A system designed for purpose

Every mortgage market is patchwork. Rules, products, and features exist because of past events, a crisis, a policy choice, or a market failure. The result is a structure that reflects history more than design. That doesn’t make it bad, but it does mean we carry baggage that limits what the system could be.

Around the world, mortgage markets are defined by their history

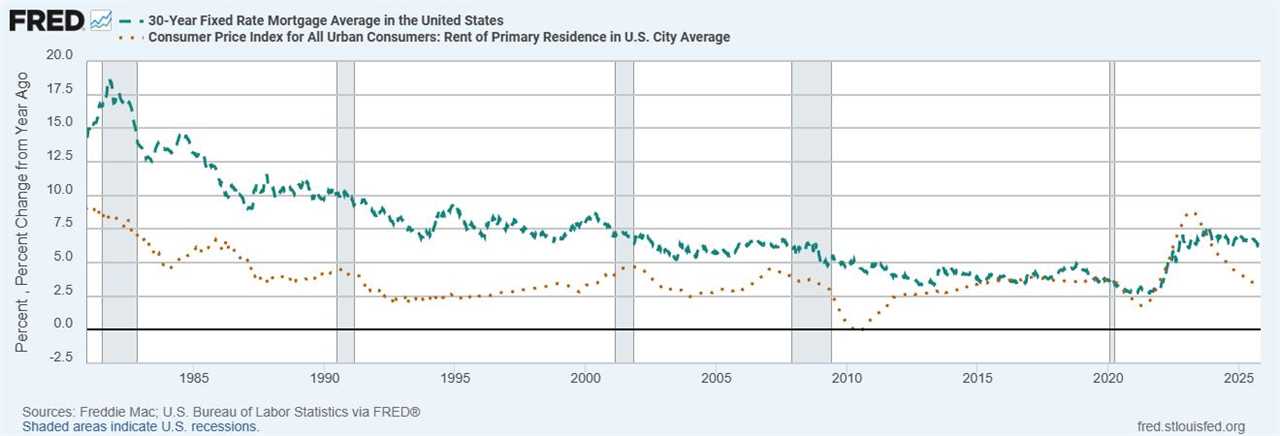

The U.S. introduced the 30-year fixed-rate mortgage during the Great Depression, as a policy response to stabilize households and lenders in the face of mass foreclosures. In Israel during the 1980s, hyperinflation gave birth to CPI-indexed principal loans, aligning debt obligations with real prices to preserve the system’s viability. In the UK, the high and volatile inflation of the 1970s and early 1980s pushed the system toward variable-rate mortgages, where the risks of interest rate movements were shifted more directly to households.

Every country has similar stories — products and structures built as reactions to the crises of their time. Over decades, these layers of responses have hardened into a patchwork system that is increasingly difficult to reform. What worked to solve yesterday’s problem may no longer be fit for today’s challenges, but inertia and legacy make change hard.

Homeownership is remarkably “sticky”

Over time, ownership rates barely shift unless something fundamental changes in the financing system. From 1750 through the Great Depression, U.S. homeownership hovered at around 46.5% ±1.5%. It wasn’t until the introduction of the 30-year fixed-rate mortgage, modern amortization schedules, federal housing agencies, and the GI Bill after World War II that rates began to climb. Between 1940 and 1970, ownership rose steadily from ~45% to ~65% as these structural supports took hold.

“The homeownership rate is stubbornly stable – it only moves with major systemic redesign.”

Don Layton – Freddie Mac CEO, 2012-2019

Since then, the number has barely budged. For the past fifty years, homeownership in the U.S. has oscillated within a narrow band of ~65% ±2%. That stickiness shows both the deep, enduring appeal of homeownership — and the fact that only system-wide reforms, not marginal tweaks, meaningfully move the dial.

If we were building the mortgage market today, we wouldn’t be constrained by that past. We would start with the purpose: to finance the consumption of housing by households. Housing is essential, and homeownership provides benefits that extend beyond the individual to families, communities, and society as a whole. The system’s purpose is to give every household that wants to own a home the tools to achieve it — sustainably and fairly.

Playing to stakeholders’ strengths

A clean-slate market would recognize the strengths and weaknesses of each participant:

- Households are the consumers of housing, but also the weakest financial entity in the system. They need stability, transparency, and fairness — not complexity or excessive risk transfer.

- Banks and credit unions excel at origination — marketing, sales, underwriting, and operations. They should continue to serve as the primary interface with borrowers. But they are not strong at long-term asset management; forcing them to carry duration and prepayment risks indefinitely weakens both them and the system.

- Investors and capital markets are best at managing long-term assets, pricing risk, and providing liquidity. A clean-slate system would give them standardized, transparent instruments to absorb the risks banks shouldn’t hold.

- Brokers should serve as advisors and guides. Today, their incentives are too often tied to volume, not outcomes. In a redesigned market, brokers would be rewarded for matching households with products that are sustainable for the long run.

- Regulators and policymakers should focus on transparency, fairness, and systemic stability, not product micromanagement. Their role is to ensure trust, not to stifle innovation.

In short: each player should focus on what they do best.

Product design: Learning globally, innovating locally

No country has a perfect system, but every country has features worth learning from:

- Mortgage portability (Canada, Europe): A loan that moves with the borrower, reducing lock-in and increasing labor mobility.

Imagine if a homeowner with a 3% mortgage rate, could take their loan (and its terms) when they move. This seems intuitive, but extremely hard to implement in the US market, mainly due to mortgage securitization, and many lenders are not national. - Indexed products (Iceland, Israel): Linking payments to inflation or wages, aligning obligations with real household capacity.

Imagine a monthly payment that is linked to the borrower’s salary – small when they are young and just getting started, and increases as their earnings increase. Or, imagine the monthly payment was linked to the actual price of housing consumption, also known as rent.

“We can’t solve problems by using the same kind of thinking we used when we created them.”

Albert Einstein

- Tradable mortgage bonds (Denmark): Standardized securities that give investors liquidity and borrowers lower costs.

- Compounded products: Hybrids that start fixed and gradually shift to indexed or floating structures, balancing stability with flexibility.

We should also innovate beyond what exists:

- Equity-like features for households: A mortgage is purely debt today. Yet companies raise capital with a mix of debt and equity. Why shouldn’t households have access to similar blended structures — for example, products where investors share upside in home value in exchange for reduced debt burden?

- Aligned incentives: Loan officers shouldn’t be rewarded only for origination volume. Their incentives should account for the long-term performance and risk profile of the assets they help create.

Incentives and alignment

A redesigned system would carefully balance short-term and long-term incentives. Today’s structures often prioritize immediate fees, leading to volume-driven origination and weak long-term discipline. If we want a healthier market:

- Originators should benefit when loans perform well over time.

- Servicers should be rewarded for quality customer outcomes, not just collections.

- Investors should have confidence that risks are transparent and fairly priced.

When incentives align across the chain — household, lender, broker, investor — the system becomes both more stable and more inclusive.

Main Street and Wall Street: Partnership, not opposition

The relationship between main street and Wall Street is often framed as adversarial: households on one side, investors on the other. But in a clean-slate system, the two would be partners.

Capital markets have the depth and tools to absorb risk. Banks and credit unions have the relationships and distribution networks to originate responsibly. Households bring demand, trust, and repayment capacity. Aligning these three is the only way to create a housing finance system that is sustainable at scale.

The market we should build

“Yesterday’s home runs don’t win today’s games.”

– Babe Ruth

If we were designing today, we would not settle for a one-size-fits-all debt instrument that traps households, overburdens banks, and leaves investors navigating opaque products. We would build a system that:

- Gives households flexible, portable, and even equity-like options to finance ownership.

- Lets banks focus on origination and servicing, not long-term asset warehousing.

- Provides capital markets with standardized, transparent channels to fund housing.

- Rewards brokers and loan officers for long-term outcomes, not just short-term volume.

The result would be a mortgage market that expands access to homeownership, distributes risk to the right balance sheets, and strengthens both local communities and the broader financial system.

We can’t erase history. But we can learn from it, here and abroad, to imagine something better.

Jonathan Arad is the CEO of Takara.

This column does not necessarily reflect the opinion of HousingWire’s editorial department and its owners. To contact the editor responsible for this piece: [email protected].

Read More

By: Jonathan Arad

Title: If we built the mortgage market from scratch, what would it look like?

Sourced From: www.housingwire.com/articles/if-we-built-the-mortgage-market-from-scratch-what-would-it-look-like/

Published Date: Thu, 20 Nov 2025 07:23:43 +0000

.png)