Oscar Wong/Getty Images

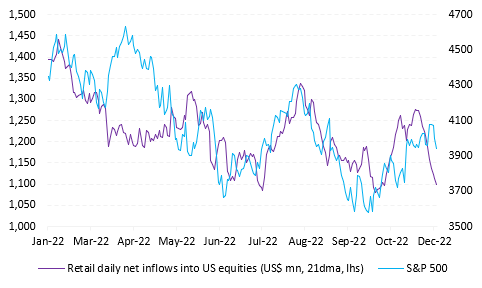

- Risk-aversion toward stocks looks like it's setting in among retail investors as 2022 winds down.

- Average daily purchases have dropped to about $1 billion over the past month, around the year's lows, said Vanda Research.

- Flows "paint a picture of caution" before the last inflation report and Fed meeting in 2022.

Risk-aversion among retail investors appears to be setting in as 2022 approaches its end, with daily overall stock purchases hovering around lows of the year, according to Vanda Research.

They are still net buyers of equities, but average daily purchases have declined to just above $1 billion over the past month, with the slowdown on display across ETFs, single stocks, and sectors. The firm's VandaTrack tool monitors retail activity in more than 9,000 stocks and ETFs.

"Retail flows paint a picture of caution ahead of the CPI print and FOMC meeting this month," Marco Iachini, senior vice president of research at Vanda, said in a weekly report published Wednesday. "Beyond cash equities, activity in the options market remains stagnant."

The S&P 500 and the Nasdaq Composite have dropped into a bear market this year with the Fed turning aggressive in responding to inflation that's burning at its hottest in four decades. While there are signs of prices cooling, the November core inflation rate may show an increase of 0.4% compared with a 0.3% rise a month earlier, according to a Bloomberg survey of economists.

An edge higher in core inflation would take place after the Fed this year has already pushed its benchmark borrowing costs from zero to a range of 3.75% to 4%.

"The lack of action and diversity across purchases is likely symptomatic of a return to dollar-cost-averaging strategies," said Iachini. "In contrast to earlier in the year, where bouts of speculation were more common during bear market rebounds, the relative dullness of recent retail action looks like a sign that retail investors are ready to turn the page on 2022."

Tesla, however, remains a favorite among retail investors as the stock "continues to experience an incrementally higher flow of capital," said Vanda. Net retail purchases of Tesla stock were $666.3 million over a five-day period starting last week.

City Index, a UK-based broker, this week said the "Powell pump" has been erased from the S&P 500 – a wipe-out of gains the index piled on after Federal Reserve Chairman Jerome Powell last week said signs of easing inflation carry the potential for the central bank to reduce the size of interest rate increases.

The Fed may decide on a rate hike of 50 basis points at its December 13-14 meeting after a run of four rate hikes of 75 basis points each. The FOMC has kicked up the fed funds rate at each meeting since March.

Headline inflation in October stood at 7.7%.

Vanda Research

Read More

By: [email protected] (Carla Mozée)

Title: Daily stock buying by retail traders is near its lowest point all year as caution builds ahead of the final Fed meeting of 2022

Sourced From: markets.businessinsider.com/news/stocks/stock-markets-tesla-daily-purchases-retail-investors-traders-fed-markets-2022-12

Published Date: Wed, 07 Dec 2022 19:54:44 +0000

Did you miss our previous article...

https://trendinginbusiness.business/politcal/stocks-could-plummet-another-25-if-theres-a-recession-next-year-dr-doom-economist-nouriel-roubini-warns

.png)