Shoppers aren’t the only ones scouting for deals this Black Friday.

While bargain hunters line up for discounted TVs and video game consoles, many prospective homebuyers are scrolling through listings in hopes of snagging their own big-ticket markdown.

According to HousingWire Data, price cuts have become a defining feature of the late-fall housing market — with discounts deepening just as the holiday sales season kicks off.

Nearly 41.2% of active single-family listings include price reductions. The median cut is 4%, amounting to roughly $17,230 off the typical $427,900 listing price.

Homes are sitting on the market for a median of 77 days, and 10.2% of listings are being relisted — a sign that deals are falling through or sellers are testing lower price points.

In most metro areas, the typical reduction falls between $10,000 and $25,000.

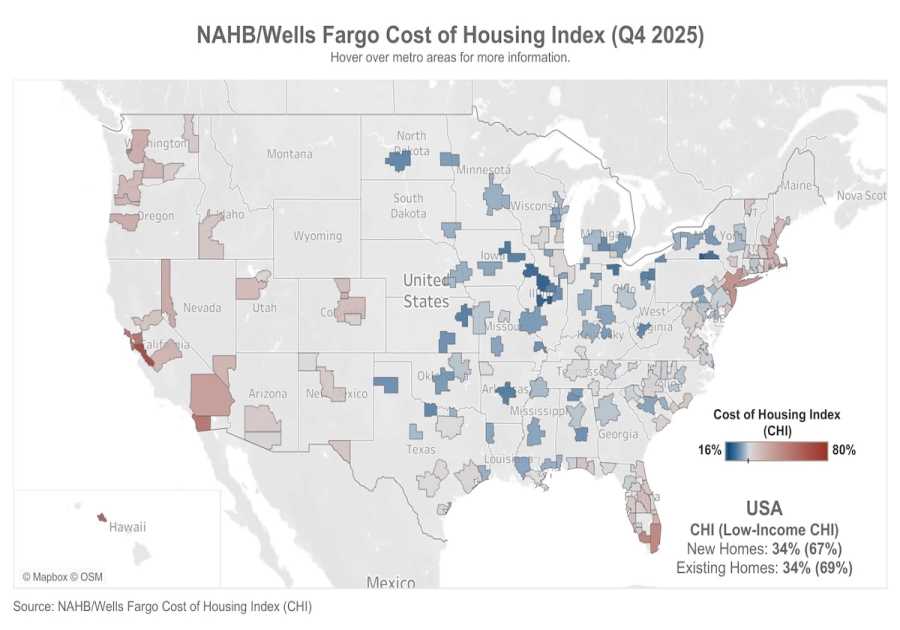

Where discounts run deep — and shallow

Austin ranks high with 52.5% of listings marked down, with an average reduction of $22,236.

In Pittsburgh, 47.2% of homes listed saw cuts, at an average markdown of $13,346, while New Orleans posted a 40.5% cut rate with an average reduction of $13,361.

Indianapolis has the highest price-cut rate in the nation at 56.3% — bucking assumptions about bargain-market stability.

More affordable markets are mixed. St. Louis posts a relatively low 39.9% cut rate, but Louisville, Kentucky, and Indianapolis do not follow the trend.

What’s in store for 2026?

The next three months — a period that typically sees slower buyer traffic — are expected to bring more markdowns.

HousingWire Data’s 12-week trend analysis shows stable price-cut activity, consistent reduction sizes and inventory swinging between 2.2 and 2.9 months at the current sales pace.

Based on these patterns, three likely scenarios are presented:

Base case scenario — 60% probability

• Price-cut rates: 42% to 44%

• Median cut magnitude: 4.2% to 4.5%

• Typical cuts, in dollars: $18,000 to $20,000

• Days on market: 80 to 85

Winter slowdown scenario — 25% probability

• Price-cut rates: 45% to 48%

• Median cut magnitude: 4.5% to 5%

• Typical cuts, in dollars: $20,000 to $25,000

• Days on market: 85 to 95

Market acceleration scenario — 15% probability

• Price-cut rates: 38% to 40%

• Median cut magnitude: 3.5% to 4.0%

• Typical cuts, in dollars; $15,000 to $18,000

• Days on market: 70 to 75

Metro outlook

High-pressure markets are expected to remain under discount strain:

• Austin: 54% to 57% cut rate; typical cuts of $23,000 to $26,000

• Indianapolis: 57% to 60% cut rate; cuts of $14,000 to $16,000

• Denver: 54% to 56% cut rate; cuts of $25,000 to $28,000

More resilient markets may see steady or improving conditions:

• Springfield, Missouri: 25% to 28% cut rate; cuts of $12,000 to $14,000

• San Jose: 26% to 29% cut rate; cuts of $85,000 to $95,000

• New York City: 29% to 32% cut rate; cuts of $38,000 to $42,000

Seasonal factors — which typically drive a 15% to 20% increase in price-cut activity — are playing their usual role.

Inventory remains tight at 2.7 months, interest rates are keeping buyers choosy and regional economic conditions continue to vary.

Still, most sellers retain enough home equity to reduce prices again if needed.

------------Read More

By: Jonathan Delozier

Title: Homebuyers hunt for Black Friday bargains as price cuts spread

Sourced From: www.housingwire.com/articles/housing-market-price-reductions/

Published Date: Mon, 24 Nov 2025 22:37:05 +0000

.png)