Have lower mortgage rates finally boosted the weekly purchase application data? Mortgage rates are at 6.29% today following the PPI inflation report. The report, which was expected to show inflation of 3.3%, came in significantly lower at 2.6%. This led to a slight decrease in bond yields. Still, mortgage pricing has remained at the same 6.29% level as yesterday, according to Mortgage News Daily. However, today I finally have enough evidence to show that housing data really improves once rates get below 6.64% and head toward 6%.

Purchase application data

Analyzing purchase application data is the quickest way to determine if lower mortgage rates are having an impact. After 2022, I’ve noticed that housing demand improves when mortgage rates drop below 6.64% and move towards 6%. We observed this trend twice: in late 2022 and around the middle of last year, each time leading to over 12 weeks of positive data before rates increased again. So what have the past six weeks indicated since mortgage rates fell below 6.64%?

After breaking below 6.64%, we are seeing the demand data we’ve been looking for. Five out of the last six weeks have shown positive week-to-week results, which complements the positive year-over-year data showing double-digit growth every week. Now, we just need 12-14 weeks of this to make this the third time since late 2022 that the demand data picks up at this level of mortgage rates. Below is the week to week data that came out today and how purchase application data has looked in 2025.

Purchase application data update:

- +7% week to week

- +23% year over year

Here is the weekly data for 2025 so far:

- 17 positive readings

- 12 negative readings

- 6 flat prints

- 32 straight weeks of positive year-over-year data

- 19 consecutive weeks of double-digit growth year over year

What is important to me is to see an increase in week-to-week growth that aligns with the year-over-year data. So far this year, the week-to-week data has not been as strong as the year-over-year growth. We can attribute the positive year-over-year data to having more sellers — who are also buyers — filling out the purchase applications to buy a home. However, what we still need is consistent positive week-to-week data.

Conclusion

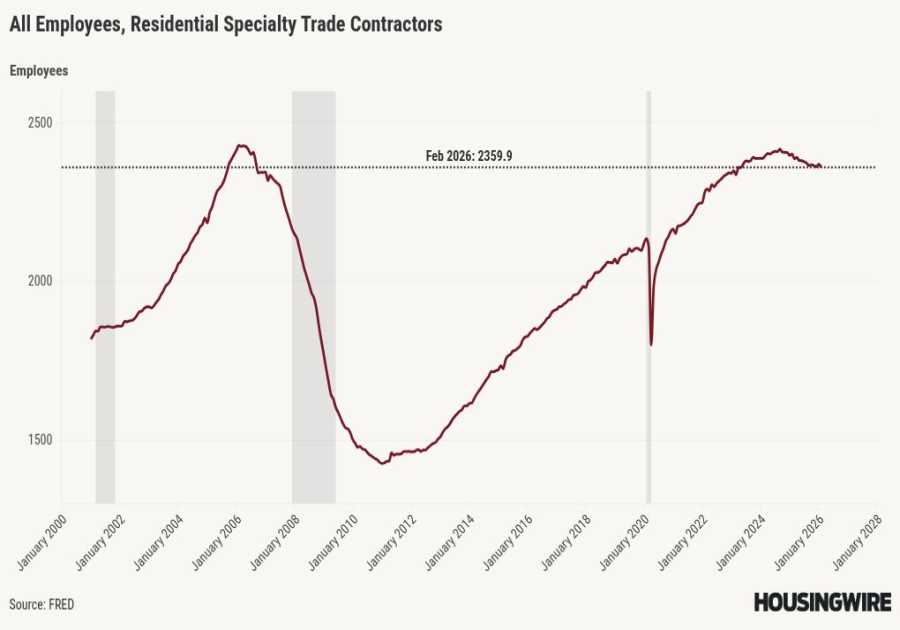

Lower mortgage rates are already helping the housing market, which is desperately needed as residential construction labor has been falling for months now. We still have time to change this, and as you can see below, this is a very critical labor sector to my own economic cycle work.

We will have the CPI inflation report tomorrow and the Fed meeting next week, so we have a lot more variables that can move the bond market and mortgage rates in the next seven days.

------------Read More

By: Logan Mohtashami

Title: Lower mortgage rates are impacting housing demand more noticeably now

Sourced From: www.housingwire.com/articles/lower-mortgage-rates-are-impacting-housing-demand-more-noticeably-now/

Published Date: Wed, 10 Sep 2025 16:20:50 +0000

Did you miss our previous article...

https://trendinginbusiness.business/real-estate/the-ultimate-real-estate-agent-schedule-to-set-you-up-for-success

.png)