Welcome back, team. Phil Rosen here, reporting from New York.

While I was enjoying NBA games and "Succession" this weekend, my colleague Theron Mohamed was rubbing shoulders and shaking hands with some of the world's top investors in Omaha for Berkshire Hathaway's annual shareholder meeting.

Before we get to the news, we've got a dispatch from Theron — our in-house Warren Buffett expert — on the legendary conference.

If this was forwarded to you, sign up here. Download Insider's app here.

Paul Morigi/Getty Images

1. "A carnival, a rock concert, and a cult." That's how Todd Finkle, the author of a new biography on Buffett, described the investor's yearly bash.

It's a truly unique experience to sit in a stadium packed to the rafters with people who have traveled from around the world not to "Shake It Off" with Taylor Swift, but to watch two guys in their 90s answer questions about investing and dispense life advice.

In between swigs of Coca-Cola and mouthfuls of See's Candies, Buffett and his business partner, Charlie Munger, tackled topics ranging from the grim outlook for banks and real estate to Elon Musk's grand ambitions, the risks posed by AI, and the prospect of de-dollarization.

The dynamic duo entertained the rapt audience with funny anecdotes, witty repartee, and an exclusive movie featuring a besotted Jamie Lee Curtis fawning over Munger.

There were also investment panels, cocktail parties, steak dinners, fun runs, and shopping events during the weekend.

In the true spirit of "Woodstock for Capitalists," shareholders lined up in droves to buy Buffett and Munger Squishmallows and other merchandise at the Berkshire Bazaar of Bargains. They also piled into shuttles and journeyed to Buffett's prized jewelry store, Borsheims.

The hot topics among Buffett loyalists included Berkshire's surprise paring of its Taiwan Semiconductor stake last winter (Buffett cited geopolitical concerns about China), and its polarizing decision to plow tens of billions of dollars into two fossil-fuel companies, Chevron and Occidental Petroleum.

Berkshire shareholders said they felt reenergized by the weekend's activities, and couldn't wait to return next year.

Have a question about the Omaha weekend? Tweet (@Theron_Mohamed) or email ([email protected]).

In other news:

REUTERS/Brendan McDermid

2. US stock futures are flat early Monday. Check out the latest market moves.

3. Earnings on deck: Tyson Foods, BioNTech, and DISH Network, all reporting.

4. Morgan Stanley recommends buying into this batch of highly efficient stocks that could hold strong the rest of the year. Earnings are set to decline as the economy falters, but analysts are confident this list of 41 names will continue to deliver. See the full list.

5. US officials are looking into possible market manipulation of regional bank stocks. Volatility in the sector is drawing scrutiny, as there are solid fundamentals like stable deposits, one source told Reuters. A banking association is asking the SEC to stop short-bets on bank stocks.

6. The stock market could become "untouchable" if the bank crisis keeps spiraling. That's what Fundstrat's Tom Lee said in a recent note, adding that any intervention raises too many tail risk issues across the economy and in commercial real estate.

7. Fears of de-dollarization are overblown, according to Bank of America. But there's still reason to be cautious as US brinkmanship and rising debt could threaten the strength of the greenback. Read more.

8. Four of the world's top investors agree on the biggest risks that will cause the next recession. With a combined half a trillion dollars in assets, here's how each of them plan to protect clients in the months ahead.

9. The president of Nationwide's $175 billion retirement business shared his top tips for savers. He broke down three common blunders to avoid in your finances — and how to save "a couple hundred thousand dollars" by age 30.

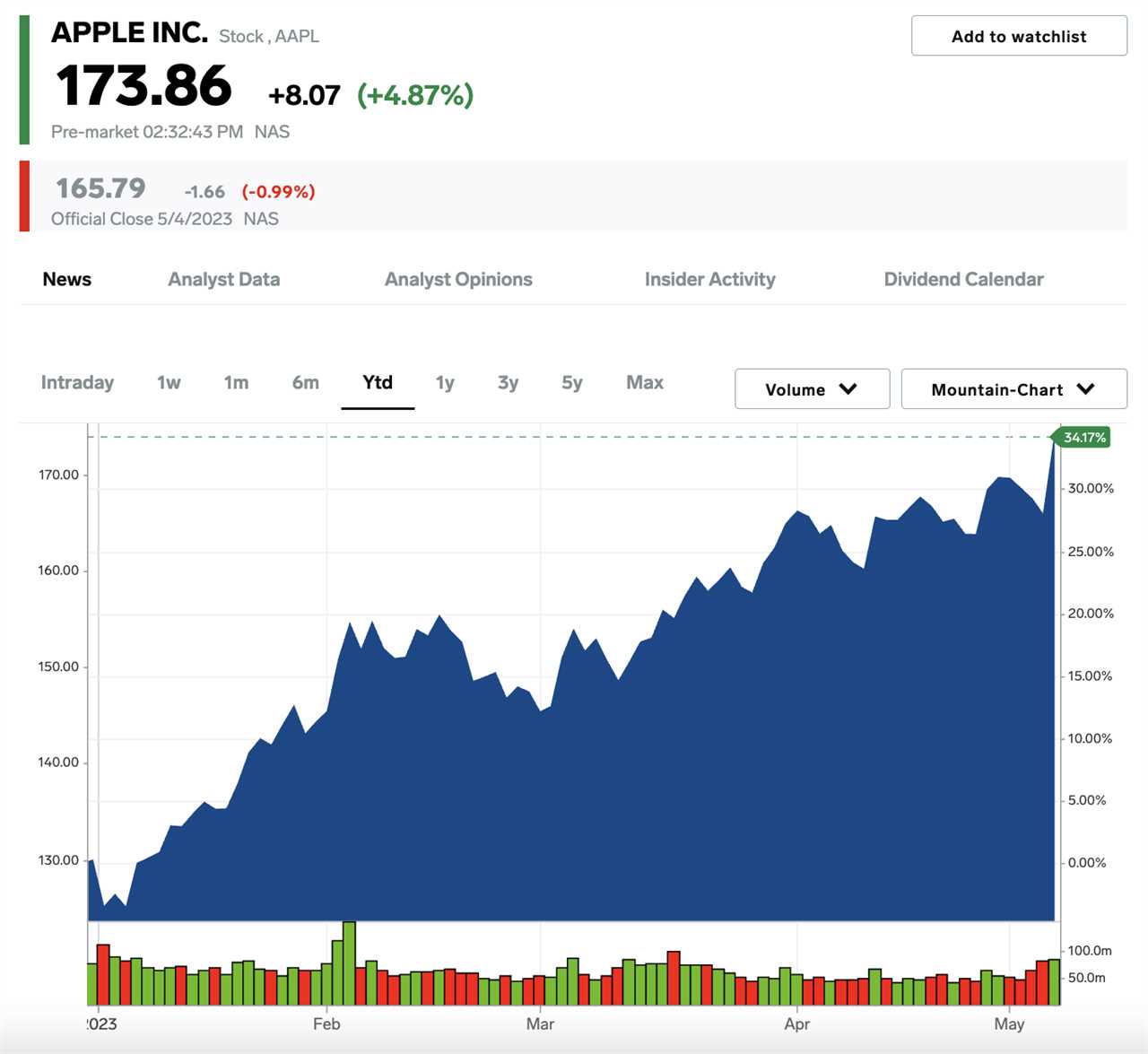

Markets Insider

10. Strong Apple earnings helped ease investor concerns of a possible iPhone slowdown. The stock jumped on Friday after the latest report exceeded analyst expectations. Wedbush analysts said Apple delivered "another masterpiece performance."

Curated by Phil Rosen in New York. Feedback or tips? Tweet @philrosenn or email [email protected]. Edited by Max Adams (@maxradams) in New York.

Read More

By: [email protected] (Phil Rosen)

Title: Warren Buffett's Berkshire Hathaway just hosted its legendary annual investor weekend. Here's what to know.

Sourced From: www.businessinsider.com/warren-buffetts-berkshire-hathaway-investor-weekend-shareholders-markets-finance-banks-2023-5

Published Date: Mon, 08 May 2023 10:12:19 +0000

Did you miss our previous article...

https://trendinginbusiness.business/politcal/radical-leftist-katie-hobbs-says-gavin-newsom-has-done-good-things-on-homelessness-twitter-users-react-california-is-a-literal-shthole

.png)