Foreclosure leads aren’t for the faint of heart, but they can be well worth the effort. If you’ve been thinking about diving into this niche, you should know up front – it’s not just about pulling a list. It’s about knowing where to look, understanding the process and showing up for people who are in a tough spot.

Grabbing a name and number is one thing, but building trust with someone facing foreclosure is something else entirely. This guide walks you through some of the best ways to find foreclosure leads, whether you’re working your local market or casting a wider net. We’ll also talk about how to actually turn those leads into clients.

Understanding foreclosure leads

Foreclosure leads are homeowners who are behind on their mortgage and at risk of losing their property. Depending on where they are in the process, they might still be living in the home (also called pre-foreclosure), actively listed for auction or already repossessed by the bank (referred to as real estate owned or REO). Each stage represents a different kind of opportunity, and knowing how to approach each one is key.

What makes these leads so valuable is motivation. Most people facing foreclosure aren’t looking to hold out for top dollar and instead are trying to avoid damage to their credit, get out from under a loan they can’t afford or just find a way to move forward. That’s where you come in. Whether you’re helping them sell, offering a creative solution or looking for investment deals, this niche gives you the chance to solve real problems and build real relationships.

Plus, while other agents are chasing FSBOs and expired listings, foreclosure leads are often overlooked. That means less competition, and in many cases, quicker turnaround times. If you’re willing to do a little digging and show up with empathy and know-how, these leads can be some of the most rewarding in the business.

10 proven ways to find foreclosure leads

There’s no single place to find every foreclosure lead which is why successful agents and investors use a mix of strategies. Some leads come from tech tools, while others come from good old-fashioned hustle. Whether you prefer data at your fingertips or boots-on-the-ground prospecting, here are 10 effective ways to uncover foreclosure opportunities in your market.

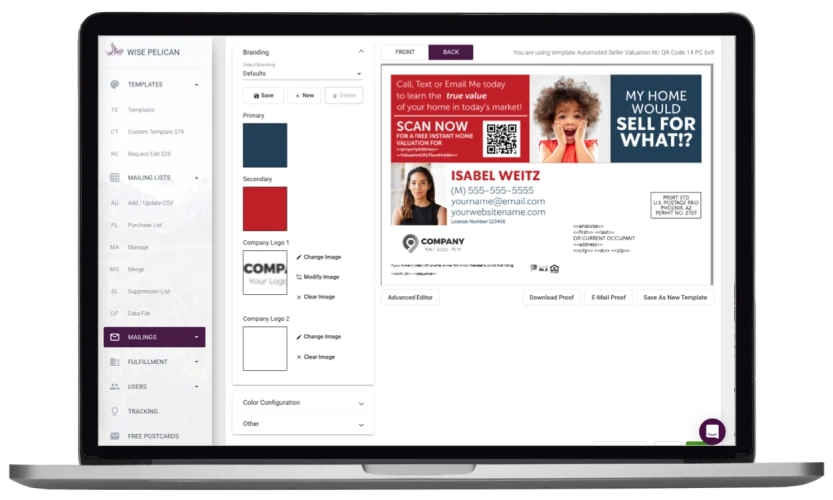

1. Use a foreclosure lead generation platform

If you want to work smarter and not harder – using a foreclosure lead service is one of the easiest ways to get accurate, up-to-date leads without spending hours combing through public records. These platforms pull data directly from trusted sources like county records and legal filings, giving you a list of homeowners in pre-foreclosure, auction or even bank-owned stages.

REDX is one of the leading providers of foreclosure leads. What we like about REDX is that it doesn’t just hand you a spreadsheet and send you on your way. You can sort leads by zip code, get property details and even see when the foreclosure process started – all in one place. It takes what could be a really messy research process and makes it feel easy and organized. If you’re serious about working the foreclosure niche, this kind of tool is worth the investment.

Visit REDX.png)