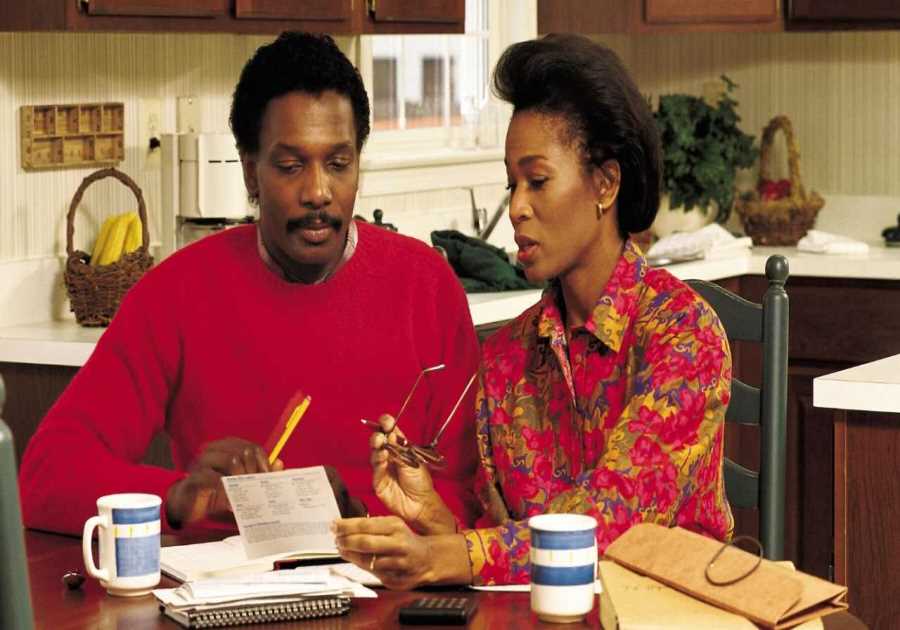

The stability and wealth-building that comes with homeownership can be beneficial for anyone, including people with disabilities.

Some types of mortgage loans are better suited to certain needs than others. For example, someone who requires a home to be adapted to their mobility needs might find a renovation mortgage to be a better option than a standard conventional mortgage.

Additionally, if you need assistance beyond a mortgage to get into a home, there are many different forms of aid available that can help you become a homeowner if you have a disability or are in a lower-income household. Here’s a round up of the most commonly-used home loans and grants for those with a disability.

Can I get a mortgage on Social Security disability?

When you go through the mortgage approval process, you’ll need to show proof of income. Lenders will use all the eligible income you earn to determine how much house you can afford.

If you receive disability income, either from the Social Security Administration (SSA) or from other sources, you can use disability income to buy a house.

Sources of disability income that can be used to qualify for a mortgage include:

- Social Security Disability Insurance (SSDI)

- Supplemental Security Income (SSI)

- Private disability insurance

- Worker’s compensation

- VA disability compensation

How to use disability income to qualify for a mortgage

Shashank Shekhar, founder and CEO of InstaMortgage, says that the process of verifying disability income with your lender is generally straightforward and shouldn’t be too burdensome.

According to Fannie Mae and Freddie Mac, the two government-sponsored enterprises that set the guidelines for conforming mortgages, lenders need to know:

- That you’re eligible for disability benefits

- How much you receive and frequency of the payments

- That you’ll continue to receive these benefits long term

Your mortgage lender will likely ask for a letter that verifies your benefits (such as an SSA award letter). If you don’t have that, you can provide other documentation to show you’re receiving disability income.

“Even something as basic as a proof of current receipt, which can be your bank statement, in most cases that shows that you’re getting the money from SSA, that will work as well,” Shekhar says.

Home loans for homebuyers with disabilities

You’ve got your proof of disability income lined up, now you just need to decide which type of mortgage you want. There are many options available to all homebuyers. Which one is right for you depends on what you qualify for and what suits your needs.

If you need additional funds to make the home you purchase more accessible, look for lenders that offer renovation mortgages. These combine the funds to purchase and renovate a home into a single loan, meaning you’ll only have one monthly payment to worry about.

1. Conventional loans

Conventional loans are mortgages that aren’t backed by a government agency.

If a conventional mortgage meets Federal Housing Finance Agency (FHFA) loan limits and adheres to Fannie Mae and Freddie Mac guidelines, it’s considered a conforming loan.

These types of mortgage are very popular because they allow lower down payments than many others. You’ll need to put at least 3% down and have a minimum credit score of 620 to get a conventional loan.

For renovation mortgages, look for lenders that offer Fannie Mae HomeStyle Renovation or Freddie Mac CHOICERenovation mortgages. Some lenders may have their own renovation mortgage products available as well.

2. FHA loans

FHA loans are mortgages backed by the Federal Housing Administration. They’re a good option for borrowers with less than ideal credit.

You can get an FHA loan with a down payment of just 3.5% and a credit score of 580. If you have a larger down payment, you may be able to qualify with an even lower score.

The FHA also insures a renovation mortgage product, called a 203(k) rehabilitation loan.

3. USDA loans

USDA loans, which are guaranteed by the US Department of Agriculture, can be a really great deal for low-income folks in eligible areas.

You can use a USDA mortgage to get into a home without a down payment. To qualify, you’ll need to meet income limits and be in an eligible rural or suburban area. Lenders typically look for a credit score of at least 640.

If you’re very low-income, you may also want to look into the USDA’s direct loan program. With a direct loan, the USDA is the lender, rather than guaranteeing a loan made by a private lender.

USDA direct loans are available to those who currently don’t have “decent, safe, and sanitary housing” and are unable to obtain a loan through other sources.

4. VA loans

VA loans are backed by the Department of Veterans Affairs. They’re only available to veterans and service members who meet minimum service requirements. Some surviving spouses may also be eligible. If you have a disability, you may qualify with as little as a single day of service.

You can use a VA loan to buy a home with no down payment, and they typically come with lower rates than conventional mortgages.

In addition to meeting service requirements, you’ll need to meet your lender’s credit requirements. This means you’ll likely need a credit score of at least 620, though some lenders have lower or higher requirements.

For veterans who have disabilities, the VA offers additional benefits along with the standard VA loan program. Those with a service-connected disability don’t have to pay the VA funding fee, and if you receive VA disability compensation, you can use that to qualify.

This article was written by Molly Grace from Business Insider and was legally licensed through the DiveMarketplace by Industry Dive. Please direct all licensing questions to [email protected].

------------Read More

By: newscred_admin

Title: Mortgages and grants to help people with disabilities buy a home

Sourced From: www.pncrealestatenewsfeed.com/mortgages-and-grants-to-help-people-with-disabilities-buy-a-home/

Published Date: Thu, 28 Dec 2023 13:23:13 +0000

Did you miss our previous article...

https://trendinginbusiness.business/real-estate/the-worst-things-we-bought-in-2023

.png)