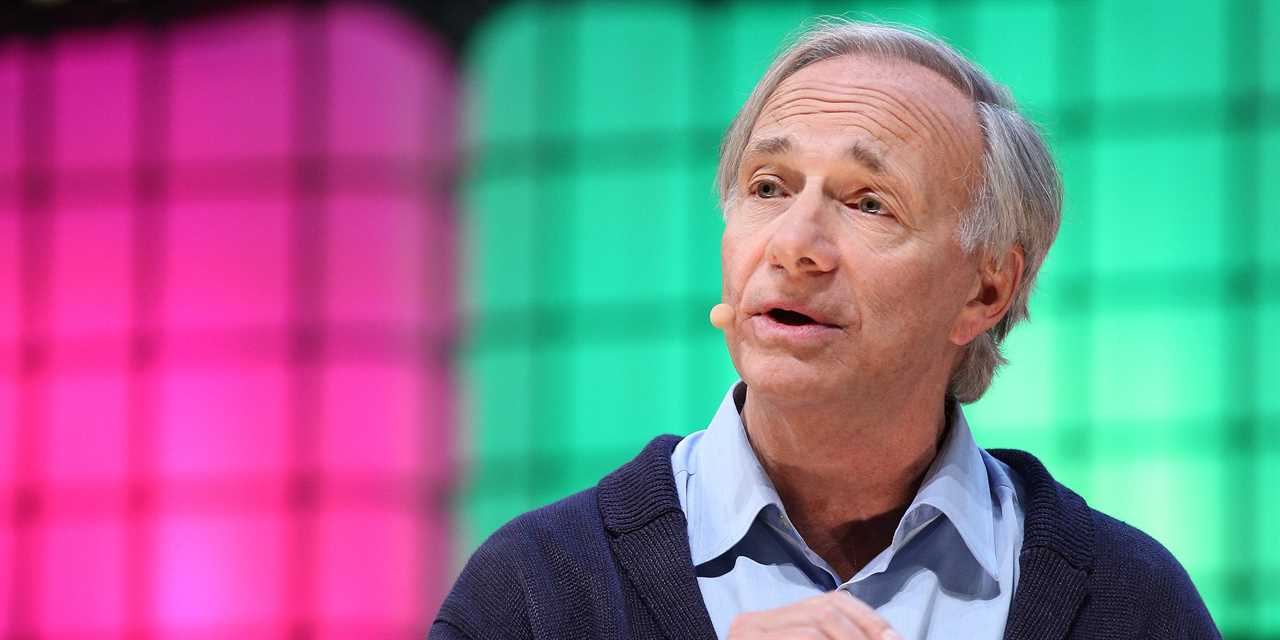

Pedro Fiúza/Getty Images

- Billionaire investor Ray Dalio sounded the alarm on US debt and said bonds aren't a good long-term investment.

- If investors aren't receiving a high enough real interest rate, they will sell bonds, he warned.

- "I don't want to own debt, you know, bonds and those kinds of things. Temporarily right now, cash I think is a good investment."

A global bond market that's already overloaded with US debt may see selling pressure that sends rates higher, Bridgewater Associates founder Ray Dalio said.

Speaking at the 10th Milken Institute Asia Summit in Singapore on Thursday, the billionaire investor noted that the US Treasury must sell huge amounts of bonds as federal deficits balloon, adding that the situation is also a world problem.

But if investors aren't receiving a high enough real interest rate, they will sell those bonds, he warned.

"The supply-demand [imbalance] isn't just the amount of new bonds. It's the issue of 'do you choose to sell the bonds?' I personally believe that the bonds longer term are not a good investment," Dalio said.

If selling happens, it forces interest rates to go further up, as the market needs to attract bond buyers. That means monetary authorities would face the difficult task.

"When the interest rates go up, the central bank then has to make a choice: Do they let them go up and have the consequences of that, or do they then print money and buy those bonds? And that has inflationary consequences," Dalio said. "So, we're seeing that dynamic happen now."

The bond market is awash in US debt. In one quarter alone, the Treasury Department flooded the market with $1 trillion in T-bills.

Meanwhile, with $7.6 trillion in US debt coming due in under a year, debt servicing costs will likely mean an uptick in rates.

When asked later at the Milken event for his investment advice, Dalio said, "I don't want to own debt, you know, bonds and those kinds of things. Temporarily right now, cash I think is a good investment."

Read More

By: [email protected] (Filip De Mott)

Title: Billionaire investor Ray Dalio sounds the alarm on US debt and says bonds aren't a good long-term investment

Sourced From: markets.businessinsider.com/news/bonds/billionaire-investor-ray-dalio-alarm-us-debt-bonds-inflation-cash-2023-9

Published Date: Thu, 14 Sep 2023 15:17:29 +0000

.png)