The price tag of President Joe Biden’s student loan amnesty just keeps growing — and it’s not the neediest who are getting the money, either.

According to the New York Post, a new study by the University of Pennsylvania estimates that a new round of student loan cancellation programs raises the amount that taxpayers are stuck holding to $559 billion total, including $84 billion under new provisions announced last week.

The kicker? The newest provisions under the Saving on a Valuable Education, or SAVE, plan will benefit those in higher tax brackets the most.

The income-driven plan was introduced last summer, but new loan cancellations for 277,000 borrowers were announced last week.

“Today’s announcement shows — once again — that the Biden-Harris Administration is not letting up its efforts to give hardworking Americans some breathing room,” Education Secretary Miguel Cardona said in a statement, the Post reported.

“As long as there are people with overwhelming student loan debt competing with basic needs such as food and healthcare, we will remain relentless in our pursuit to bring relief to millions across the country.”

Cardona was doing the usual media rounds promoting how the plan was going to help the most vulnerable student loan recipients:

.@SecCardona breaks down who qualifies for President Biden’s new student debt relief plan.#GMA3 pic.twitter.com/BB3PVT76K4

— GMA3: What You Need To Know (@ABCGMA3) April 9, 2024

However, the University of Pennsylvania’s Penn Wharton Budget Model found that the new round of cancellations wasn’t exactly going to help those who were struggling to put food on the table — unless their diet consisted of three square meals of foie gras and Wagyu steak.

“President Biden recently announced five main provisions to provide student loan debt relief. Some of provisions are already mostly covered by President Biden’s SAVE plan introduced in 2023. Some provisions, however, are more incremental to the SAVE plan, including one provision — the forgiveness of longer-term debt — that expands eligibility to higher-income households,” read a Thursday media release of the study’s key takeaways.

“We estimate that the New Plans will cost $84 billion in addition to the $475 billion that we estimated for President Biden’s SAVE plan, for a total cost of about $559 billion across both plans.

“While the New Plans, like the SAVE plan, contain provisions to relieve debt based on individual or household income, the New Plans will also relieve some longer-term student debt for about 750,000 households making over $312,000 in average household income,” it continued.

“The main reason for this high average household income is that the SAVE plan already provides long-term debt relief to households with lower incomes.”

Of the five major components of the new plans announced on April 8, two in particular stick out as driving the relief up the income ladder.

First is the threshold for waiving accrued and capitalized interest on the loans: “Up to $20,000 in accrued and capitalized interest will be waived for borrowers with current balances above the initial balance upon entering repayment, regardless of borrower’s income,” the Wharton media release read.

“Single borrowers making less than $120,000 or couples making less than $240,000 a year will qualify for a total waiver of all current balances above the initial balance if they are enrolled in any IDR plan. Automatic relief will be applied, and so no application is needed.”

Second is the elimination of undergraduate student debt for those who have been paying it for over 20 years or gradate debt for 25 years.

“If student loan repayments started on or before July 1, 2005, all debt will be eliminated for borrowers with undergraduate loans only. (For borrowers with any graduate debt, this date is pushed back to July 1, 2000). No enrollment in IDR plans will be needed to receive the relief, but currently it’s unclear if any other application will be required from the borrowers,” the news release said.

The total cost of all the five measures is a touch over $84 billion, added to the estimated $475 billion Biden’s unilateral student loan relief has already put taxpayers on the hook for.

However, in this case, Biden is providing relief to households who are less than $100,000 away from that magical $400,000 number that he says makes you one of the wealthy that he plans to tax to pay for his spending sprees — you know, those who need to start paying their “fair share.”

To say this is ridiculous is an understatement — until, of course, you realize that 2024 is an election year and Biden’s poll numbers haven’t looked hot since the beginning of the race, despite the fact that Democrat DAs and the Department of Justice have been on a quest to tie up the presumptive Republican nominee in court until November.

As House Budget Committee chairman Rep. Jodey Arrington, a Texas Republican, noted, this wasn’t just unconstitutional, it was a “quest to buy votes.”

“In reality, his plan will shift the responsibility of paying for loans owed by high-income earners who freely incurred them onto the backs of all taxpayers, many of whom do not even have a college degree,” Arrington said via a statement.

“[Biden’s] administration is dead set on circumventing the Supreme Court, defying Congress, and saddling our country with more debt.”

And unlike he says, it’s not taking from the rich to give to the poor. It’s taking from those who didn’t take college loans or paid them off and giving relief to wealthy people who did and haven’t.

Is this what student debt relief should look like? It is when one is down badly in the polls and is grasping at straws to get suburban voters in swing states. That’s hardly good policy — but as cynical strategizing, it’s not half bad.

This article appeared originally on The Western Journal.

The post Biden’s Student Debt Cancellation Has Taxpayers Paying Over $550 Billion, Benefits Wealthier Families appeared first on The Gateway Pundit.

------------Read More

By: C. Douglas Golden, The Western Journal

Title: Biden’s Student Debt Cancellation Has Taxpayers Paying Over $550 Billion, Benefits Wealthier Families

Sourced From: www.thegatewaypundit.com/2024/04/bidens-student-debt-cancellation-taxpayers-paying-550-billion/?utm_source=rss&utm_medium=rss&utm_campaign=bidens-student-debt-cancellation-taxpayers-paying-550-billion

Published Date: Wed, 17 Apr 2024 17:00:09 +0000

Did you miss our previous article...

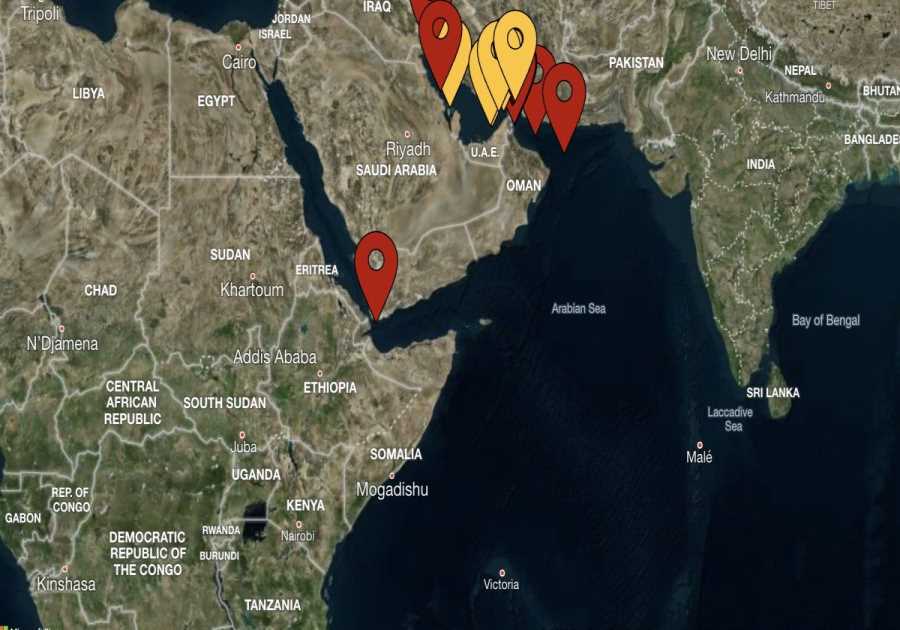

https://trendinginbusiness.business/politcal/iran-and-israel-dragged-their-shadow-war-out-of-the-dark-and-its-much-more-dangerous-now

.png)