Phew! Hey readers — I'm Phil Rosen. I'm still in shock after last night's episode of Succession — no spoilers, but dang(!). Talk about drama.

Today we're diving into how a recession could affect the stock market — and why it may not be all bad in the eyes of investors.

If this was forwarded to you, sign up here. Download Insider's app here.

Associated Press/Richard Drew

1. Markets so far this year haven't acted like they're too concerned about a recession, and that's no accident, according to DataTrek Research.

Any turbulence at this point is to be expected, since classic signals — like the inverted yield curve — have been blaring for some time now. We're riding the track toward the most-forecasted recession in history.

But Nicholas Colas, the cofounder of DataTrek, said a downturn would actually remedy the "three most intractable problems" that have been ailing stocks coming out of the pandemic:

- High inflation: Sticky, high prices have weighed on stocks, but a slowdown would alleviate this.

- Aggressive Fed rate hikes: Stocks could begin to look attractive again once policy loosens up, since bonds have been the more popular choice of late, relative to equities.

- Falling productivity in the labor market: A recession could stop companies from hoarding workers, which could improve profit margins.

To Colas, markets are effectively embracing the possibility of an economic contraction. In his words:

"Markets see a recession as a 'feature,' not a bug."

How are you positioning your portfolio for the year ahead? Tweet me (@philrosenn) or email me ([email protected]) to let me know.

In other news:

Xinhua News Agency /Getty Images

2. US stock futures fall early Monday, as investors brace for a week of economic data, central bank meetings, and mega-cap tech earnings that will include Microsoft, Alphabet, Meta Platforms, and Amazon. Here are the latest market moves.

3. On the docket: Coca-Cola, Credit Suisse, and First Republic Bank, all reporting.

4. We spoke to four tech fund managers about how to invest in artificial intelligence. Wall Street's been paying a lot of attention to the nascent space since ChatGPT burst onto the scene in November — and these experts broke down where to park your cash without getting sucked into the hype.

5. Ex-Treasury chief Larry Summers said the Fed has inflation on the ropes. The central bank's final interest-rate hike could come in May, but stagflation is still a risk. These are his 12 best quotes from a new interview.

6. Cash held in money-market funds just dropped for the first time since the banking turmoil started. The dip snaps a trend of record inflows since last month. Here's what to know.

7. Bed Bath & Beyond filed for bankruptcy Sunday after running out of options. The US home-goods retailer warned in January that there was considerable doubt about its survival after grappling with sliding sales. You've now only got a couple of days left to use the retailers' coupons. Read more on the bankruptcy filing here.

8. Russia minted 22 new billionaires last year. That happened even as the West imposed sanctions on the country to try and cripple its financial system. In total, there are now 105 Russian billionaires — and their combined net worth has jumped to $474 billion.

9. Real-estate agents are about to get slammed. There are now two agents for every home for sale. That means many of them won't survive the housing crunch's deal slowdown.

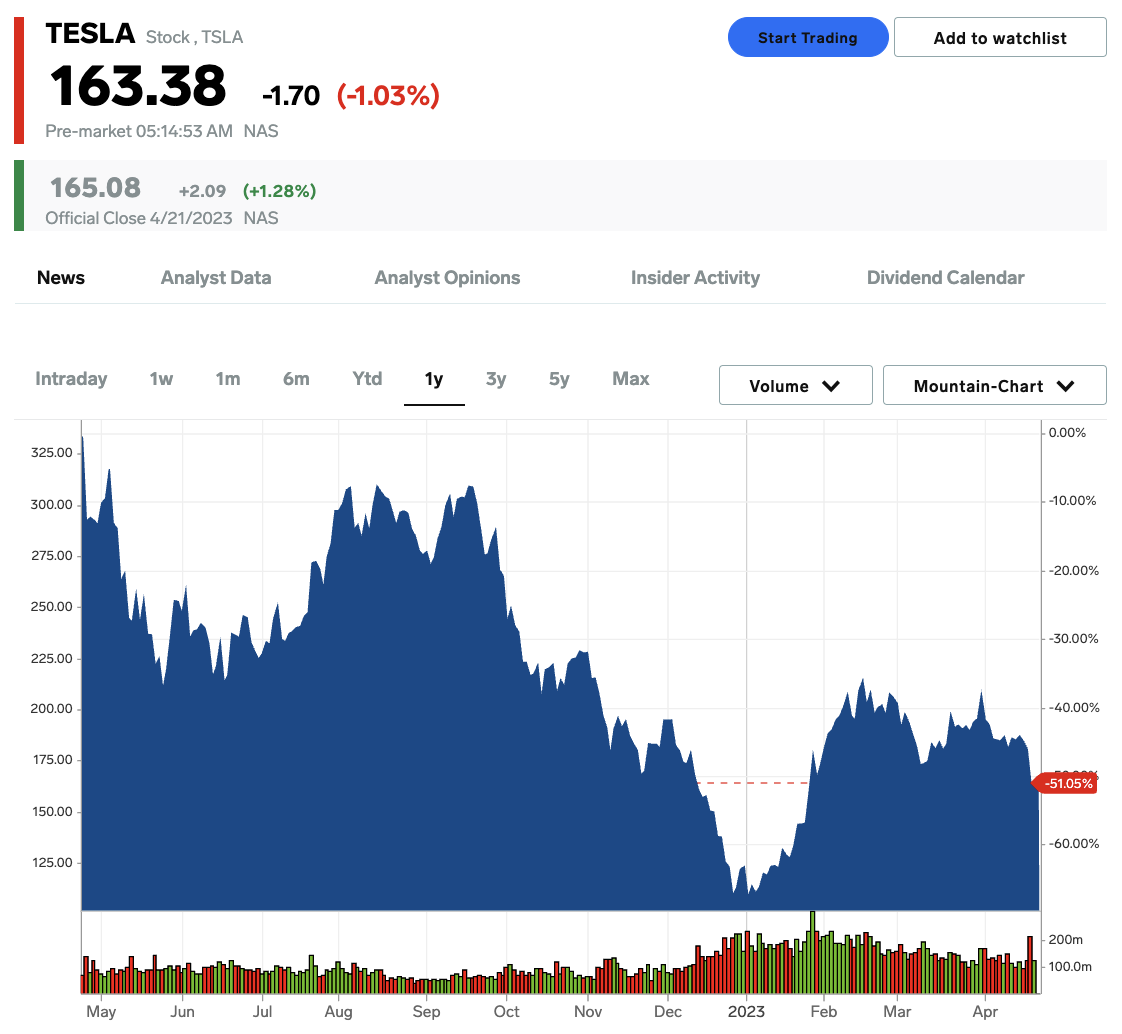

Markets Insider

10. Tesla stock could soar to $2,000 a share in five years. At least that's what Ark Invest's Cathie Wood thinks. She anticipates that a robo-taxi boom will power Elon Musk's company to historic highs.

Curated by Phil Rosen in New York. Feedback or tips? Tweet @philrosenn or email [email protected].

Edited by Max Adams (@maxradams) in New York and Hallam Bullock (@hallam_bullock) in London.

Read More

By: [email protected] (Phil Rosen)

Title: Markets are ignoring recession signals because a downturn might actually ease a handful of problems facing stocks

Sourced From: www.businessinsider.com/markets-investing-recession-signs-downturn-stocks-datatrek-wall-street-finance-2023-4

Published Date: Mon, 24 Apr 2023 10:00:00 +0000

.png)