You may have heard the good news: In recent weeks, several mortgage and real estate brokerage execs have exclaimed that we may have already reached the bottom of the market. For prospective home buyers and sellers, that could mean a gradual decline in mortgage rates, which would unlock inventory and—dare I say—sales activity.

But there are still ultra-competitive markets in America where those conditions will simply be offset by rising prices.

You may have seen a picture making the rounds on Housing Twitter and LinkedIn recently. It shows about 50 people waiting in line at an open house in Mount Laurel, New Jersey. The house ended up having five offers and sold for $50,000 over ask.

In much of suburban New Jersey, where new construction is rarer than cheap Bruce Springsteen tickets, the pandemic-era conditions never left. There’s still plenty of money and demand emanating from New York City and Philadelphia and very little inventory. I mean very little inventory.

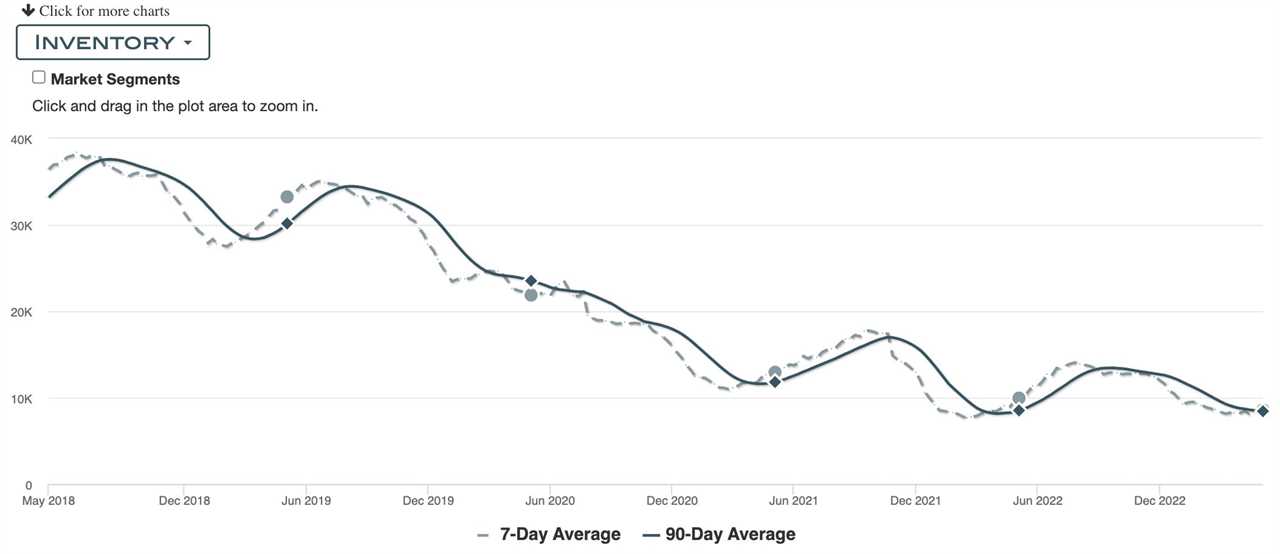

In New Jersey, the median list price last week of a single family home checked in at $565,000, according to Altos Research data. In May 2020, it was $425,000. Single family inventory last week fell to 8,556; three years ago it was 21,874.

This has serious consequences for real estate agents and loan officers alike, since it’s usually a zero sum game. You land the client and get a commission, or you don’t and you get bupkis.

“I sent pre-approvals two-to-three times a day, and then there are 30-plus offers on the homes and I virtually never get contracts,” one veteran loan officer told HW in late March. “One home recently had over 60 offers! Incredibly frustrating, and I know and have spoken with multiple $100 million-per-year originators/friends who are writing nothing here as well.”

If mortgage rates were to fall into the 5% range and stay there for a period, I think we’d see some supply shake loose in New Jersey. But for markets like suburban New Jersey, the demand will still vastly exceed the supply for years to come. There’s simply no easy or fast way to overcome two decades of underbuilding, NIMBYism and poor housing policies. It’s great for existing homeowners whose properties become more valuable due to scarcity. But it’s bad for everyone else, agents and loan officers included.

According to Altos data, the housing fever is even higher in Rhode Island, Massachusetts and Connecticut. In Connecticut, single-family inventory has dropped 80% in the past six years while prices have increased by 44%, according to data from the Federal Reserve Bank of St. Louis. And this is just the Northeast – try finding a home in Los Angeles for under $1 million.

What’s it like in your neck of the woods? Share your story with me at [email protected] and we’ll look at supply and demand in your market.

DataDigest is a newsletter in which HW Media Managing Editor James Kleimann breaks down the biggest stories in housing through a data lens. Sign up here! Have a subject in mind? Email him at [email protected].

------------Read More

By: James Kleimann

Title: DataDigest: The pandemic housing frenzy never went away in these markets

Sourced From: www.housingwire.com/articles/datadigest-the-pandemic-housing-frenzy-never-went-away-in-these-markets/

Published Date: Wed, 10 May 2023 13:10:40 +0000

Did you miss our previous article...

https://trendinginbusiness.business/real-estate/everything-you-need-for-an-urban-adventure-from-a-nudist-picnic-to-surfing-the-rockaways

.png)