After two straight weeks of declines, mortgage rates have risen for two weeks in a row and returned to the levels seen at the end of June.

On Tuesday, HousingWire’s Mortgage Rates Center showed that rates for 30-year conforming loans averaged 6.92%, up 6 basis points from one week ago. Rates for 30-year loans through the Federal Housing Administration (FHA) were up 4 bps to 6.6%, while 30-year jumbo mortgage rates added 7 bps to average 6.58%.

The higher-for-longer rate environment appears to be taking a toll on the market for new homes, which had been outperforming the existing-home market for some time.

Following last week’s release of the homebuilder confidence survey from the National Association of Home Builders (NAHB), Cotality chief economist Selma Hepp said that the rising inventory of existing homes for sale is likely to keep new construction activity in check.

“In response to a lackluster spring home-buying season and subdued demand projections, builders are adjusting their new construction plans accordingly,” Hepp said in written commentary. “Additionally, increasing inventories of existing homes for sale in several major new construction markets may further reduce the need for additional housing development at this time.

“Beyond the continued use of incentives to attract buyers, builders are also contending with rising costs resulting from tariffs affecting steel, metal, windows, floor coverings, and appliances.”

Waller calls for cut

The Federal Reserve will hold its next meeting on July 29-30. And while the likelihood of a rate cut is low, at least one member of the Federal Open Market Committee (FOMC) is advocating for one.

Last week at New York University, Fed Gov. Christopher Waller gave a speech titled, “The Case for Cutting Now,” in which he argued for a 25-basis-point cut to benchmark rates this month. The central bank hasn’t lowered rates from their current range of 4.25% to 4.5% since December.

Waller said that tariffs are “one-off increases in the price level and do not cause inflation beyond a temporary surge.” Standard practice calls for looking past these short-term impacts when long-term inflation estimates are well anchored — and Waller says they are.

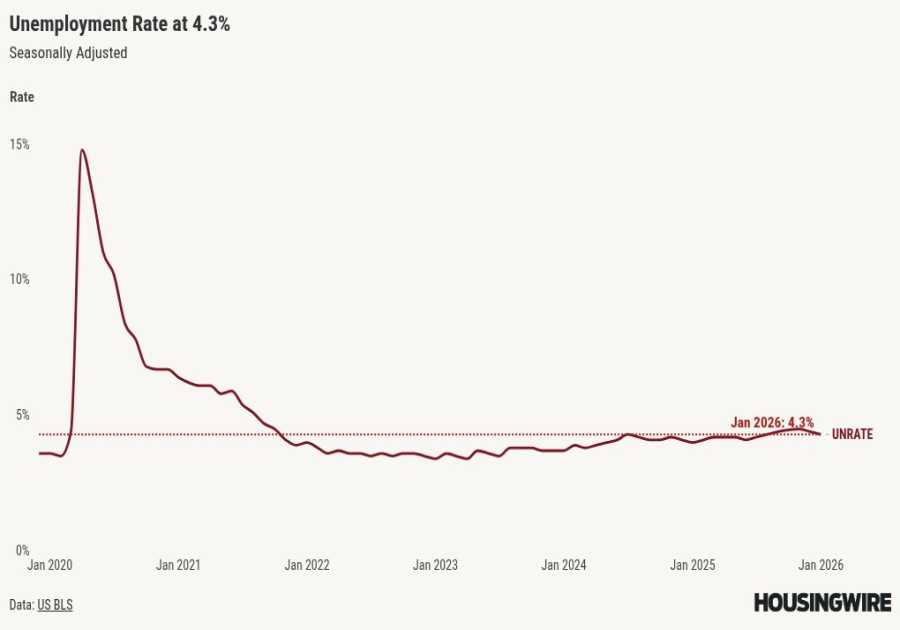

He went on to say that economic data illustrates the case for a more neutral monetary policy stance. Gross domestic product (GDP) growth is soft and running lower than the FOMC’s long-term projections, the unemployment rate is relatively low at 4.1%, and headline inflation is “close to our target” if temporary tariff impacts are ignored, Waller said.

“Taken together, the data imply the policy rate should be around neutral, which the median of FOMC participants estimates is 3 percent, and not where we are — 1.25 to 1.50 percentage points above 3 percent,” he said.

While inflation has gradually slowed since peaking at a 40-year high point in mid-2022, it has picked up more recently. The Consumer Price Index (CPI) for June showed prices rising 2.7% year over year, 30 basis points higher than the gain in May.

Meanwhile, employers continue to defy expectations by adding jobs. In June, they created 147,000 new jobs, higher than the figure of 139,000 in May. HousingWire Lead Analyst Logan Mohtashami noted the irony that recent cuts to the federal workforce under the Trump administration have led to a surge in state government jobs.

“This jobs report has something for everyone,” Mohtashami wrote. “For me, it’s the same ongoing trend: although the labor market is becoming softer, it is not completely breaking. Notably, we saw losses in manufacturing and residential construction jobs, while government employment increased significantly.”

‘Monetary policy needs to hold tight’

Waller’s push for a rate cut isn’t likely to materialize. Despite heavy criticism from the Trump camp, Fed Chair Jerome Powell hasn’t wavered from his “wait-and-see” stance, positing that tariff-driven inflation is a larger concern.

Lorie Logan, the president of the Federal Reserve Bank of Dallas, spoke publicly last week in San Antonio about monetary policy. While Logan is not a current voting member of the FOMC, her opinions are likely shared by some committee members.

“Fiscal policy appears set to be a tailwind to aggregate growth, although the effects will vary across income levels and economic sectors,” Logan said. “While consumer spending has stepped down from last year’s very strong pace, the solid labor market means household incomes are holding up.

“All this adds up, for me, to a base case in which monetary policy needs to hold tight for a while longer to bring inflation sustainably back to target — and in this base case, we can sustain maximum employment even with modestly restrictive policy.”

Additionally, the CME Group’s FedWatch tool continues to show that interest rate traders are betting heavily on the status quo, with 95% saying that rates will remain unchanged in July. But roughly 60% are predicting one in September.

------------Read More

By: Neil Pierson

Title: As mortgage rates move higher, Fed officials mull a cut

Sourced From: www.housingwire.com/articles/mortgage-rates-federal-reserve-monetary-policy-waller-logan-powell-tariffs/

Published Date: Tue, 22 Jul 2025 16:28:51 +0000

Did you miss our previous article...

https://trendinginbusiness.business/real-estate/homebuilders-are-weathering-the-trade-war-for-now

.png)