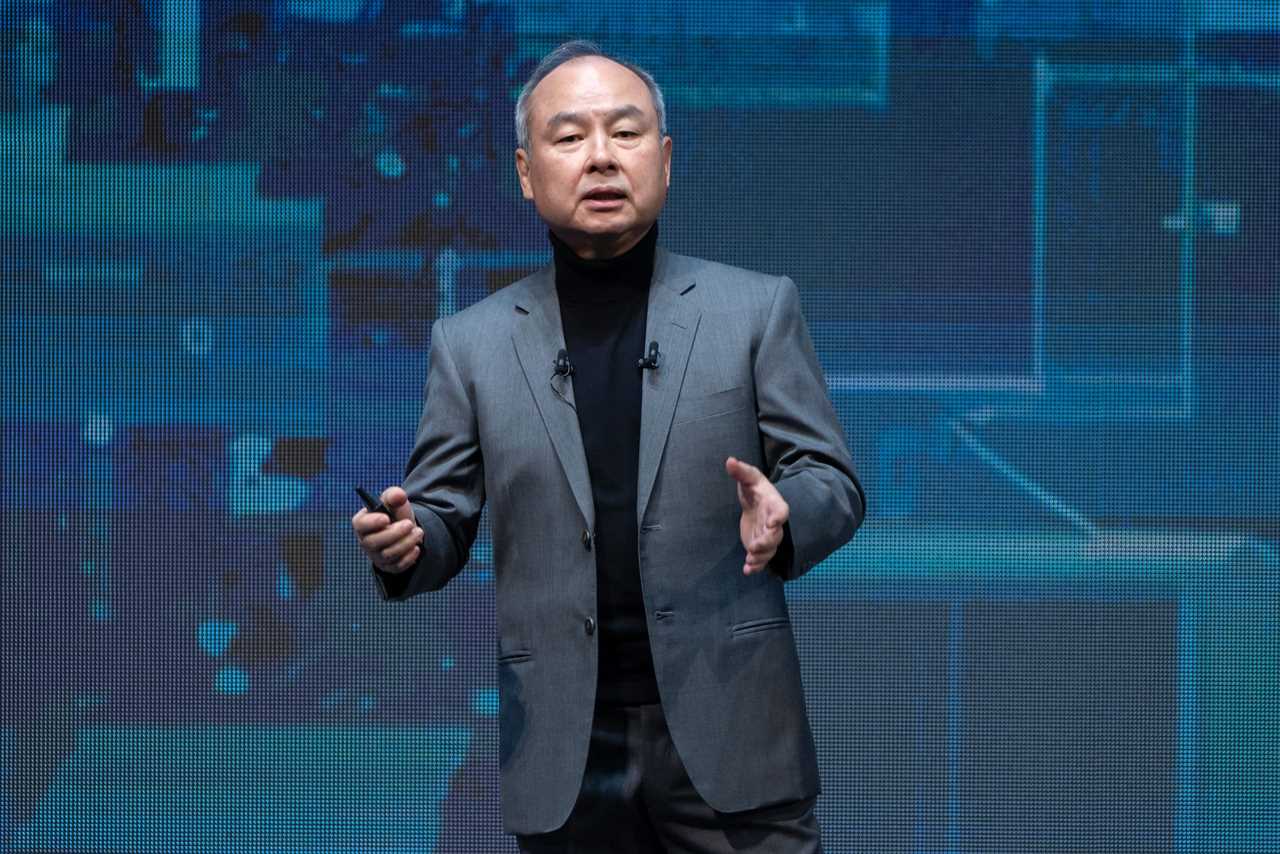

Tomohiro Ohsumi/Getty Images

- Masayoshi Son's bet on AI seems to be paying off.

- The Japanese billionaire's conglomerate posted a $1.5 billion profit for its latest quarter.

- The gains come off the back of its big bet on chip firm ARM, which is targeting AI opportunities.

Masayoshi Son once branded those dismissive of artificial intelligence as a bunch of "goldfish." Stuck in a bowl, they'd watch on as the world around them would find new freedoms thanks to the technology.

It's a bold view. It's also one starting to show signs of truth for the Japanese billionaire.

SoftBank, the Tokyo-based conglomerate Son founded during Japan's boom years in the 1980s, signaled that its all-in bet on AI was starting to pay off after posting its latest earnings on Monday.

Despite an annual net loss of ¥227.6 billion ($1.5 billion), the company posted a profit of about $1.48 billion for the three months to March 31, capitalizing on profit momentum generated in the previous quarter.

For SoftBank a key driver of the gains over successive quarters has come thanks to ARM.

The Cambridge-based chip firm — which SoftBank listed on the Nasdaq in September having maintained ownership of it since a $32 billion take-private deal in 2016 — has soared since its IPO as investors lap up its fresh AI focus.

ARM, which makes chip designs for the likes of Apple, is seeking to find opportunities to deploy its tech with AI companies, particularly those focused on servicing the highly-intensive computing needs of generative AI operators.

Michael M. Santiago/Getty Images

SoftBank has benefited from this for a clear reason: it still has a 90% stake in ARM, which has doubled in value to over $110 billion since the listing.

"ARM is central to our AI shift," SoftBank's chief financial officer Yoshimitsu Goto said on Monday. Its closely-watched net asset value figure, meanwhile, jumped 45% to $178.3 billion — driven by the soaring share price of ARM.

For Son, the profits will offer reassurance that he's on the right track with AI after years of hit-and-miss investments on other technologies through startup betting.

Arguably the biggest investment flop for Son came from his backing of WeWork, the real estate startup that collapsed in November after once enjoying a $47 billion valuation.

SoftBank has also had mixed success with a duo of venture capital funds run out of London called the Vision Funds, which have sprayed cash at startups globally since 2017. Some of their bets, such as those on pizza robot and dog-walking startups, have since imploded.

As a result, Son's reputation has often been put on the line, with critics wondering if the billionaire could ever replicate the success he enjoyed from a $20 million investment in Alibaba that has since made him $72 billion.

But as the appetite for ARM's AI activities show, SoftBank has room to grow in the face of the latest boom. Son seems aware of this, with the company selling down several Vision Fund investments in recent months to plow fresh cash into AI opportunities.

Risks remain, of course. AI euphoria since ChatGPT's introduction to the world has sent stocks of AI-focused companies like Nvidia to dizzying heights, leaving investors to wonder if a downturn might be around the corner.

With about $40 billion of cash on hand at the end of March, though, Son will feel ready to step up his search for AI's next big thing. If he's able to find the right bets, AI could pay off handsomely in the long term.

Read More

By: [email protected] (Hasan Chowdhury)

Title: Looks like Masayoshi Son's plan to go all in on AI is starting to pay off for SoftBank

Sourced From: www.businessinsider.com/softbank-ceo-masayoshi-son-rewarded-ai-bet-arm-2024-5

Published Date: Mon, 13 May 2024 12:42:47 +0000

Did you miss our previous article...

https://trendinginbusiness.business/politcal/embattled-democratic-senator-bob-menendez-goes-on-trial-today-in-connection-with-bribery-and-corruption-charges

.png)