“Home sellers are buyers” — this is a phrase that I have been using in my economic work to explain the reality of the housing market recently. Obviously, people don’t sell a home to be homeless. So, when home prices and mortgage rates rise so quickly, some sellers won’t list, which means they’re not buying either. That’s reflected in today’s existing home sales report by the National Association of Realtors (NAR), where they fell again. We are getting closer and closer to the low 4 million print we had in January.

This has take us to deficient levels of demand while prices are still rising. Yes, this, my friends, is why I say the housing market is savagely unhealthy, something I discussed with CNBC last Friday. It also shows how the housing market is different this cycle than during any other housing cycle — in many decades. This is where we are heading, but unlike last year when home sales crashed, we are stuck here with low demand.

Existing home sales data

According to the NAR, total existing-home sales — completed transactions that include single-family homes, townhomes, condominiums, and co-ops — waned 2.2% from June to a seasonally adjusted annual rate of 4.07 million in July. Year-over-year, sales slumped 16.6% (down from 4.88 million in July 2022). “Two factors are driving current sales activity – inventory availability and mortgage rates,” said NAR Chief Economist Lawrence Yun. “Unfortunately, both have been unfavorable to buyers.”

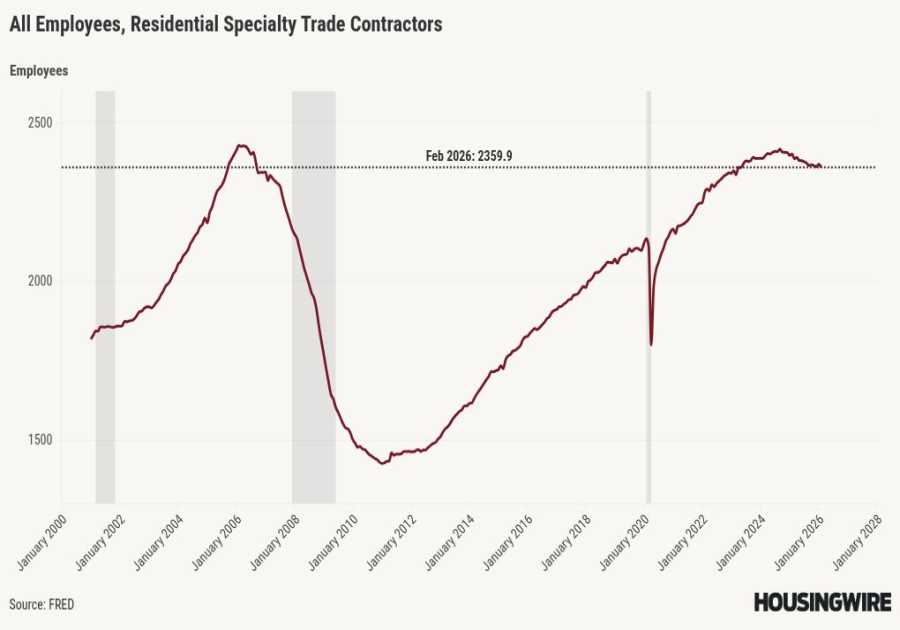

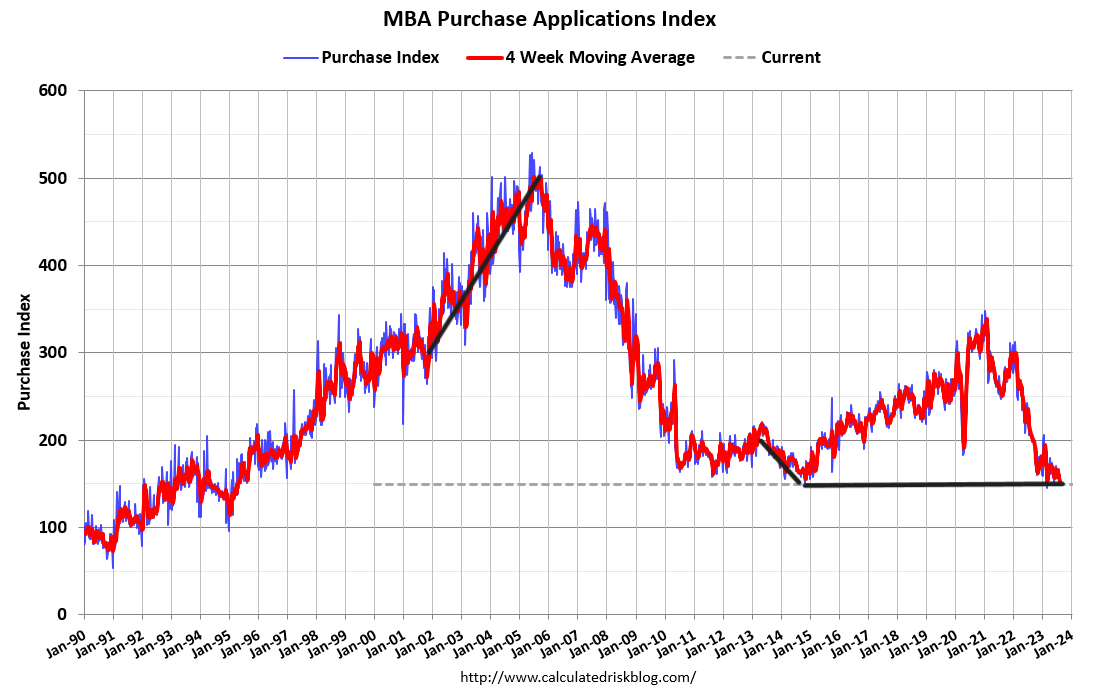

As we can see in the chart below, since 2010, whenever rates rise, demand falls. When rates fall, demand picks up again. What happened with existing home sales in February was that we had three months of positive purchase application data as mortgage rates fell from 7.37% to 5.99%. We had a massive one-month print from 4 million to 4.5 million. After that, little has been happening with existing home sales — mortgage rates and home prices are too high to push growth.

No movement in purchase apps

Purchase application data year to date has 16 negative prints versus 14 positive prints and one flat print. So, there is little movement in either direction. If I swing back to November 9, 2022, then we have 21 positive prints. Hopefully, this shows you the power of forward-looking purchase apps data, which aren’t collapsing currently, but they’re not growing either. We are stuck at deficient levels but heading lower as mortgage rates have risen.

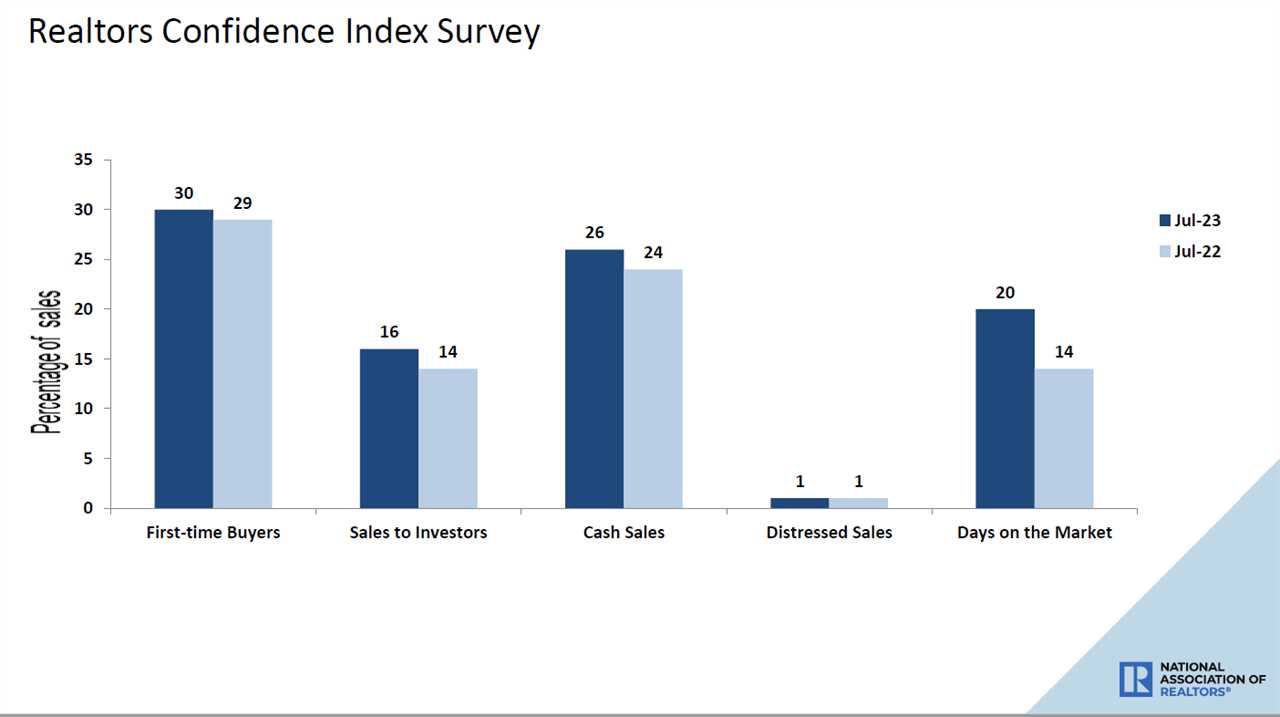

Now let’s look at the buyer profile and the days on the market. Days on the market are growing year over year, positive for housing, but still too low for my taste. You must understand that days on the market are seasonal, so we will be entering the timeline when the days on the market will grow. The key is to focus on the year-over-year data rather than the seasonal fall and rise.

@NAR_Research

First-time buyers were responsible for 30% of sales in July; Individual investors purchased 16% of homes; All-cash sales accounted for 26% of transactions; Distressed sales represented 1% of sales; Properties typically remained on the market for 20 days. #NAREHS

“Total housing inventory registered at the end of July was 1.11 million units, up 3.7% from June but down 14.6% from one year ago (1.3 million). Unsold inventory sits at a 3.3-month supply at the current sales pace, up from 3.1 months in June and 3.2 months in July 2022,” according to NAR.

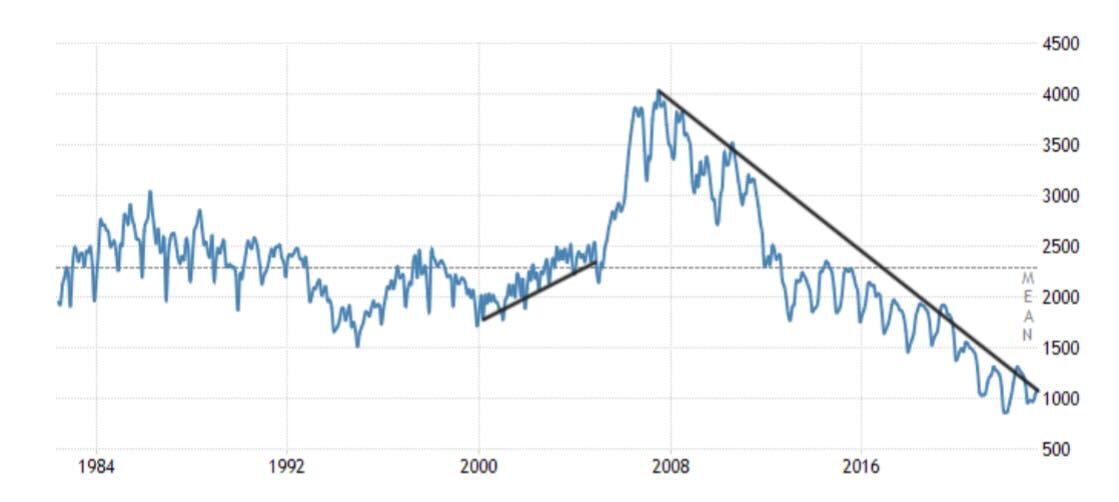

Historical inventory levels

Even with the biggest one-year sales crash ever, NAR-reported inventory levels are still near all-time lows. If most home sellers are buyers, then when they list their homes, they know they’re qualified to buy a home at current rates. Hopefully, this explains why we still have low active listings data. Traditionally, we have between 2-2.5 million active listings, currently at 1.11 million.

NAR Inventory data going back to 1982.

Today’s existing home sales data shows that we were slowing down again — even before the recent move in higher mortgage rates. However, home sales aren’t crashing like in 2022, and inventory has been negative year over year for some time now. This is a much different housing cycle than the ones we have seen in previous decades.

The 30-year mortgage and low total housing cost has made the American home not only the best hedge against inflation but a hedge against an aggressive Federal Reserve. Remember, sellers are buyers, and we lack both to push more housing demand in the existing home sales market.

Read More

By: Logan Mohtashami

Title: Existing homes sales market falls again, market lacks sellers

Sourced From: www.housingwire.com/articles/existing-homes-sales-market-falls-again-lacks-sellers/

Published Date: Tue, 22 Aug 2023 17:07:19 +0000

Did you miss our previous article...

https://trendinginbusiness.business/real-estate/magical-midwest-towns-13-charming-small-towns-in-minnesota

.png)