This posting is on what to do with your personal finances in the event of war. And to be even more specific, this article is about a war happening in the borders of your country. Not one happening far away from you that your country is involved with.

Wait, isn’t this topic ridiculous? Wars just don’t happen that much these days.

No.

While it is true that wars, industrial accidents, and crime have become increasingly rare in the last 100 years, even rare events like war can and do happen.

The Chances of a Revolutionary Event: 37 percent

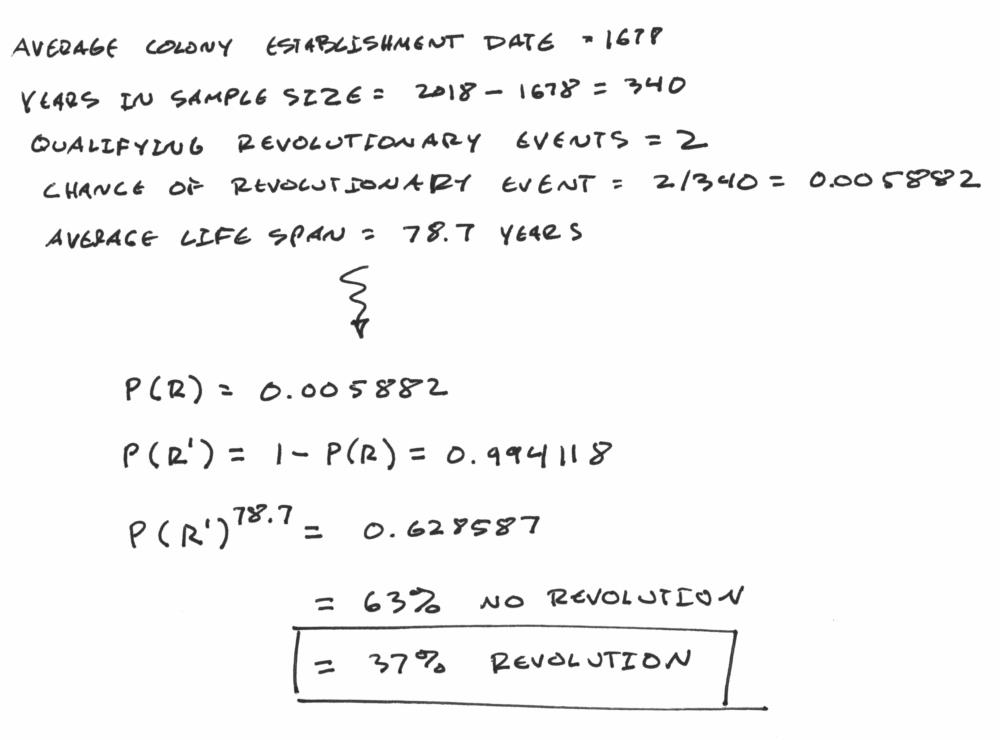

In a little-noticed 2018 analysis, hydrologist BJ Campbell gave a very tight synopsis of the chances of a violent revolution in the United States in his article “The Surprisingly Solid Mathematical Case of the Tin Foil Hat Gun Prepper“. Noting that there have been two major revolutionary events in the United States since the country’s founding, he calculated a 37 percent chance that any American of average life expectancy will experience at least one nationwide violent revolution. Here is his math:

Wealth Destruction Is An Enduring Part of Human Condition

In the 1980s, historians Will and Ariel Durrant synthesized some of the major findings of recorded history in their book The Lessons of History. They noted that out of the last 3,421 years where reliable historical records exist, just 268 had no wars. So, while conflict has been absent from the post-war finance literature, it is an enduring part of the human experience for virtually all of recorded history.

So, What To Do With Your Money In Case Of A War?

With notable exceptions, this topic has been largely ignored by the investing community. Possibly because professional investors tend to not have military experience or have spent substantial time in countries with a history of political instability.

The only really through work on this subject is Barton Biggs’ seminal book Wealth, War and Wisdom. Biggs, now deceased, was a Yale graduate, U.S. Marine Corps veteran, Morgan Stanley executive, and hedge fund manager. Wealth, War and Wisdom is one of the only thorough books on how wide-scale military conflict impacts personal finances. Biggs looked at the impact of the Second World War on stock markets and discussed how wealth was preserved in Europe during the 1940s.

So, to answer the question of what to do with your money in case of war, let’s review each of the asset classes below in light of Biggs’ discussion. I’ll add in some relevant historical and contemporary examples.

The ultimate conclusions are diversify and get out of the way. War is profoundly destructive for wealth building, and it is remarkably worse if your country is on the losing side.

By asset class:

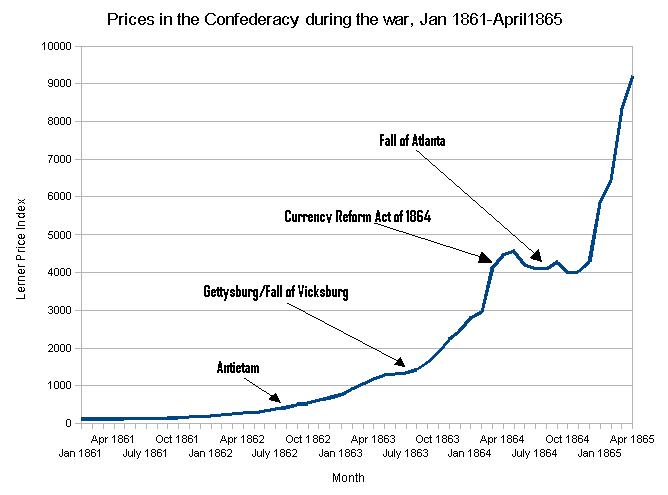

1) Cash: Wartime inflation and taxation usually substantially undermines the value of cash holdings. For example, cash proved to be a poor asset class during the Second World War. Inflation soared as high as 30 percent in France, 40 percent in Italy, and 50 percent in Japan — wiping out of the value of these currencies. In the United States, income taxes were raised to its highest historical levels — 94 percent on incomes above $200,000 — and inflation jumped as high as at 14 percent. The inflation numbers are historically consistent with what’s known about the U.S. Civil War. Here is a chart of the Lerner Price Index in the Confederate States of America between January 1861 and April 1865. Essentially, confederate money became worthless during the conflict period.

2) Precious metals: Gold and silver work well as a means of protecting small amounts of wealth. However, large amounts are almost sure to be confiscated or stolen. As they were during the German and Russian occupations of Europe during the Second World War.

3) Bonds: Depending on where you live, the performance of bonds can suffer a great deal during wartime. Between 1900 and 1949 bonds issued by Axis governments returned a negative -96 to -98 percent return. In contrast, bonds issued by Allied and neutral powers had average returns of 1.8 percent.

4) Real estate: During World War II, if you were on the losing side, physical real estate (houses and buildings) were generally not good assets to hold. Real property in Poland, France, Belgium, Denmark, and Eastern Europe was frequently confiscated or destroyed in the fighting. By the end of 1944, virtually no rents were paid on land or buildings in continental Europe. During the American Civil War, nearly 20 percent of all major plantations were destroyed. On the other hand, small, out of the way farms generally avoided destruction, at least during World War II and provided a good way to both preserve wealth and provide for yourself.

5) Equities: Even during World War II, stocks outperformed all other asset classes in countries which were directly impacted by the war. This was the case for both the Axis and Allied powers in World War II. However, performance depended largely on whether or not the country won or lost the war. Among countries victorious in World War II, stocks showed a 4.2 percent real return between 1900 and 1949. Among those countries that lost World War II, or were occupied, real returns of up to -26 percent were evident.

6) Personal property: Generally speaking looting in conflict zones is common, so personal property such as art, valuable collectibles, etc. are likely to be stolen by occupying powers. However, as Biggs warns, even if valuable personal property is able to be sold, it is often at a fraction of the item’s true value.

7) Cryptocurrency: Cryptocurrencies are vulnerable in wartime in two regards. First, they depend on localities having sufficient electrical power to access cryptocurrency exchanges. Recent experience in Venezuela suggests this isn’t always the case, per the BBC. Second, cryptocurrencies under the control of large corporations or national governments are vulnerable to confiscation. Fully 29 percent of global cryptocurrency trading takes place within the United States and “know your customer” regulation has increased substantially in the United States, elevating possible confiscation risk.

Practical Advice On What To Do With Your Money In Case Of War

Biggs offers some practical advice for safeguarding your wealth in the event of war:

- Diversify your wealth by moving at least 5 percent of it out of the country. Be careful of Swiss banks, they require strict documentation that is often not available post-conflict

- Buy a small farm with 5 percent of your wealth. This should be in an out of the way location

- Put 5 percent of your wealth in TIPS (Treasury Inflation-Protected Securities), inflation is common in countries experiencing warfare

- Be sure your stock holdings are diversified. Don’t put all of them in computerized databases in the giant banks — go paper instead. Be sure the stock is in your name, not in the “street name” or the name of the brokerage. Focus on global equities. If you’re holding domestic stocks, you’re going to get wiped out. Plain vanilla index funds are fine.

- Pay attention to stock markets. Markets have generally done a good job signaling when wars turn around

- Hold gold and silver outside of the country. Keep only a small amount at home

- Diversify your currency holdings. Carefully consider what currencies you want to hold and where you want to hold them

To briefly wrap this up — both Wealth, War and Wisdom and math behind the long run human experience suggest that war is more common and more destructive than we’d like to admit. The best thing you can do is diversify your assets and get them out of the way of the conflict by moving them out of the country.

Source: Barton Biggs, Wealth, War and Wisdom. Wiley. 2008.

------------Read More

By: James Hendrickson

Title: What To Do With Your Money In Case of War

Sourced From: www.dinksfinance.com/2023/05/what-to-do-with-your-money-in-case-of-war/

Published Date: Mon, 15 May 2023 11:20:06 +0000

.png)