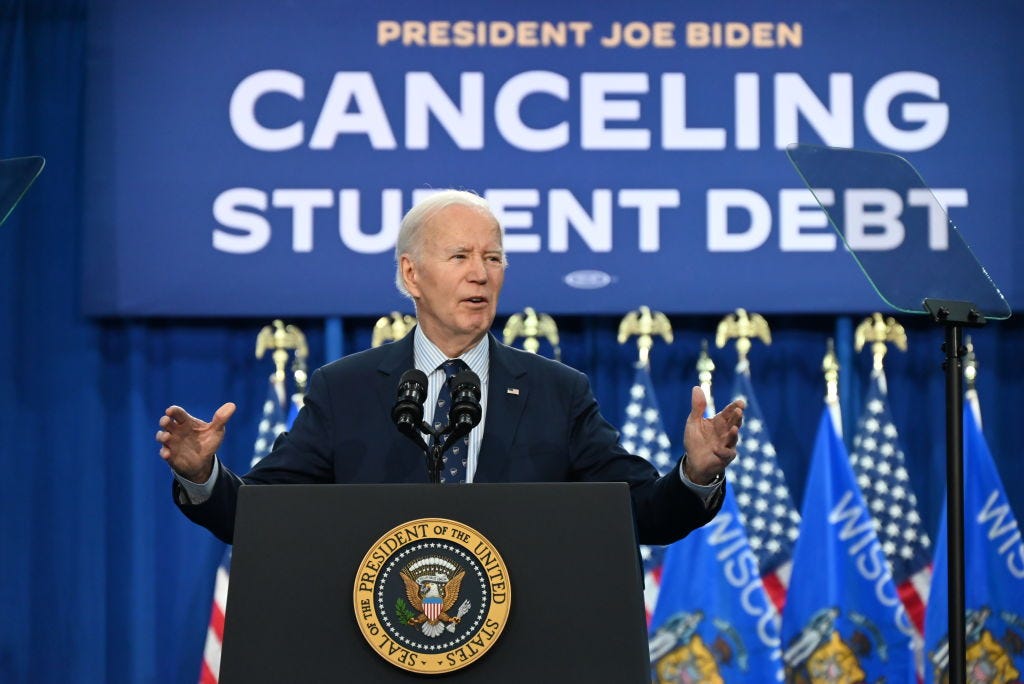

Kyle Mazza/Anadolu via Getty Images

- Biden released new details for his second attempt at student-loan forgiveness.

- While it likely won't go into effect until the fall, an earlier Supreme Court decision could put the relief at risk.

- The ruling would address whether agencies have the authority to interpret a law's scope, like debt relief.

New details for President Joe Biden's student-loan forgiveness plan are out — and it's already shaping up to be a rocky road to implementation.

The same day the Supreme Court struck down Biden's first attempt at broad debt relief at the end of June 2023, the Education Department announced its plan B: relief for borrowers using an authority under the Higher Education Act of 1965.

In contrast to the HEROES Act — the law Biden used for his first attempt at relief — the HEA requires the administration to undergo a process known as negotiated rulemaking. The process requires a series of negotiations with stakeholders before drafting the regulatory text for the rule, which then enters a period of public comment before the relief can be implemented.

The Education Department completed negotiations on the relief in February. It released new details of the rule on April 8 — but senior administration officials previously said the actual draft text would be published in the coming months, with the implementation of the relief set to begin in the fall, at the earliest.

Not only does this timeline coincide with the presidential election, which could imperil any relief should Biden lose — it also puts the relief under the shadow of Supreme Court rulings set to arrive by June.

How a Supreme Court ruling on fisheries could affect student-debt relief

Cary Coglianese, an administrative law professor at the University of Pennsylvania, told Business Insider that "there's a larger context within which this plan would be evaluated if it eventually goes to court, which I would expect it will."

And that larger context, Coglianese said, is "possibly the rolling back of deference to agencies altogether in their interpretation of statutes."

Coglianese is referring to a rule known as the Chevron doctrine, the fate of which is currently awaiting a Supreme Court ruling. In a case known as Loper Bright Enterprises v. Raimondo, a group of fisheries challenged the National Marine Fisheries Service's interpretation of a law requiring some fisheries to pay or subsidize the salaries of some federal agents who come on fishing expeditions to collect data.

The fisheries argued against that interpretation, calling into question the Chevron doctrine, which allows federal agencies to interpret a law how they see fit as long as it doesn't interfere with Congress' language.

So, if the Supreme Court strikes down Chevron, federal agencies would no longer have the authority to decide on laws related to their responsibilities — meaning the Education Department would not be able to interpret its student-debt relief authority under the Higher Education Act.

"That would, it seems to me, just provide another sort of quiver in the arsenal, if you will, to send the Biden debt-relief plan packing again," Coglianese said.

"In other words, we have a Supreme Court in which, in general, they're skeptical of agency action, at least of a certain kind of agency action, and with one student-debt relief case they've already sent a signal that they thought that was going out farther than Congress specifically authorized," Coglianese said. "And if they eliminate Chevron deference, it suggests that they're very serious about not giving agencies much leeway."

Lawsuits to likely target the law's broadness

While the regulatory text for Biden's new student-debt relief plan has not yet been published, its newly released details targeted different categories of borrowers the Education Department plans to make eligible for relief. It includes up to $20,000 in relief for borrowers with unpaid interest, along with loan forgiveness for those who have been in repayment for at least 20 years.

The Education Department has maintained it has the authority to enact this relief under the HEA's compromise and settlement authority, which states that the department can "enforce, pay, compromise, waive, or release any right, title, claim, lien, or demand" related to federal student debt."

However, Luke Herrine — an assistant law professor at the University of Alabama — told BI that any legal challenge will likely take issue with the department's interpretation of the HEA's authority for debt relief and argue that Biden's plan is too broad.

"The fight is primarily going to be, I assume, over whether a clause that on its face looks very broad is actually as broad as it looks, which is partly a matter of, who gets to resolve the ambiguity with that clause? Do you defer to an agency to make that determination for the agency? And increasingly, it's the case that the conservative judiciary does not believe in any sort of deference to administrative agencies," Herrine said.

Herrine said he expects the same groups who brought the cases against Biden's first debt relief plan to challenge this second one. Some of them have already filed lawsuits challenging Biden's new SAVE income-driven repayment plan — including Missouri Attorney General Andrew Bailey, who wrote on X that he would see Biden in court after the release of new details for the debt relief.

Ultimately, it comes down to how courts interpret the Education Department's authority, and should legal challenges arise, Coglianese said it's likely the arguments will be very similar to the cases that ended up striking down the first student-loan forgiveness plan.

"The administration is certainly still facing a very skeptical Supreme Court," Coglianese said. "Even though it's a different statute, it's still a skeptical Supreme Court. It's still a pretty big program even though it's a smaller one."

"So it's a risk that the court will, in the end, not allow the administration to go forward with this for the same reasons it didn't allow it to go forward the first go around," he continued. "Clearly, though, it's a risk the administration wants to take on behalf of the American public and the large segment of the American public that's been burdened with a lot of student loans."

Read More

By: [email protected] (Ayelet Sheffey)

Title: How Biden's new student-loan forgiveness plan could be jeopardized before it even goes into effect

Sourced From: www.businessinsider.com/will-new-student-loan-forgiveness-plan-be-blocked-scotus-chevron-2024-4

Published Date: Sun, 14 Apr 2024 10:48:01 +0000

Did you miss our previous article...

https://trendinginbusiness.business/politcal/jennifer-pan-and-her-former-boyfriend-were-both-found-guilty-of-conspiring-to-kill-her-parents-heres-where-daniel-wong-is-now-

.png)