The U.S. housing market is showing signs of a broad slowdown, with resale home prices now declining in more than one-third of major metro areas, according to a report from John Burns Research & Consulting (JBREC).

Of the 150 metro markets tracked by the firm, resale prices have dropped year over year in 53 of them (35%) as the slowdown spreads from early hotspots like Texas and Florida to other parts of the country.

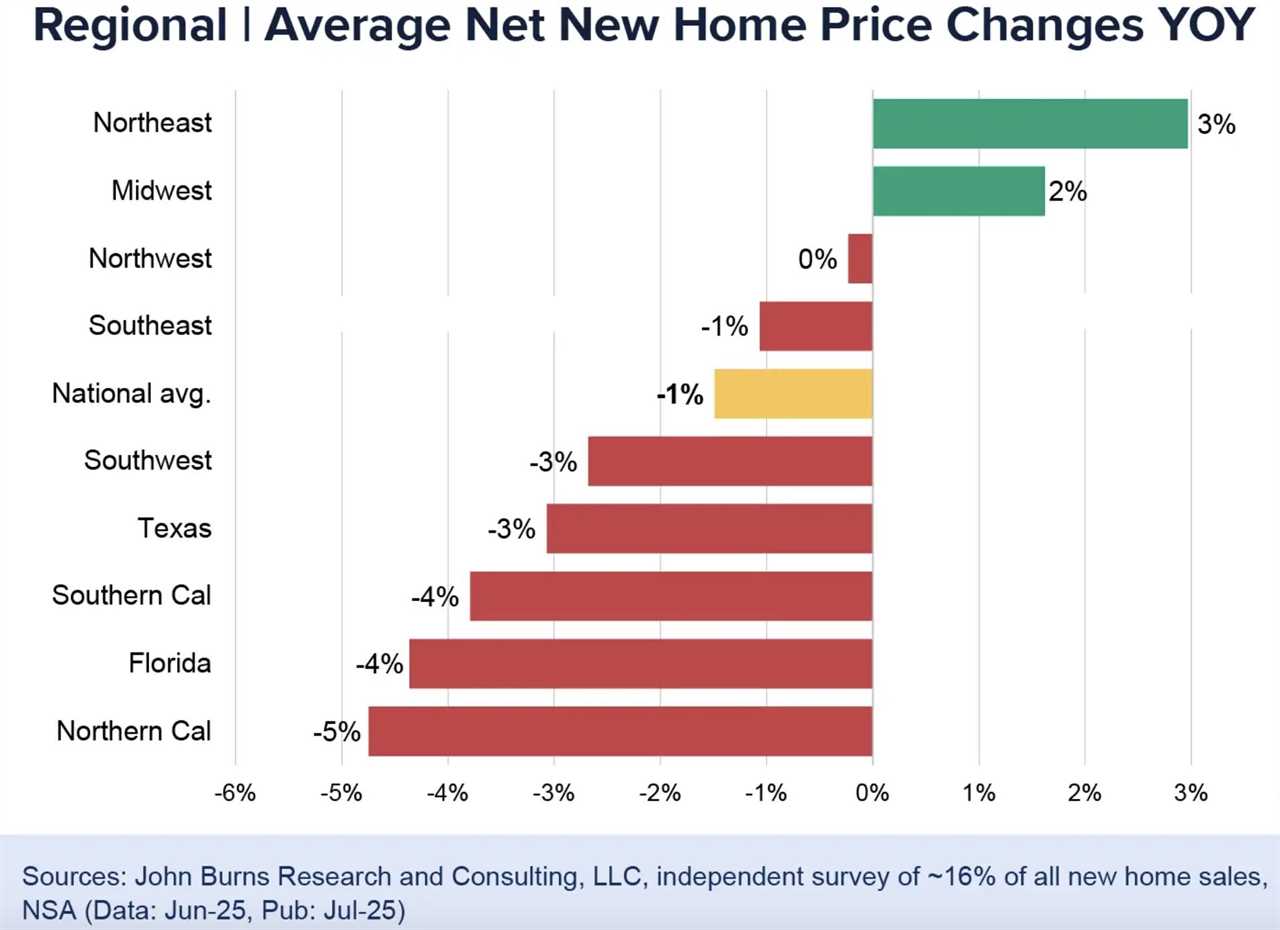

New-home prices fall amid oversupply

Homebuilders — who are facing a rare surplus of unsold finished homes — are slashing prices and offering incentives to lure buyers. The average price of a new home, including concessions, is down 1.5% compared to a year ago, according to JBREC.

“New home construction (is) exceeding job creation in most areas,” the report notes. “The supply of newly built homes is outpacing new demand.”

This mismatch is reshaping builder strategies nationwide.

From the Southeast to the West Coast, and increasingly in the Midwest and Northeast, price weakness is expanding as once-resilient markets lose their pricing power, the report added.

Job market slows, weakening buyer demand

The labor market, a critical driver of homebuyer activity, is faltering and dragging housing demand down with it, JBREC argues.

“Employment growth has slowed, and some markets are losing jobs compared to last year,” the report states. “The high-income sectors that typically drive new home purchases (information, financial activities, and professional and business services) are experiencing the steepest losses.”

While job growth continues in some post-pandemic hotbeds like Charlotte, Salt Lake City and San Antonio, the pace has slowed notably. In contrast, the Bay Area and other high-cost coastal markets are now posting year-over-year job losses.

These declines disproportionately affect high-income workers, who are most likely to purchase new homes. And despite economic uncertainty, rental housing has shown more strength, the report found.

Buyers, sellers and investors

Buyers with secure jobs may find rare opportunities in the current climate. For sellers, however, the dynamics have shifted as fast, above-list-price sales are no longer the norm.

“The days of quick sales at a high asking price have ended in most markets,” the report said. “Realistic pricing and patience will be essential.”

Entry-level sellers must meet the affordability constraints of first-time buyers, while sellers of move-up and luxury homes must consider the logistics of their buyers who need to sell their current properties.

Investors face a mixed bag. Flippers and those targeting high rental yields may struggle, but long-term investors with a strategy focused on asset diversification or rental portfolio growth may find opportunities, JBREC explained.

“The housing market is entering a new phase after years of explosive growth,” the report concludes. “Understanding these trends can help you make better decisions, whether you’re buying, selling or simply planning for the future.”

What does HousingWire Data say?

Of the 366 metro areas tracked by HousingWire Data, 168 (or 45.9%) have experienced year-over-year declines in their median prices as of July 11. The data also confirms that Texas and Florida continue to experience significant pressure.

Florida metros are experiencing widespread price declines, with 85% showing year-over-year declines, while 60% of Texas metros are experiencing a dip.

Miami-Fort Lauderdale-Pompano Beach leads the declines in Florida with a 10.5% year-over-year decline, according to HousingWire Data. The median price in the metro area has fallen from $849,000 to $760,000. There’s a similar stories in other areas:

- Naples-Marco Island down (-7.1%)

- Deltona-Daytona Beach-Ormond Beach (-6%)

- Cape Coral-Fort Myers (-5%)

In Texas, the Sherman-Denison metro area shows the largest price decline among the state’s metros at 10.1%. Median prices have fallen from $428,410 to $385,000.

------------Read More

By: Jonathan Delozier

Title: John Burns: Home prices are down in 35% of US markets

Sourced From: www.housingwire.com/articles/home-prices-down-in-35-percent-of-markets-john-burns/

Published Date: Thu, 07 Aug 2025 19:40:51 +0000

.png)