Reuters/ Yuriko Nakao

- Buying a diamond is about to get more expensive, industry experts told Business Insider.

- That's due to a number of pandemic distortions that are finally working their way out of the industry.

- Prices could rise as much as 10% over the next year, some analysts say.

Buying a diamond is about to become more expensive.

Blame a myriad of factors that are boosting the market, including tighter supply, hotter demand, and a wave of couples who are expected to get cuffed in the coming years, industry experts say.

Jewelers are anxiously looking forward a hotter engagement season after a tepid year of sales, with prices across all diamond categories plunging around 30% in 2023. For lower-quality and smaller diamonds, prices plunged to their lowest levels in about 10 years, according to Paul Ziminsky, a leading diamond analyst.

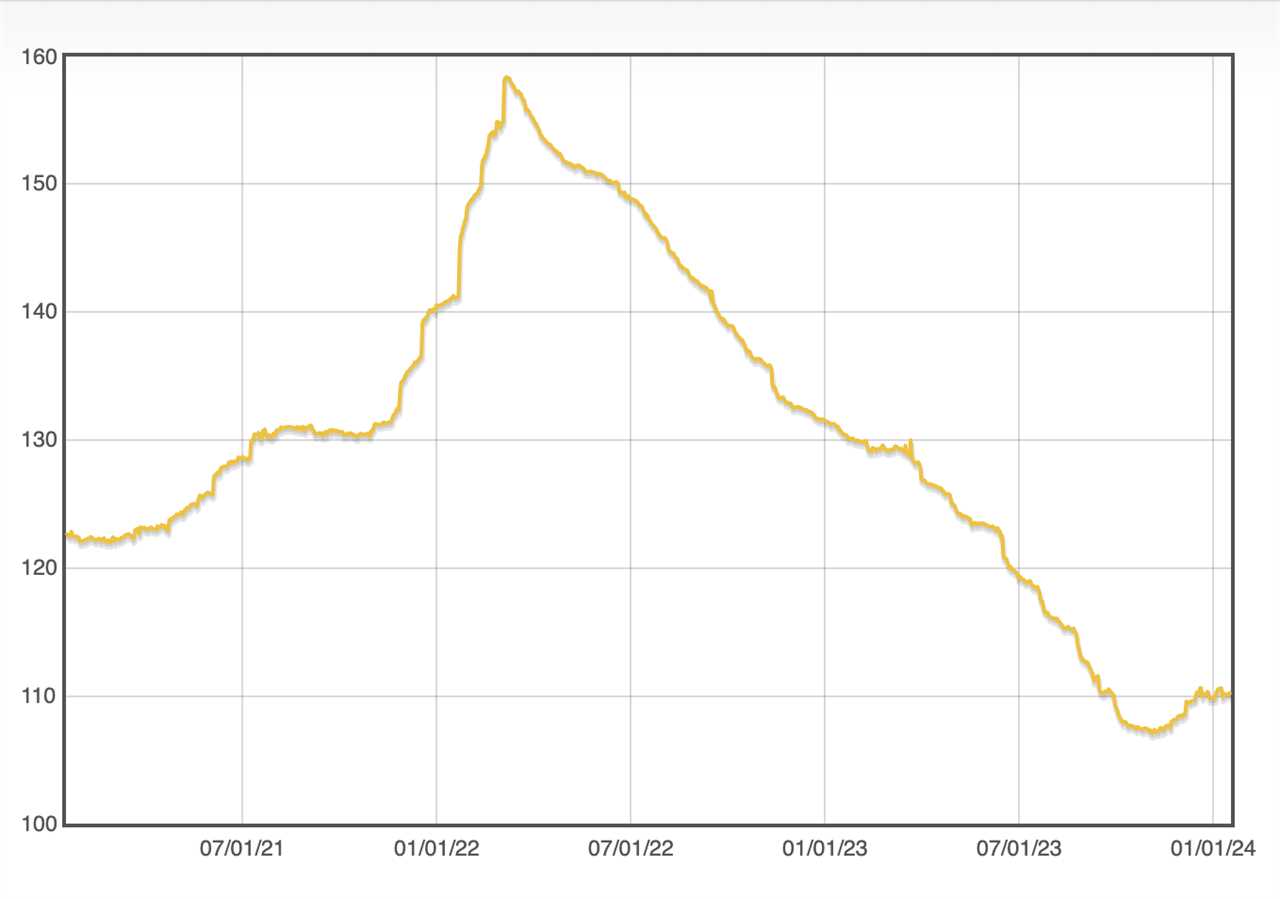

But diamond prices have begun to tick higher in recent months. The International Diamond Exchange's Diamond Index climbed past a level of 110 in January, snapping a steep decline that lasted nearly all of the past two years.

IDEX Diamond Index over the last three-month period

International Diamond Exchange

Cormac Kinney, the CEO of the commodities trading firm Diamond Standard, told Business Insider he sees even better days ahead for the diamond trade. He and Ziminsky predict prices could climb another 5%-10% this year.

But over the next 20 years, that growth could scale, resulting in a boon for diamond investors. Kinney's firm expects diamond prices to skyrocket over the next few decades, though he didn't have an exact price target.

There's a major disturbance in the force," Kinney said of the price movement.

Jewelers on the mend

The upswing in diamond prices will be fueled by several factors, Ziminsky and Kinney said.

For one, the supply of available diamonds will become even tighter this year. That's a reversal from 2023, when diamond producers, who shuttered mining activity during the pandemic, ended up overproducing diamonds, causing prices to tumble.

Efforts are already underway to tighten supply, Ziminsky said, with some suppliers halting mining activity altogether. The Russian mining giant Alrosa, for instance, paused sales of rough diamonds for two months last year to boost prices.

Tighter supply will be exacerbated by the G7's recent ban on Russian diamonds, Kinney added, as Russia is no longer be able to pass off its diamonds off to Chinese and Indian refiners, who can then sell them to the West. That could slash another 30% of the world's diamond supply off the market, he estimated.

"We'll begin to see inventory levels normalize. And once that happens, we'll start to see natural diamond prices recover," Ziminsky said.

Demand is also about to heat up after an anemic 2023. Americans — many of whom had splurged on goods like expensive jewlery during the pandemic — had started to shift away from those luxuries last year, experts say. But demand for goods and luxury items will normalize as the pandemic distortions continue to recede, Kinney said.

US demand for engagement rings, which makes up a huge portion of the diamond market, also looks to be on the rise. Couples are flashing signs that they could be on the way to tying the knot, according to Signet Jewelers, which tracks 45 "milestones" couples typically hit on the way to marriage. Google search interest for engagement rings was up 10% in the third quarter, the jeweler said in its latest earnings call.

Those factors could return diamonds to their pre-pandemic growth trend — somewhere in the high single-digit percentage range, Kinney and Ziminsky say.

Over the long-term, Kinney sees an even larger upswing coming, thanks to investors growing more interested in the gems as a hard asset.

Investors typically want commodities when the economy faces higher risks of inflation, recession, and volatility, he said. Those are all key components of the new investing regime, Wall Street forecasters say.

Demand from investors could account for around 15% of all available diamonds on earth, or around $180 billion worth of the stones, Kinney estimates, extrapolating based on investor demand for other commodities. Combined with rising demand and falling supply, that could send diamond prices shooting higher over the coming decades.

Kinney didn't have an exact price target, but pointed to gold as a comparison. Gold prices have rocketed over 500% since 2003, the year gold became easily tradeable in an ETF.

"Over 20 years, I expect diamond prices to go up substantially," he said.

The forces propelling the diamond market are unique, given that other commodities and collectibles have been trapped in a downward spiral recently as the air comes out of the bubble in speculative investments fueled by ultra-low interest rates. Prices for luxury watches, fine wines, whiskey, and trading cards all crashed in 2023, with no signs a rebound.

Read More

By: [email protected] (Jennifer Sor)

Title: Why diamonds are about to get a lot more expensive

Sourced From: markets.businessinsider.com/news/commodities/diamond-prices-engagement-ring-carat-value-outlook-recession-mining-supply-2024-1

Published Date: Sun, 21 Jan 2024 13:16:01 +0000

.png)