Spencer Platt/Getty Images

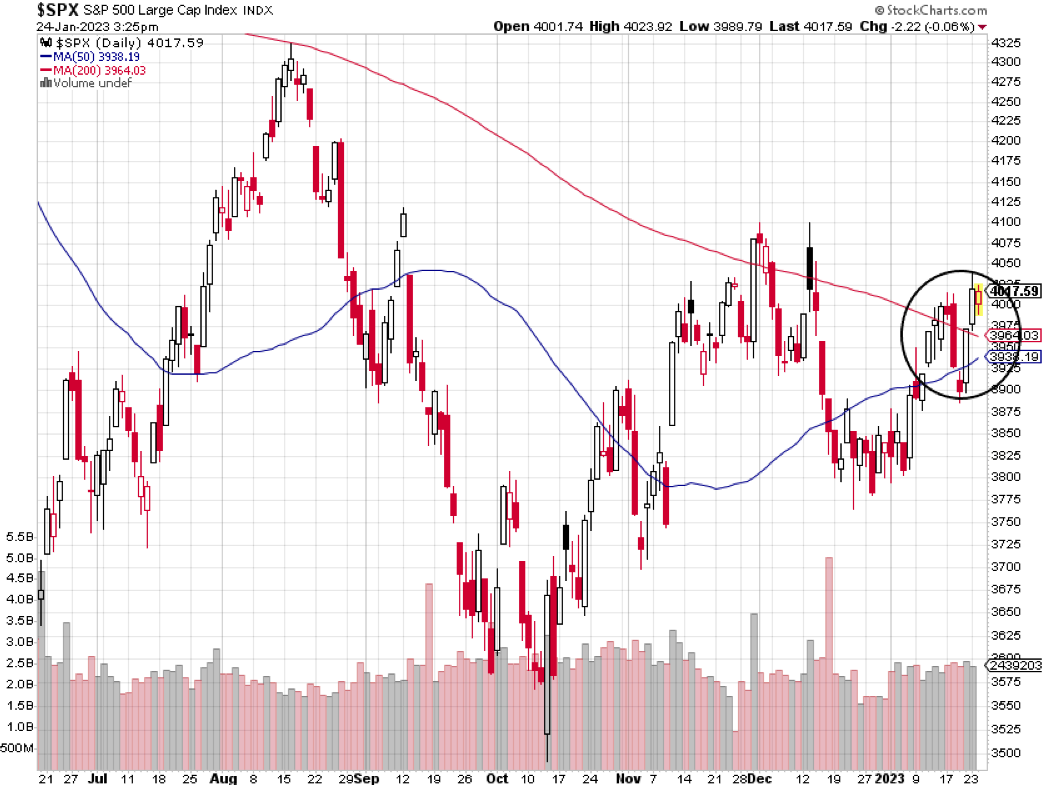

- The S&P 500 is on the verge of flashing a closely followed technical buy signal later this week.

- The "golden cross" occurs when the 50-day moving average moves above the 200-day moving average.

- The indicator suggests more upside could be in store for the S&P 500, which is up 15% from its October low.

The stock market is on the verge of flashing a closely followed technical buy signal that suggests more upside ahead for equities.

The S&P 500's rising 50-day moving average was just 26 points below its falling 200-day moving average on Tuesday. With the gap between the two averages falling by about eight points per day, the S&P 500 is on track to flash a golden cross by the end of this week, barring a big sell-off between now and then.

If the technical signal does materialize, it would be the first time for the S&P 500 since July 2020 amid the ongoing recovery from the COVID-19 pandemic. Stocks went on to surge as much as 52% after the July 2020 golden cross.

The indicator can help alert traders to securities in the stock market that are solidifying their uptrend and are likely to experience a continuation with higher stock prices.

In December, the Dow Jones Industrial Average flashed the golden cross signal. Since then, the index is about flat.

Meanwhile, the Nasdaq 100 is still far away from generating a golden cross, and that's something traders will want to see happen to confirm that the recent rally in stocks can be sustained well into 2023.

The opposite signal to the golden cross is the "death cross," which is a sell signal that triggers when the 50-day moving average crosses below the 200-day moving average. The S&P 500 flashed a death cross in March of last year, and the index subsequently went on to fall another 16% at its low.

But the technical buy indicator can sometimes be a head-fake as it has a success rate of 64%, according to data compiled by The Chart Report. Analyst Ian McMillan looked at a total of 81 golden crosses that occurred in the Dow Jones Industrial Average dating back to its inception in 1896.

He found that on average, stocks were higher three months after a golden cross 62% of the time, and higher six months after the golden cross 64% of the time.

The average three-month return when stocks were higher after a golden cross was 7.33%, while the average return six months after the golden cross was 10.65%.

Stressing the importance that moving average crossover signals are not perfect, Ari Wald, head of technical analysis at Oppenheimer & Co., said of The Chart Report, "All big rallies start with a golden cross, but not all golden crosses lead to a big rally."

The golden cross signal is one of many trading patterns that technical analysts employ to buy stocks. Meanwhile, the bearish death cross is in addition to many trading patterns that traders use to sell stocks.

StockCharts

Read More

By: [email protected] (Matthew Fox)

Title: The S&P 500 is on the verge of flashing a closely watched 'golden cross' that suggests more upside ahead

Sourced From: markets.businessinsider.com/news/stocks/stock-market-bullish-golden-cross-analysis-buy-signal-sp500-outlook-2023-1

Published Date: Tue, 24 Jan 2023 20:56:50 +0000

Did you miss our previous article...

https://trendinginbusiness.business/politcal/i-research-harmful-microplastics-heres-what-i-do-to-keep-my-family-safe-from-their-toxic-chemicals

.png)