Brendan McDermid/Reuters

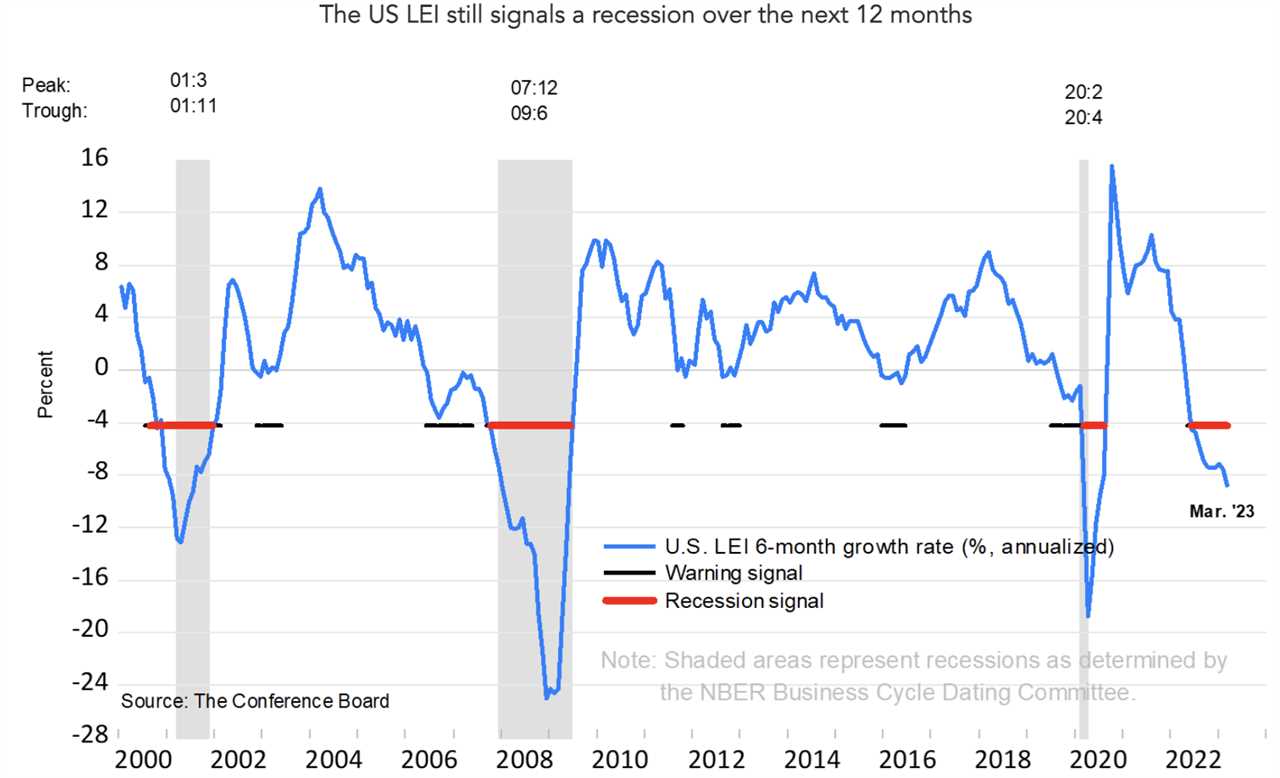

- The Conference Board's Leading Economic Index declined further in March, suggesting a recession will hit in mid-2023.

- The LEI is down 4.5% over the last six months, a steeper decline than the 3.5% rate in the preceding six months.

- The key indicator has declined for 12 consecutive months.

The Conference Board's Leading Economic Index for the US dropped for the 12th consecutive month in March, signaling that a recession is set to hit in the middle of 2023.

The indicator — which broadly tracks business cycles using 10 inputs from across manufacturing, unemployment, building permits, and interest rate spreads, among other factors — slipped 1.2% in March to 108.4, following a decline of 0.5% in February.

In the six-month span leading up to March, it fell 4.5%, a steeper drop than the 3.5% contraction from the preceding six-month stretch.

"The Conference Board forecasts that economic weakness will intensify and spread more widely throughout the US economy over the coming months, leading to a recession starting in mid-2023," Justyna Zabinska-La Monica, senior manager, business cycle indicators, at the Conference Board, said last week.

The Leading Economic Index has seen its sharpest reversal on record outside of a recession dating back to the 1950s, Wells Fargo economists said in a recent note, and presents a "clear message" that a downturn remains ahead.

The Conference Board

To be sure, the data illustrated that manufacturer's new orders for consumer goods and materials, as well as stock prices, have been positive contributions over the last six months.

All other indicators pointed lower, however, with negative contributions flashing across non-financial as well as financial components, like credit and Treasury rates.

Recent bank turmoil that started with Silicon Valley Bank added pressure to the financial and credit systems, while the labor market's strength has started to lose some momentum over the last month.

At the same time, the New York Fed's Recession Probabilities Model suggests the odds of a downturn are at their highest since 1982. The model's April reading shows a 57.7% chance of a recession.

Read More

By: [email protected] (Phil Rosen)

Title: The US will tip into a recession in mid-2023, according to an indicator that's declined for 12 consecutive months

Sourced From: markets.businessinsider.com/news/stocks/recession-economy-downturn-markets-conference-fed-inflation-stocks-business-cycle-2023-4

Published Date: Tue, 25 Apr 2023 12:22:14 +0000

Did you miss our previous article...

https://trendinginbusiness.business/politcal/the-fish-rots-from-the-head-why-the-cia-is-dysfunctional

.png)