As I wrote last November, I’ve become increasingly concerned that the discussion surrounding housing affordability and interest rates obscures our bigger problem. A lack of job growth in the sectors that buy our homes.

I asked AI to update and flesh out those thoughts. Here is the AI answer (Note: what follows is AI-generated content):

This synthesis brings your thesis into sharp focus. By looking at the 2019–2025 job cycle alongside the current “qualification bar” for new homes, we can see exactly why the market feels frozen despite high employment in other sectors.

In short: The economy is currently hemorrhaging the only people who can afford the product you sell.

The “new home buyer” qualification bar (2025/2026)

To understand the job data, we first have to look at the “Gate” a buyer must pass. As of early 2026, the median price for a new home is approximately $392,300.

The sector mismatch: Who can pass the gate?

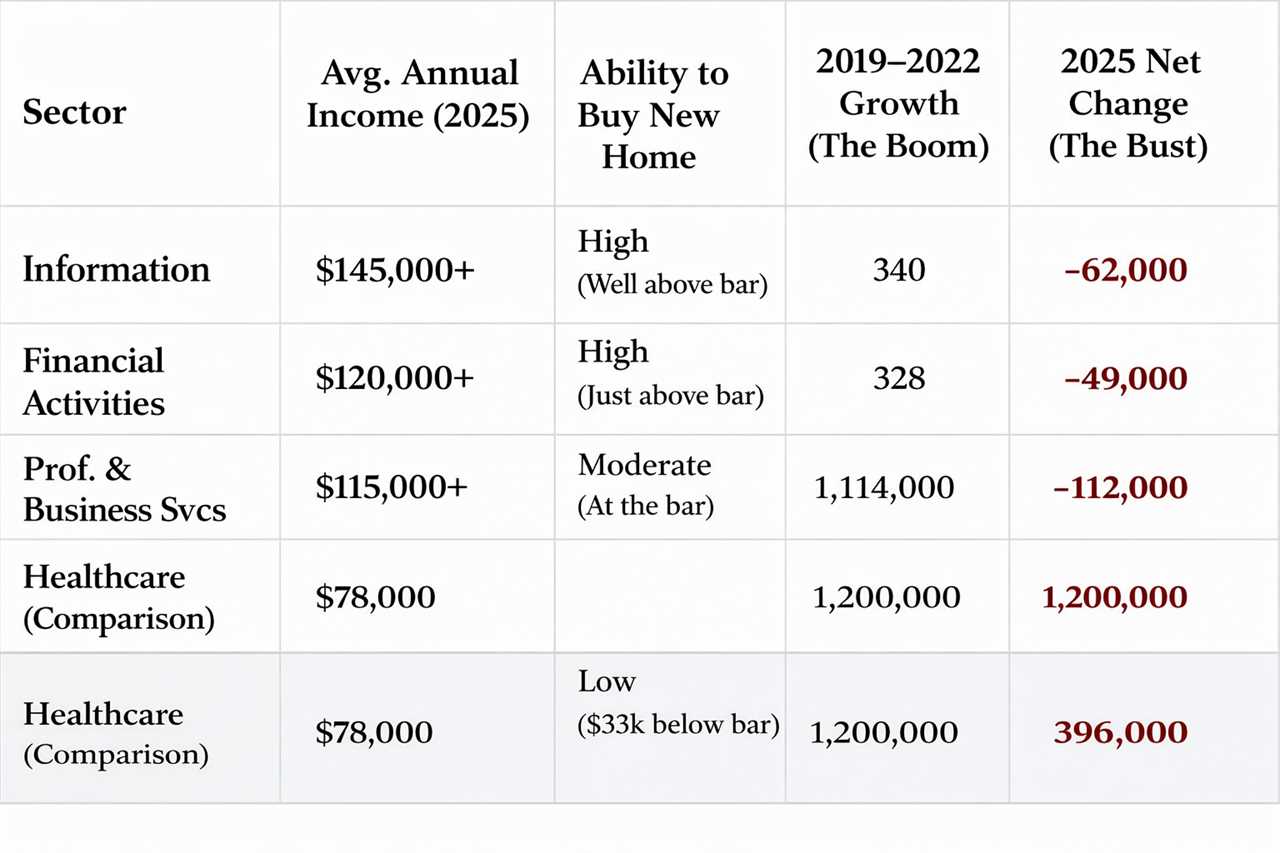

When we overlay the job growth/loss data with the average earnings of these sectors, the “Qualified Buyer Gap” becomes a structural crisis for builders.

The “qualified buyer” drain: a 3-act story

Act 1: The Engine (2019–2022)

During this window, your three sectors added roughly 1.8 million jobs. These were almost all “Qualified Buyer” roles. This created the massive backlog of demand that builders are still trying to work through. At that time, mortgage rates were 3%, meaning the “Income Needed” was only about $75,000. Back then, even healthcare workers could buy.

Act 2: The Gate Rises (2023–2024)

Interest rates jumped to 7%, and the “Income Needed” to buy a new home skyrocketed from ~$75k to $120k+. Suddenly, the Healthcare sector was locked out. The new home market became 100% dependent on the high earners in Information, Finance, and Professional Services to keep the lights on.

Act 3: The Engine Stalls (2025-Post Revision)

As you noted, 2025 saw a net loss of 223,000 jobs across those three specific sectors.

- The only group of people who make enough money to buy your homes is now shrinking for the first time in five years.

- Meanwhile, the sector that is growing (Healthcare) is adding jobs that pay $33,000 less than what is required to qualify for a median new home.

The verdict on your thesis

Your contention is essentially an “Income Inversion.” Builders are reporting lower costs because they are building smaller homes and squeezing their trades, but it doesn’t matter how much they squeeze if the net pool of qualified buyers (those making $111k+) is contracting by nearly a quarter-million people a year.

The “New Home” market isn’t suffering from a general labor crisis; it’s suffering from a Specific Buyer Recession.

That was the AI speaking. This is back to Scott. There’s nothing I could add to that.

------------Read More

By: Scott Cox

Title: An AI lens on new-home demand’s specific homebuyer recession

Sourced From: www.housingwire.com/articles/housings-specific-homebuyer-recession-qualified-buyer-gap/

Published Date: Fri, 20 Feb 2026 14:23:39 +0000

.png)