Getty Image

- Investors should focus on three strategies through year-end, UBS's global chief investment officer said.

- They include getting the tech trade right, preparing for rate cuts, and learning how to manage risk effectively.

- "Our guiding principles remain steadfast: a commitment to long-term thinking, diversification, and the belief that time in the market trumps timing the market."

Exiting the first quarter of the year, investors are looking at record-setting stocks, a strong US economy, and assets that have been able to shrug off geopolitical risks.

From here, they're preparing for Federal Reserve interst-rate cuts after what was the fastest hiking cycle in 40 years. Meanwhile, artificial intelligence euphoria is still going strong, propelling gains in tech. And amid those forces, as investors march into the rest of the year, UBS has three key strategies that they say are worth focusing on.

Here's what they look like:

(1) Getting the tech trade right

It is a bubble, it's not a bubble — there's no end to the number of bullish and bearish views on tech as the AI euphoria has ripped through the stock market.

"In our view, investors should hold some diversified strategic exposure to the technology sector and the likely winners from tech disruption," Mark Haefele, UBS's global chief investment officer, wrote to clients.

The select companies that are the likely "winners" of any tech disruption are those like AI infrastructure companies (think IBM, Microsoft, Amazon, etc.) and platform and application companies that are well positioned to leverage advances in AI.

According to the bank, the tech sector will see an 18% earnings growth this year and a 72% annualized growth in AI revenues over the next five years. That growth potential makes today's valuations look reasonable, Haefele wrote, but it also means that the scope for disappointment is higher too.

For anyone who is too heavy in tech right now, Haefele suggests broadening out to other promising pockets of the market, like energy transition, healthcare disruption, and solutions to address water scarcity.

(2) Getting ready for rate cuts

The Fed is currently signaling three rate cuts for the rest of the year, with the first one being seen by investors as arriving in June.

When those cuts come, it's going to send bond yields lower. According to UBS, the 10-year yield — or the benchmark interest rate for the rest of our financial system — is forecasted to drop from 4.3% today to 3.5% by year-end. That implies a total return of 9.3%, Haefele wrote.

"This backdrop means that now is an attractive time for investors to lock in still-elevated yields, benefit from potential capital gains if yields fall, and diversify portfolios against risks," he said. "We think it is important to take steps to prepare portfolios for lower interest rates — in particular, by ensuring they have exposure to durable income streams."

That means diversifying liquidity holdings into fixed-term deposits, bond ladders, and structured investment strategies, beyond just cash and money-market funds. Investors should also consider high-quality bonds which look attractive because of high interest rates, like investment-grade corporate bonds.

(3) Learning how to manage risk effectively

There are myriad of risks lurking in the shadows waiting to grip nervous investors, from perky inflation numbers to market volatility before the 2024 election.

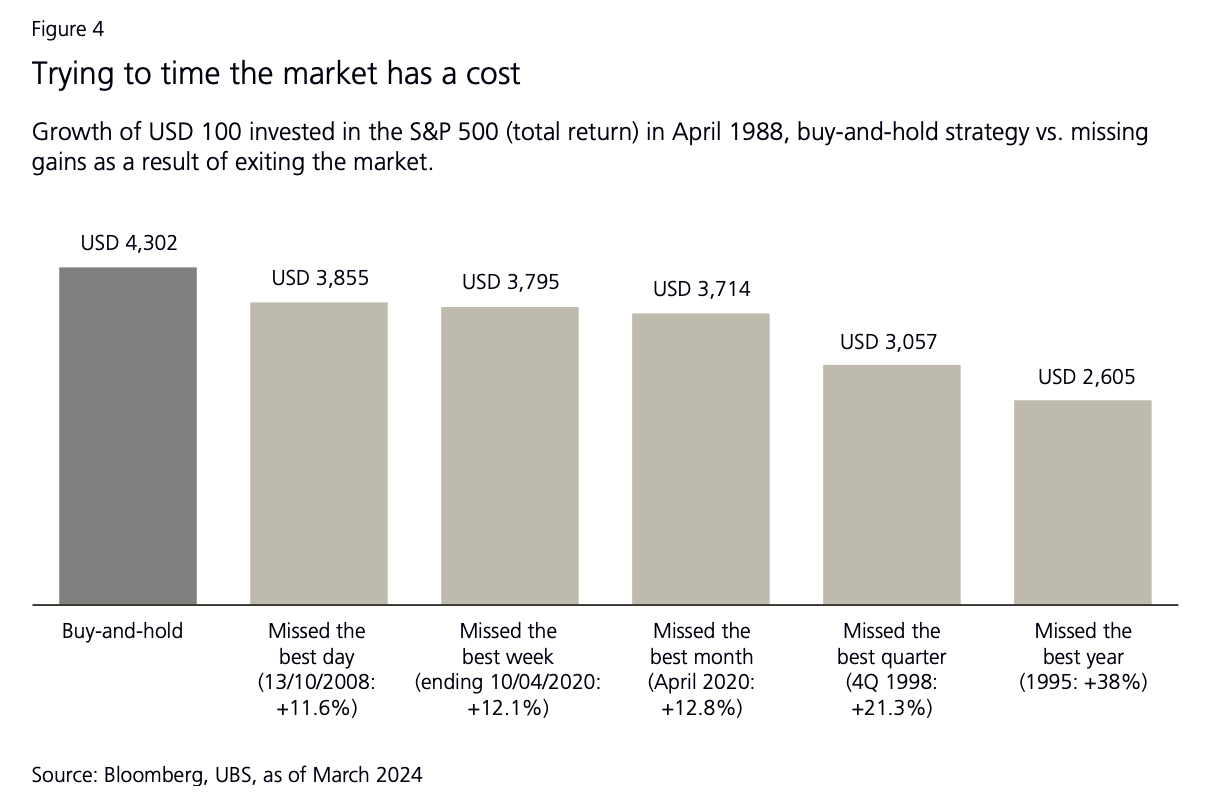

"Against this backdrop, and with major equity indexes trading near all-time highs, it can be tempting for investors to manage risks by taking profits or staying on the sidelines," Haefele wrote.

But that would be a mistake.

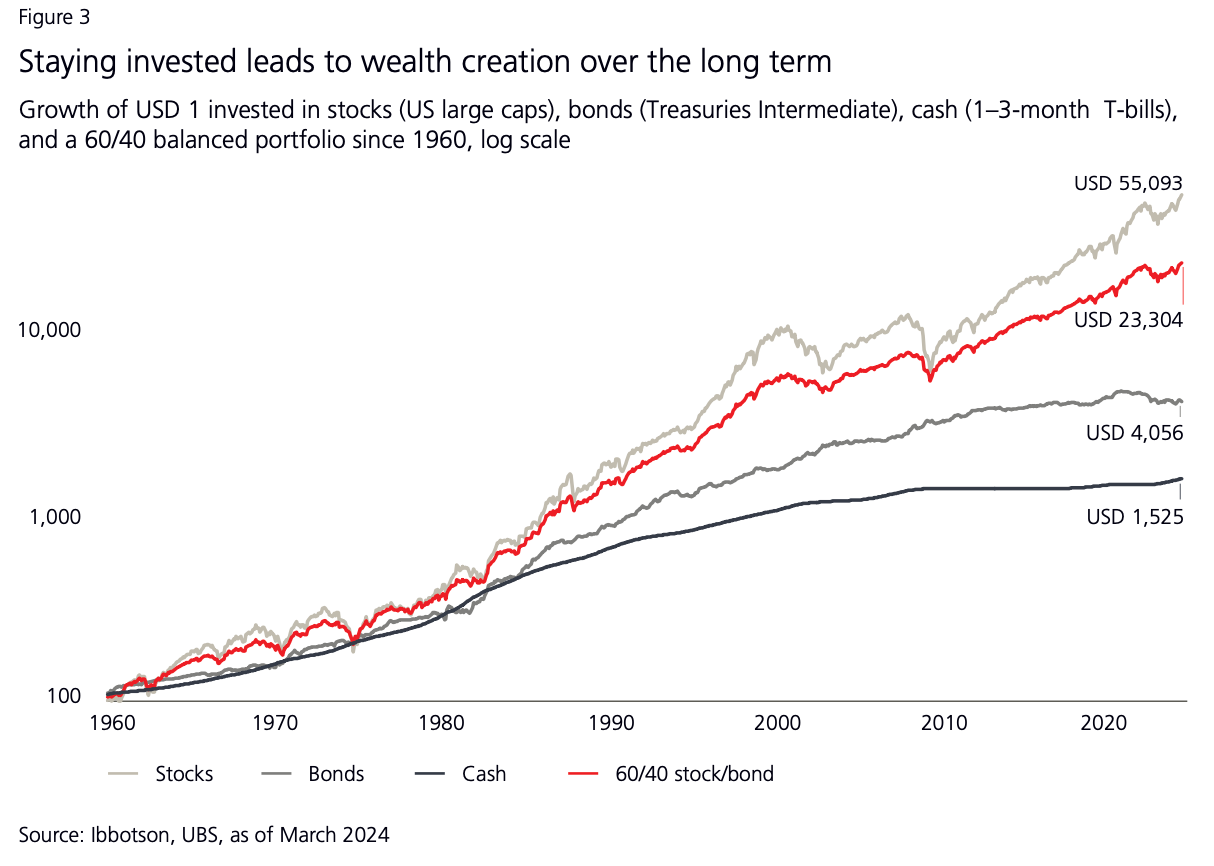

"History has shown that being invested and hedging risks is preferable to selling out or staying uninvested," he said.

UBS

Instead, to navigate the minefield of risks, investors should effectively diversify their assets across asset classes, regions and sectors. That could mean adopting theories like the 60/40 split, which allocates 60% of a portfolio to stocks and 40% to bonds. That strategy has only delivered a negative return over a 5 year horizon 5% of the time, Haefele wrote.

Investors should also remember that diversifying a portfolio is not limited to just stocks and bonds, he noted. For example, UBS is optimistic about certain strategies with "unique sources of returns" like credit hedge funds and private equity, and investing themes like digitization and decarbonization.

"As we navigate a year that promises to be historic for financial markets, our guiding principles remain steadfast: a commitment to long-term thinking, diversification, and the belief that time in the market trumps timing the market," he said.

UBS

Read More

By: [email protected] (Aruni Soni)

Title: 3 strategies for investors through year-end as rate cuts start and the AI trade broadens, according to UBS

Sourced From: markets.businessinsider.com/news/stocks/stock-market-2h-investing-strategies-outlook-rate-cuts-ai-trade-2024-3

Published Date: Sun, 24 Mar 2024 11:39:01 +0000

.png)