Drew Angerer/Getty Images

- The US could default on its debt as soon as June 5 if the debt ceiling isn't raised by then.

- Experts told Insider that even a short-term default could cost jobs in different industries.

- Biden and McCarthy reached an agreement in principle on Saturday.

Congress has just days to raise the debt ceiling — and Americans' jobs are on the line.

For months, Speaker of the House Kevin McCarthy and President Joe Biden have been at odds over the best approach to raise the debt ceiling, and now, those negotiations are coming down to the wire. Treasury Secretary Janet Yellen has repeatedly warned McCarthy that the US could hurdle into a default in early June, after which point the government will run out of money to afford federal programs and pay out benefits that millions of Americans rely on, like Social Security.

Biden and McCarthy finally reached an agreement on Saturday night, and they now have to sell the provisions to their respective parties.

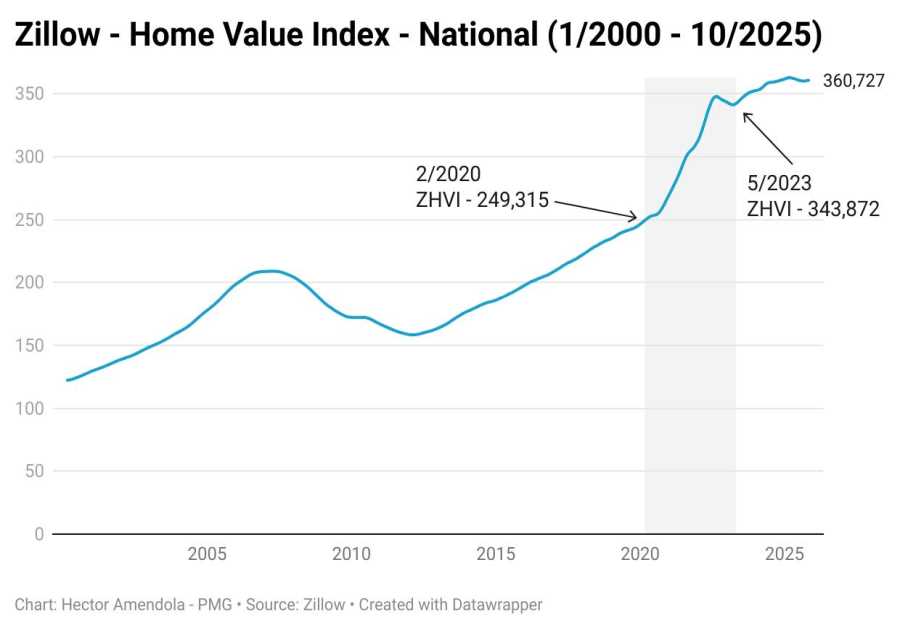

A default on the nation's debt is unprecedented, and there's no way to predict what exactly would happen to the economy should lawmakers fail to raise the debt ceiling before the deadline. But Moody's Analytics has previously estimated that even a short-term default could cost Americans over a million jobs, likely undoing the recovery the country has made since the pandemic.

One scenario Moody's Analytics examined is a "prolonged breach scenario" involving a weeks-long default. Bernard Yaros, an economist at Moody's Analytics, told Insider that scenario would occur if "the X-date is hit in early June and lawmakers don't end the crisis until the end of July."

That would translate to "7.8 million jobs lost from peak to trough," Yaros said. Professional and business services would see about 1.4 million job losses in this scenario, and health services would see just under 1 million jobs lost. Other industries would see over half a million jobs lost in this scenario, including construction.

Josh Bivens, chief economist at the Economic Policy Institute, told Insider that "an actual default would affect every single sector," adding that "it would be a mammoth across the board kind of recession."

"I think the first round effects are just people who rely on either direct payments from the government or payments from government employees," Bivens said, which can include the healthcare sector and "people who run national parks."

All the discussion surrounding a potential default could lead to economic turmoil.

Mike Konczal, the director of macroeconomic analysis at the think tank Roosevelt Institute, said on a recent press call that "hitting the debt ceiling, even just the prospect of it, is a grave threat" to the country's economic recovery.

"It's not just financial markets that would suffer. Any kind of default will put major stress on the rest of the real economy. Social Security payments would immediately be delayed," Konczal said. "This would cause hardship for many and immediately cause consumers to panic, stop spending, and slow the economy, threatening major recession."

At this point, it's unclear if Congress will reach an agreement before Americans start to experience those consequences. McCarthy told reporters on Thursday that "whenever you're able to get to an agreement, you got to make sure you print it, post it, then you got three days before you vote. We've got time, we're going to get this done."

But experts are cautioning against waiting until the last minute, and potentially triggering an economic downturn.

"If we default and it goes on for three to four months, I think you could be talking about unemployment rate increases like we saw in the financial crisis of 2008," Bivens said. "But this is all super speculative because it's the kind of catastrophe we've just never had before, and it's totally avoidable."

'A huge human toll that was unnecessarily incurred'

Phillip Sprehe, an economist at Geographic Solutions, told Insider that if the debt ceiling isn't raised, it probably won't cause "a dramatic cut in employment," but there could be "a sudden pullback in the number of job openings." Sprehe thinks that pullback would first occur in the financial sector.

And in terms of layoffs that might happen, Sprehe said that "it would really be with those companies that have kind of delicate financial positions where they're relying on interest payments from US Treasuries that they hold and they're doing this month to month, so that if they don't get that revenue in, then that could jeopardize their ability to do business and to keep up with payroll."

But beyond potential job cuts, a default risks derailing funding for federal programs that millions of Americans rely on. For example, a recent analysis from the Bipartisan Policy Center found that in the first 10 days of June — if the US defaults — the government could run out of money to pay out benefits through programs including Social Security, Medicare, Medicaid, and SNAP, based on daily Treasury statements.

"There's no corner of the economy that's going to be spared if lawmakers do the unthinkable and allow the Treasury to pierce the debt ceiling and be unable to meet all of its obligations in full and on time," Yaros said. "Everything from industries like health services, which typically are recession-proof, would suffer, and they would especially suffer here because you would have delayed payments."

Unlike in the prolonged breach scenario, a shorter breach that's "no more than a week," per Moody's Analytics' paper, would still mean a mild recession.

"It's something closer to the 2001 recession that we had after the dot-com bubble, and you get about 1.5 million jobs lost from peak to trough," Yaros said. "There's really no silver lining there. It's a mild recession, but it's still a needless recession. And 1.5 million jobs lost — that's still a huge human toll that was unnecessarily incurred."

Read More

By: [email protected] (Madison Hoff,Ayelet Sheffey)

Title: Get ready to see millions of Americans lose their jobs if Congress doesn't raise the debt ceiling in the next few days

Sourced From: www.businessinsider.com/what-will-happen-to-jobs-if-us-defaults-debt-ceiling-2023-5

Published Date: Mon, 29 May 2023 11:40:00 +0000

.png)