Spencer Platt/Getty Images

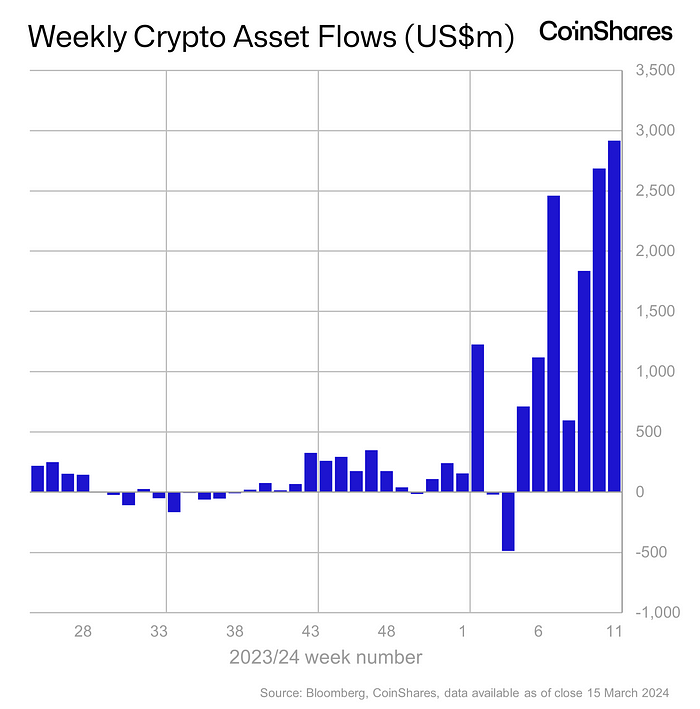

- Digital asset investment products have seen year-to-date inflows of $13.2 billion, CoinShares data shows.

- That surpasses the amount seen during all of 2021, the peak of the crypto's pandemic-era bull run.

- Last week saw crypto fund inflows hit a fresh weekly record of $2.9 billion.

Three months into 2024 and the digital asset market is already breaking annual records thanks to the slate of spot bitcoin ETFs that came online in January.

CoinShares data published on Monday showed inflows to cryptocurrency funds this year have surpassed the amount seen in all of 2021, the year bitcoin hit a record high close to $69,000 and helped fuel a massive rally throughout the wider crypto market.

Total inflows to crypto funds and products year-to-date have reached $13.2 billion, per CoinShares, compared to $10.6 billion in the whole of 2021.

The CoinShares report showed digital asset investment products saw seven-day inflows totaling a record $2.9 billion last week, beating the prior week's $2.7 billion, which was also a short-lived record.

Broken down by provider, BlackRock has seen the heaviest inflows at $12.5 billion for the year. That's followed Fidelity, which has drawn about $6.8 million from investors.

CoinShares

The report also noted that bitcoin accounts for 97% of all inflows, and that's no accident.

Bitcoin, the world's largest cryptocurrency by market cap, has appreciated more than 54% this year, and it's enjoyed huge interest from investors on account of the spot ETF products that have been touted as an easier way to gain exposure to the token.

That demand surge has arrived ahead of the next bitcoin halving event, which is expected to happen in April. The cryptocurrency could run into an "explosive set-up," according to Sandy Kaul, Franklin Templeton's head of digital asset and industry advisory services.

In an interview last week, she told Business Insider that she doesn't expect the halving to be a "sell the news" occurrence.

"The dynamic could put us in uncharted territory," Kaul said. "We've never had both a supply shock and a demand shock at the same time."

Bitcoin hit a fresh all-time high last week above $73,000. The crypto slipped later in the week below $70,000 and has struggled to reclaim that level.

Bitcoin was down by 1.5% at 2 p.m. ET Monday, trading around $67,225.

Read More

By: [email protected] (Phil Rosen)

Title: Crypto fund flows this year have surpassed the total seen in all of 2021 as ETFs stoke huge demand

Sourced From: markets.businessinsider.com/news/currencies/bitcoin-etf-flows-crypto-funds-inflows-investors-blackrock-fidelity-coinshares-2024-3

Published Date: Mon, 18 Mar 2024 18:22:59 +0000

Did you miss our previous article...

https://trendinginbusiness.business/politcal/olympic-skier-lindsey-vonn-hates-the-cold-now-shes-happily-living-in-miami

.png)