Good morning, readers. I'm Phil Rosen, reporting from Los Angeles. If my math is correct, this is something like the 260th Opening Bell newsletter of 2022.

With so much competing for our attention, the privilege of writing to you each day is not lost on me. It's an honor to greet you in your inbox every morning, and I look forward to continuing.

Thank you for a great year.

Now, unlike this newsletter and all you readers, the stock market is rounding out a year to forget. Investors got wrecked and portfolios took a bludgeoning.

But we can look to that as a hint for what comes next.

Programming note: There will be no newsletter Monday, January 2, 2023. See you back here on Tuesday.

If this was forwarded to you, sign up here. Download Insider's app here.

Reuters / Brendan McDermid

1. Here's a startling fact: 94% of the S&P 500's losses for the year took place over five trading days.

A new report from DataTrek Research found that the index endured most of its 20% annual loss across a small handful of sessions.

Usually, the declines happened around spiking inflation concerns, big corporate earnings misses, and reactions to Fed interest rate hikes.

The largest dip happened September 13, when the August inflation report came in hotter than expected. That pushed the S&P 500 to finish 4.3% lower.

"This framework of 'a handful of days make the year' is also a good one with which to consider 2023," DataTrek cofounder Nicholas Colas said.

He later added: "At some point next year, equity markets should have some outsized up days as investors conclude that the Fed is done raising rates."

It's worth noting, too, that alongside slumping stocks, investor sentiment is worse than it was during the 2008 Financial Crisis.

But in Fundstrat's view, that suggests a stock market bottom is near, if it hasn't happened already.

"We are currently at the most 'entrenched' and persistent level of bearish sentiment in the survey's history," the firm said. "Think about that. More negative than [the] 2002 tech bubble and 2008 Great Financial Crisis."

I certainly wouldn't say investors are misguided to feel downbeat. Inflation brought serious pain this year, and recession fears remain top of mind.

Nonetheless, Fundstrat's position fits into a silver lining of sorts, as a bottom would open the door for a new bull market to begin.

"Investors are more focused on the shocks that are now 'realized' (in the past) and less on how things can change. We think the key to 2023 will be to focus on the latter (how things can change) rather than the former (what has been realized)."

In other words, overly bearish sentiment suggests stocks could be set up for a big rally in 2023.

What's your stock market outlook for the new year?

Tweet me (@philrosenn) or email me ([email protected]) to let me know.

In other news:

SOPA Images / Contributor/ Getty Images

2. US stock futures fall early on the final trading day of 2022 — the worst year in over a decade for stocks. Here are the latest market moves.

3. Earnings on deck: Time Out Group PLC, Tencent Music Entertainment Group, and more, all reporting.

4. This couple went from having "terrible credit" and working restaurant shifts to building a multimillion-dollar real estate portfolio. Now, Natia and Jervais Seegars earn $30,000 a month in revenue. They explained how anyone can start buying property in four steps.

5. Sam Bankman-Fried's life under house arrest doesn't seem too shabby. The ex-FTX chief is staying at his parents' $4 million property in California, near the Stanford University campus. The home has five bedrooms and a pool, and SBF reportedly goes on a daily jog with a private security detail.

6. Credit Suisse's chief US equity strategist expects stocks to perform "pretty well" in the coming months. As falling inflation expectations and a potential pickup in consumption hit the economy, that could pose good news for markets. See Jonathan Golub's full breakdown.

7. Alameda Research just sold $1.7 million in crypto. Data showed that wallets associated with the hedge fund Bankman-Fried founded unloaded Ethereum-based coins, which were then swapped for bitcoin. The bankrupt company still holds over $112 million in tokens.

8. Court documents show how FTX misused customer funds. Early deposits of users' cash were never separated from Alameda's own funds, filings show, and SBF used it all as his own personal ATM. Get the full details.

9. "Big Short" investor Michael Burry rang the alarm on a market crash this year. He warned the S&P 500 could halve in value, the US economy could suffer a prolonged downturn, and Tesla would come under pressure. Here are his best calls from 2022.

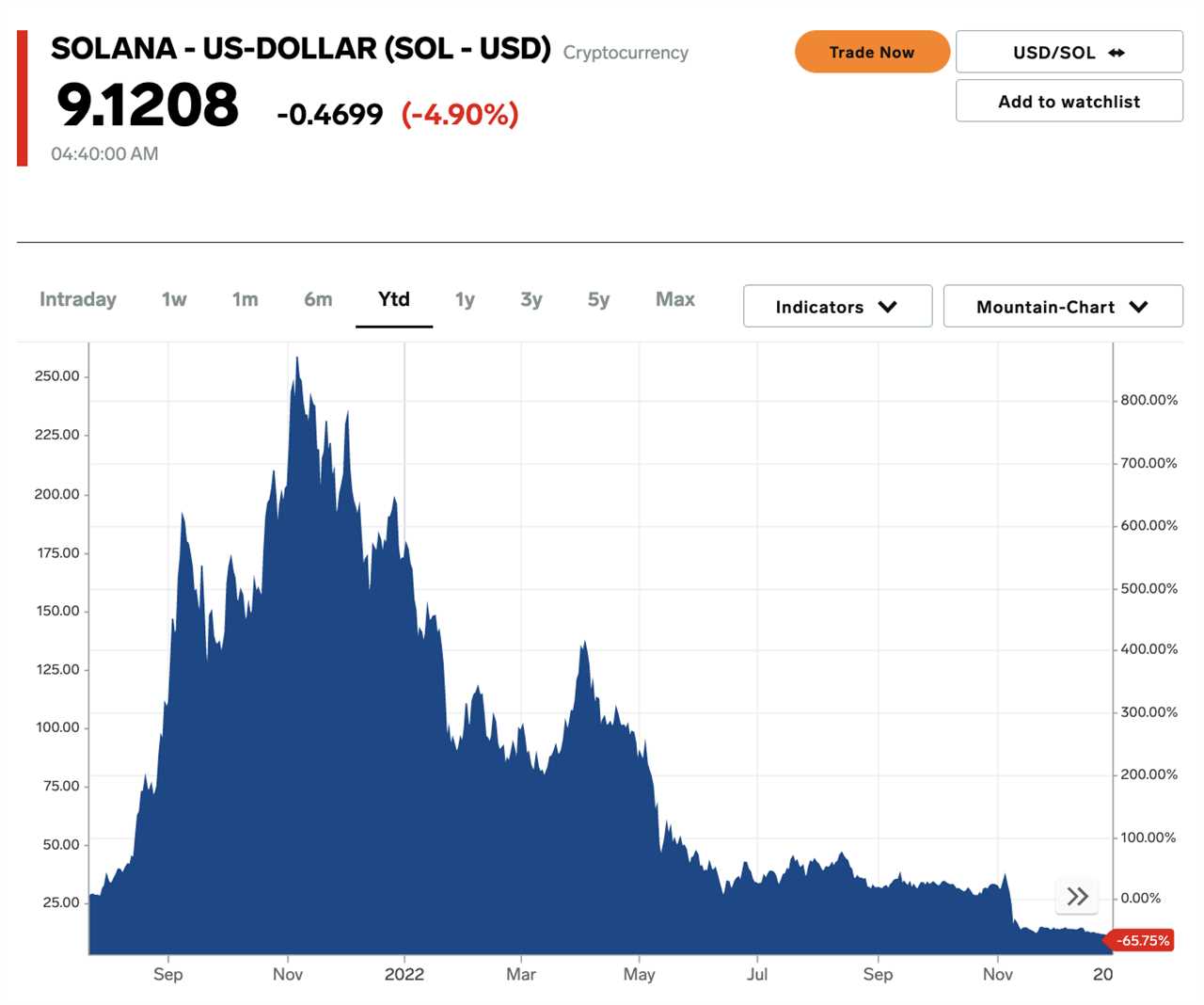

Markets Insider

10. Solana has tumbled 96% from all-time highs and was heavily championed by Sam Bankman-Fried, but not just through upbeat public comments. Dig into the relationship between FTX and the crumbling token.

Curated by Phil Rosen in Los Angeles. Feedback or tips? Tweet @philrosenn or email [email protected]

Edited by Jason Ma in Los Angeles and Hallam Bullock (@hallam_bullock) in London.

Read More

By: [email protected] (Phil Rosen)

Title: Stocks have taken a beating this year and investors feel worse than during 2008's Great Financial Crisis. Here's what that means for 2023.

Sourced From: www.businessinsider.com/stock-market-news-crypto-ftx-bankman-fried-investors-finance-2023-2022-12

Published Date: Fri, 30 Dec 2022 11:05:00 +0000

Did you miss our previous article...

https://trendinginbusiness.business/politcal/trump-lawyers-ask-judge-to-toss-e-jean-carroll-lawsuit-because-its-not-defamatory-to-say-a-journalist-made-up-a-story

.png)