A person should always have a strong point about why they are doing this and, if they accomplish this, what else they want to do; that is to have a mission and an objective for their initiative. The mission statement should be compelling to the targeted people. Having a clear idea of what they want to achieve will always keep them in line, and it won’t let them get distracted.

Divide workload

If a person thinks they are getting tired of the work, build a team. Add teammates with different areas of expertise that align with work and divide the responsibilities between the members.

Pro-tip

Give members some autonomy, giving them a sense of responsibility and admiration. They will work even better.

Make connections

Communicate with different clubs and societies at school and invite them to visit. It will not only help spread the word but will also help to catch funding sources. Do not limit to schools or universities; link the club with businesses to gain funding and exposure. About Complete Controller® – America’s Bookkeeping Experts Complete Controller is the Nation’s Leader in virtual bookkeeping, providing service to businesses and households alike. Utilizing Complete Controller’s technology, clients gain access to a cloud platform where their QuickBooks

About Complete Controller® – America’s Bookkeeping Experts Complete Controller is the Nation’s Leader in virtual bookkeeping, providing service to businesses and households alike. Utilizing Complete Controller’s technology, clients gain access to a cloud platform where their QuickBooks file, critical financial documents, and back-office tools are hosted in an efficient SSO environment. Complete Controller’s team of certified US-based accounting professionals provide bookkeeping, record storage, performance reporting, and controller services including training, cash-flow management, budgeting and forecasting, process and controls advisement, and bill-pay. With flat-rate service plans, Complete Controller is the most cost-effective expert accounting solution for business, family-office, trusts, and households of any size or complexity.

file, critical financial documents, and back-office tools are hosted in an efficient SSO environment. Complete Controller’s team of certified US-based accounting professionals provide bookkeeping, record storage, performance reporting, and controller services including training, cash-flow management, budgeting and forecasting, process and controls advisement, and bill-pay. With flat-rate service plans, Complete Controller is the most cost-effective expert accounting solution for business, family-office, trusts, and households of any size or complexity.

The post Want to Start a “Financial Literacy Club”? first appeared on Complete Controller.------------

The post Want to Start a “Financial Literacy Club”? first appeared on Complete Controller.------------Read More

By: Complete Controller

Title: Want to Start a “Financial Literacy Club”?

Sourced From: www.completecontroller.com/want-to-start-a-financial-literacy-club/

Published Date: Thu, 20 Oct 2022 14:00:02 +0000

Did you miss our previous article...

https://trendinginbusiness.business/finance/financing-your-household-the-best

.png)