Liu Jie/Xinhua via Getty Images

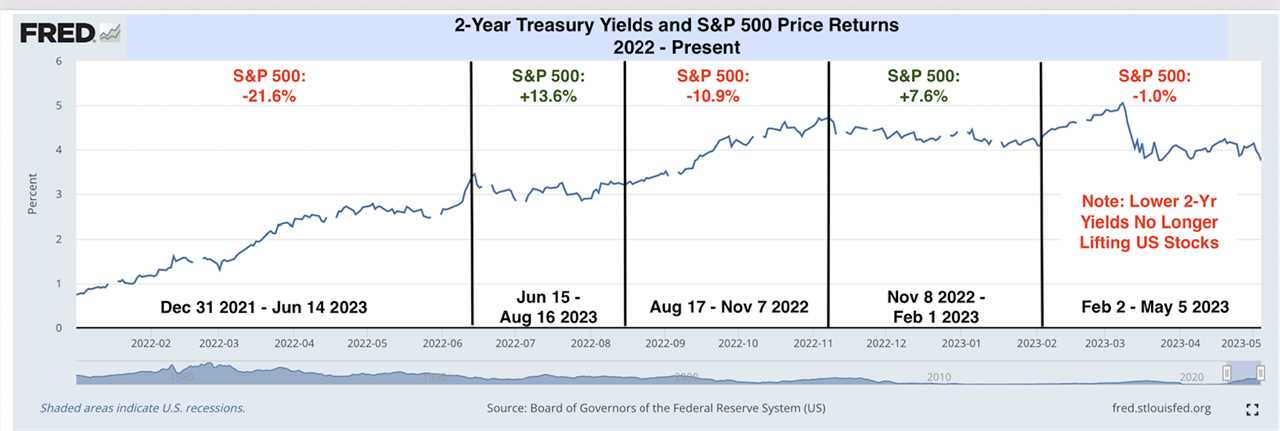

- The two-year Treasury yield has been falling but that's done little to juice the S&P 500, DataTrek says.

- The two-year yield reflects investor expectations for Fed policy moves.

- That rate has been moving lower as investors anticipate rate cuts this year.

There is a "telling" decoupling between stocks and a closely watched Treasury yield that reflects how investors foresee the Federal Reserve moving on monetary policy, says DataTrek.

Since the start of last year, there's largely been a clear tie between the two-year yield and S&P 500 returns, the research firm wrote Monday. When that bond rate rises, the index of the largest US publicly traded companies drops, and when rates stabilize, the S&P 500 climbs.

But DataTrek zeroed in on moves that have emerged from February until now. The two-year yield has fallen, to 3.92% as of Friday's close from 4.09% on February 2. "In fact, they have dropped even more since March 8th, when they topped out at 5.05 percent," said DataTrek's co-founder Nicholas Colas.

Yet, the S&P 500 has declined 1% since February 2nd, and has risen by only 3.6% since March 8th, with half of the latter gain taking place on Friday. The S&P 500 jumped 1.8% on Friday, partly powered by index heavyweight Apple.

"It is telling that their recent decline has had little effect on stock prices. Even though Fed Funds Futures are predicting rate cuts by the end of the year, equity markets are not quite sure if that's good news or bad," said Colas. "That is a break from the previous relationship between these 2 assets and therefore signals a change in market narrative."

The two-year yield has been whipped around this year, notably jumping above 5% in March for the first time since 2007.

The yield shot up after Fed Chairman Jerome Powell indicated stubbornly high inflation could lead policy makers to accelerate the pace of rate hikes - an indication that didn't materialize at its March or May meetings. Stocks sold off when the yield spiked, with the bond market preparing for a steeper Fed funds rate.

But that yield has pulled back as investors anticipate the Fed will start rate cuts as soon as July. An inverted yield curve has been flashing warning signs that the US economy is heading into or has already landed into a recession.

The Fed last week delivered its 10th consecutive rate increase to a range of 5%-5.25%.

DataTrek, Federal Reserve

Read More

By: [email protected] (Carla Mozée)

Title: A key bond yield points to rate cuts on the horizon this year - but investors aren't sure if that's good or bad news

Sourced From: markets.businessinsider.com/news/bonds/bond-yields-stock-market-2-year-treasury-fed-rate-cuts-2023-5

Published Date: Tue, 09 May 2023 11:55:20 +0000

Did you miss our previous article...

https://trendinginbusiness.business/politcal/rep-nancy-mace-says-people-want-to-see-her-jello-wrestle-with-marjorie-taylor-greene

.png)