Getty Images

- Inflation and interest rates have soared throughout 2022.

- As the economy becomes more volatile, more homebuyers are sitting on the sidelines.

- It's a "psychological hurdle" for homebuyers, the president of a large US home-building firm said.

As soaring mortgage rates further reduce housing affordability, Ryan Marshall, the president and CEO of PulteGroup, said that economic anxiety is weighing on Americans, and some are shelving their homeownership dreams as a result.

"While we reported significant growth in our third-quarter earnings, demand clearly slowed in the period as dramatically higher interest rates created financial and psychological hurdles for potential homebuyers," Marshall said to investors during the company's third-quarter earnings call on Tuesday.

According to Marshall, as fear of a possible recession spreads and housing costs climb, an increasing number of Americans are delaying home purchases while they wait for market conditions to improve.

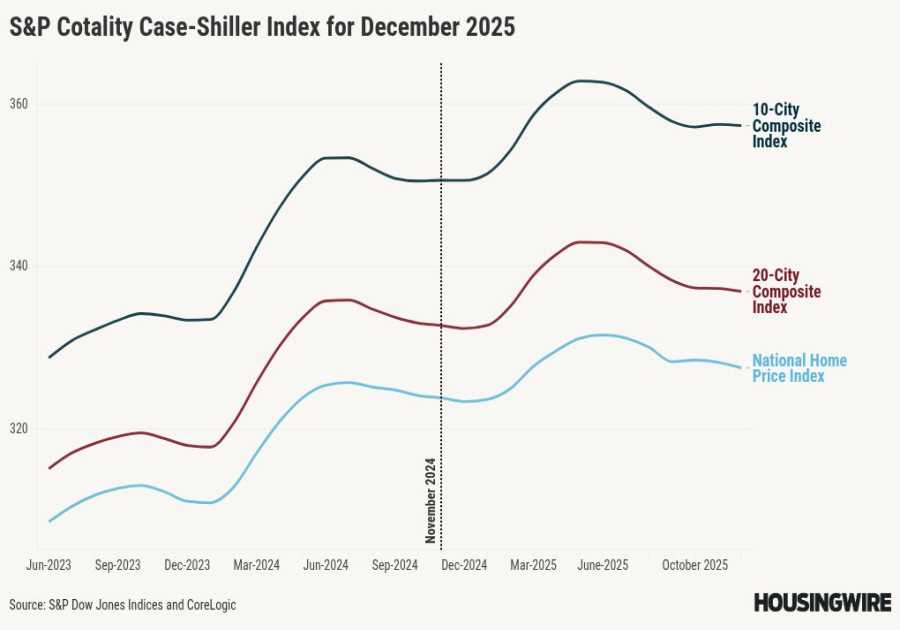

Indeed, home sales are declining in the US. According to the National Association of Realtors, sales of previously owned homes fell for the eighth consecutive month in September to a seasonally adjusted annual rate of 4.71 million units. Not only is this a 23.2% decline from the rate a year ago — it also marks the slowest rate of sales since September 2012.

As prospective buyers back away from the market, home construction is slowing even more.

Data from the US Census Bureau shows that in September, new residential construction decreased by 8.1% from the prior month. So far in 2022, US housing construction has fallen in four out of nine months. Supply-chain bottlenecks and waning demand are major contributors to the decline.

It's a trend that is also impacting PulteGroup's business. The company reported that while its earnings increased by 48% over the past year due to higher home-sale revenues, its net-new orders — meaning new-building construction — decreased by 28% from levels at the same time last year, and its cancellation rate was 24%, a notable increase from 10% in 2021 and from 15% in the second quarter of 2022.

"In response to today's more challenging market conditions, we continue to adjust our sales, construction, and investment practices as we work to turn inventory and balance our housing starts to appropriately match the pace of sales," he said.

Home-building firms like PulteGroup may have to pull back even further next year. With mortgage rates hovering above 7% and the likelihood of a recession becoming more of a reality, financial fear is likely to weigh more heavily on buyers.

It's a scenario that Orphe Divounguy, a senior economist at Zillow, said will not only impact home builders, but the overall housing market.

"What is surprising is that rising rates normally push out potential homebuyers, but they have also pushed out potential sellers," Divounguy told Insider. "What we're seeing in our data is that while demand is down, the number of new listings coming on the market has also fallen."

"We're not seeing the types of large increases in inventory that we thought we would normally see, so inventory levels remain very tight," he said.

With less housing inventory being introduced to the market, home prices are likely to remain high. That coupled with worsening economic conditions could mean homebuyers will continue to sit on the sidelines, resulting in an even larger pullback from the home-building industry.

"Unfortunately, I don't think relief is coming anytime soon," Divounguy said.

Read More

By: [email protected] (Alcynna Lloyd)

Title: Many Americans are ditching their dreams of owning a house as recession fears flare, says the CEO of one of the nation's largest homebuilders

Sourced From: www.businessinsider.com/buying-a-home-ownership-real-estate-market-recession-outlook-forecast-2022-10

Published Date: Sat, 29 Oct 2022 11:45:00 +0000

.png)