Welcome back, readers. I'm your host, Phil Rosen, reporting from Manhattan.

I hate to say it, but crypto exchange FTX's fallout is still making headlines even after JPMorgan CEO Jamie Dimon said last week it was getting way too much attention.

To kick off the weekend, Binance CEO "CZ" and ex-FTX chief Sam Bankman-Fried had a row on Twitter, lobbing accusatory volleys at one another — who lied about what, how much money was involved where.

Those tweets, of course, come as what many consider crypto's Lehman moment continues to unspool amid a deep bear market for digital assets.

In any case, I want to side with Dimon on this, at least for today: Let's put the FTX story aside for a moment.

Today we're turning our focus to the very near-term US economy.

If this was forwarded to you, sign up here. Download Insider's app here.

(Photo by Scott Heins/Getty Images)

1. Bank of America's strategists said the US could fall into a recession over the next 10 to 12 weeks. Other commentators have posited a longer-term forecast of a downturn, with some saying the pain will hit closer to mid-2023.

But BofA warned that the economy could be in a contradictory period as soon as March.

That falls in line with a recent Conference Board survey that found 91% of CEOs expect a recession next year, though the BofA timeline is more urgent.

According to BofA's Michael Hartnett, there are five signals that are foretelling a recession is around the corner:

- The yield curve is seeing its deepest inversion since 1981.

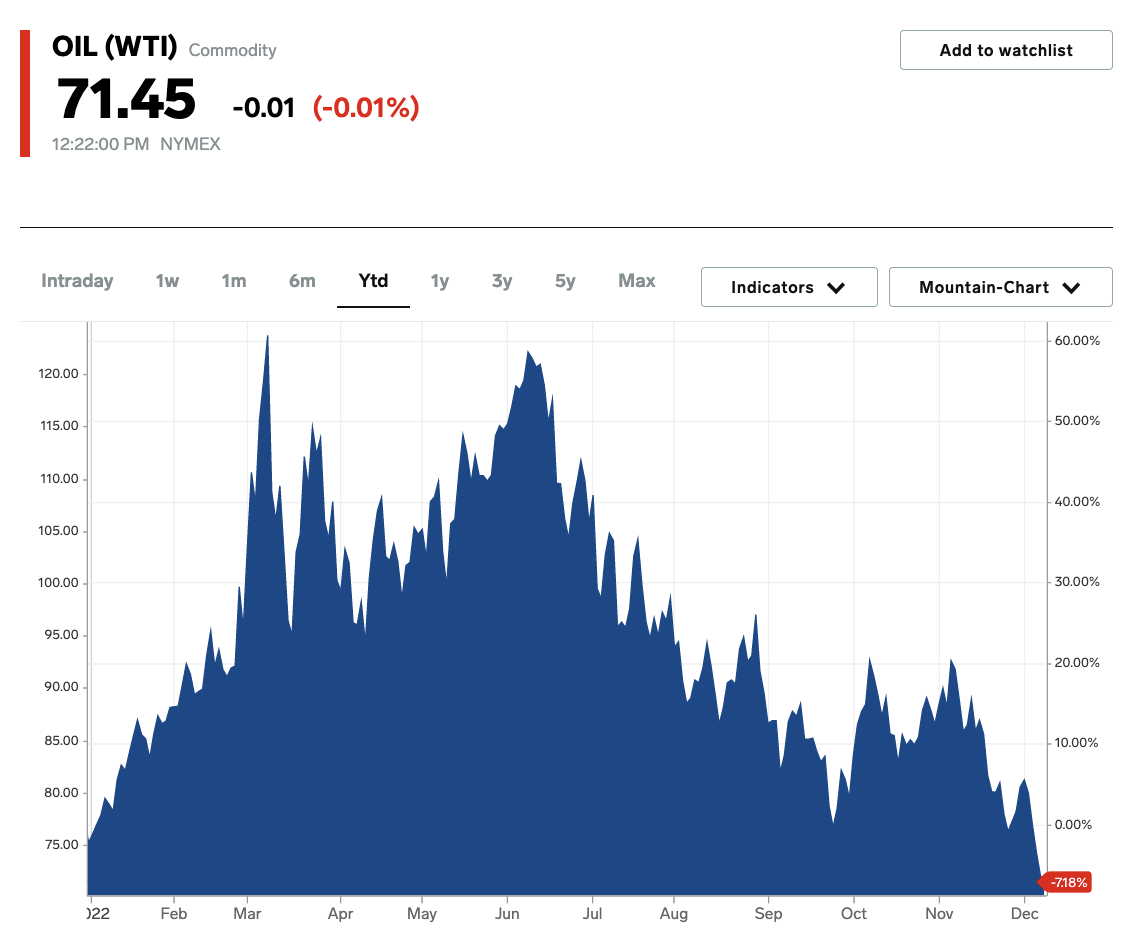

- Oil is down 40% in six months, despite bullish supply factors including China's reopening.

- Bank stocks have tumbled in recent days.

- Manufacturing orders have been down for three months.

- The US home sales index is down 37% year-over-year.

Frankly, a broad recession won't be a surprise to anyone at this point (especially Opening Bell readers). If and when it arrives, it will turn out to be the most telegraphed downturn in history.

Friends of mine who don't follow markets still talk about the strain on their wallets as inflation and borrowing costs climb, and the general mood at the dinner table isn't one I'd call optimistic.

Even so, recessionary signals that have been blaring for months are still getting louder and worse.

Ken Mahoney, CEO of Mahoney Asset Management, said in a note to clients that even as the Fed's rate hikes work their way through the financial system, other issues like expensive power bills and supply chain mishaps are still worrisome.

Plus, more layoffs certainly won't be boosting anyone's mood or economic outlook.

"When you see companies laying off droves of employees, that's not a good sign as these companies' sales are not holding up well, and it's a clear sign of economic slowdown and less spending by both businesses and consumers," Mahoney said.

Unfortunately for investors, he added that tried-and-true investment strategies (like "buy and hold") won't work anymore.

"The reason being is that for the markets, there will be an 'earnings recession', in which the S&P valuation multiple continues to compress, hence the market will remain weak and volatile," Mahoney maintained. "Investors will have to continue to stay nimble and keep it tight in terms of risk management because we have seen how risk can happen very fast."

What do you think of Bank of America's recession call?

Tweet me (@philrosenn) or email me ([email protected]) to let me know.

In other news:

Bartolome Ozonas/Getty

2. US stock futures rise early Monday, as investors count down to tomorrow's consumer inflation data and the Fed's interest-rate decision later this week. Here are the latest market moves.

3. Earnings on deck: Oracle, Uranium Energy Corp., and more, all reporting.

4. Goldman Sachs recommended this batch of stocks that have growing profit margins. And those are only set to expand in 2023 as the rest of the stock market flatlines, analysts said. See the 20 companies.

5. JPMorgan's quant guru said it's time to sell energy stocks. The sector's massive outperformance relative to oil prices can't last, and the firm's top strategist said it's time to make the tactical trade. "The catalyst for convergence would be a pullback in the broad equity market."

6. FTX's collapse is still hammering other platforms, and Chelsea just lost a $25 million sponsorship. As per Bloomberg, Crypto lender Amber is ending its deal with the soccer club, the move being part of a cost-cutting push. Meanwhile, FTX's bankruptcy has jeopardized its agreements with the Miami Heat and Mercedes F1 team.

7. Leuthold Group's Jim Paulsen said stocks have entered into a new bull market. The chief strategist said that he expects a 60% chance of the US economy side-stepping a recession — and thinks the S&P 500 could soar 26% in the next 12 months.

8. Next year will be the worst year for the global economy in decades, according to Citi. Analysts at the firm said investors shouldn't get bullish yet, and advised them to take present-day defensive positioning. These strategies can help investors protect their money and position for a later rally.

9. Investors can get a leg up in 2023 if they buy into certain ETFs. These nine funds offer strong positioning through a recession and into the next bull market, in Bank of America's view. Get the full list here.

Markets Insider

10. Russia's President Vladimir Putin said the oil price cap is "stupid." He also noted that Moscow's government finances won't be hit by the move, despite a recent warning from the country's central bank. Now, Russian officials are considering slashing oil production.

Curated by Phil Rosen in New York. Feedback or tips? Tweet @philrosenn or email [email protected]

Edited by Max Adams (@maxradams) in New York and Hallam Bullock (@hallam_bullock) in London.

Read More

By: [email protected] (Phil Rosen)

Title: A US recession is coming - here are 5 reasons why

Sourced From: www.businessinsider.com/us-recession-economy-markets-bank-america-finance-investing-stocks-goldman-2022-12

Published Date: Mon, 12 Dec 2022 11:00:00 +0000

Did you miss our previous article...

https://trendinginbusiness.business/politcal/after-failure-in-georgia-senate-runoff-republicans-could-bring-in-more-voting-changes-next-year

.png)