Happy Tuesday Opening Bell crew. I'm Phil Rosen — it's been a moment since we've checked in on the cryptocurrency sector.

Rest assured it's still humming along, with bitcoin seeing nearly a 70% gain in the first three months of the year.

Even meme token dogecoin saw a 20% jump late Monday after the Shiba Inu mascot replaced Twitter's bird logo.

I caught up with Shark Tank investor Kevin O'Leary, an active crypto investor and market veteran, to get his take on the digital asset sector and recent regulatory action.

If this was forwarded to you, sign up here. Download Insider's app here.

Courtesy of O'Leary Ventures

1. The TV personality known as Mr. Wonderful told me Monday afternoon that his stance on cryptocurrencies hasn't changed all that much since FTX collapsed, but he has shifted his stance on where to keep his assets.

Since November, he's moved his holdings to Canada, where he uses WonderFi, a name he's backed as an investor.

He told me he first got a sense of the coming regulatory crackdown speaking to policymakers following hearings in December, when FTX's implosion was still top of mind.

"Talking to the senators after the hearings, I realized the frustration they had," O'Leary said. "They were really pissed off, and they have released the hounds. They told regulators 'go get them,' and all of a sudden we have a mountain of enforcement action."

Just in the last few weeks US regulators have taken aim at Coinbase and Binance, as well as a string of celebrities and influencers with ties to crypto.

The SEC said it's "neutral" about the technology at hand, yet "anything but neutral when it comes to investor protection."

That's led O'Leary to forecast that many of the crypto founders that helped jumpstart the sector are going to be forced out by regulation in the near future.

Part of that is because those business leaders have never had to operate under the burden of compliance costs and rules.

"They don't know how to make money in a regulated environment," O'Leary said.

"I think they'll all be sued into oblivion by their own regulators. These rockstar crypto guys, they're not going to make it. I bet if you looked at who's managing these companies 36 months from now, all the current guys are gone."

What do you think happens next in the crypto industry in light of the deepening regulatory crackdown? Tweet me (@philrosenn) or email me ([email protected]) to let me know.

In other news:

Andrey Rudakov/Bloomberg

2. US stock futures rise early Tuesday, as investors continue to weigh the impact of the OPEC+ group's surprise output cut on global inflation. Plus, keep an eye out for the latest number from the monthly Job Openings and Labor Turnover Survey, due out later this morning. Here are the latest market moves.

3. On the docket: Credit Suisse, Nokia, and Scotiabank, all reporting.

4. This batch of stocks have a market-beating combination of upside and outsized dividend growth, according to UBS. These 30 names can beat a volatile market as they surge through 2023 and keep raising their dividend payments, analysts said — get the full list.

5. Morgan Stanley's top stock strategist said the blistering rally in tech stocks won't last. Even as the tech-heavy Nasdaq 100 is coming off its second-best quarter in a decade, the downside risk isn't quite gone yet, Mike Wilson explained: "We see little evidence that a new bull market has begun and believe the bear still has unfinished business."

6. Wall Street pros are more bearish on stocks than at any point since 2008. That said, that might be good news for investors, as Bank of America's sell side indicator suggests the S&P 500 will surge 16% over the next 12 months.

7. Tesla could extend its massive rally this year, according to Wedbush's Dan Ives. Price cuts to the company's Model Y and Model 3 vehicles "have paid major dividends for Musk and co.," he wrote in a research note. Musk's price war, in Ives' view, has clearly stoked up demand to start the year.

8. These 20-year-old college dropouts built a 28-unit real estate portfolio with less than $1,000 in savings combined. Caleb Hommel and Chuck Sotelo followed a mentor's advice in finding a great deal first. Then they raised the money to buy it. The pair did three deals in 2022 and used seller financing for each one.

9. Morningstar analysts listed out cheap stocks that will maintain higher-than-average dividends even in an economic slowdown. Investors can expect stable payouts regardless of what the broader economy is doing, the firm said. See their list of 10 names to buy now.

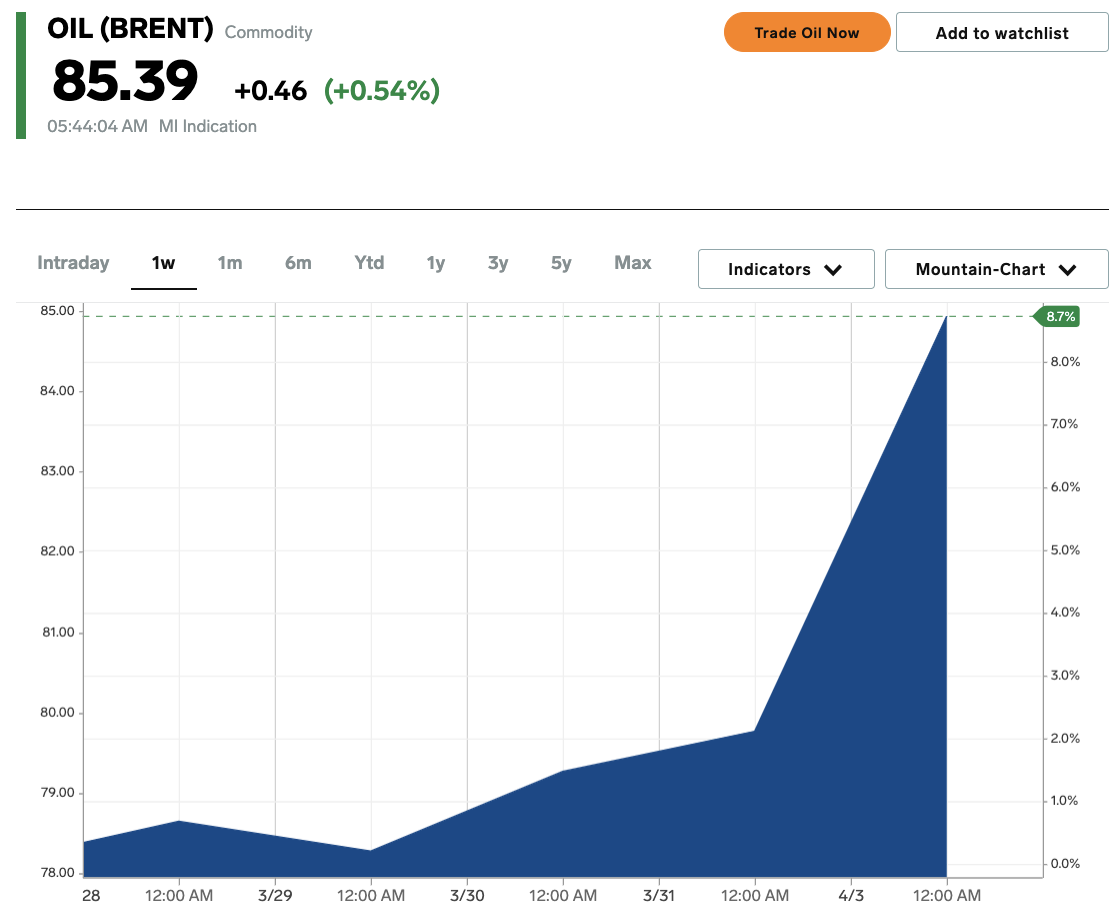

Markets Insider

10. Oil prices rallied following OPEC's unexpected supply cut. On Sunday, the oil cartel announced it would cut production by more than 1 million barrels per day, with Saudi Arabia leading the way with a 500,000 barrel-a-day reduction. Brent crude hovered at $85 a barrel early Tuesday.

Curated by Phil Rosen in New York. Feedback or tips? Tweet @philrosenn or email [email protected].

Edited by Max Adams (@maxradams) in New York and Hallam Bullock (@hallam_bullock) in London.

Read More

By: [email protected] (Phil Rosen)

Title: Shark Tank investor Kevin O'Leary breaks down his latest crypto bet as regulators look to crush 'rogue' operators

Sourced From: www.businessinsider.com/kevin-oleary-crypto-investing-wonderfi-finance-markets-wall-street-economy-2023-4

Published Date: Tue, 04 Apr 2023 10:15:00 +0000

.png)