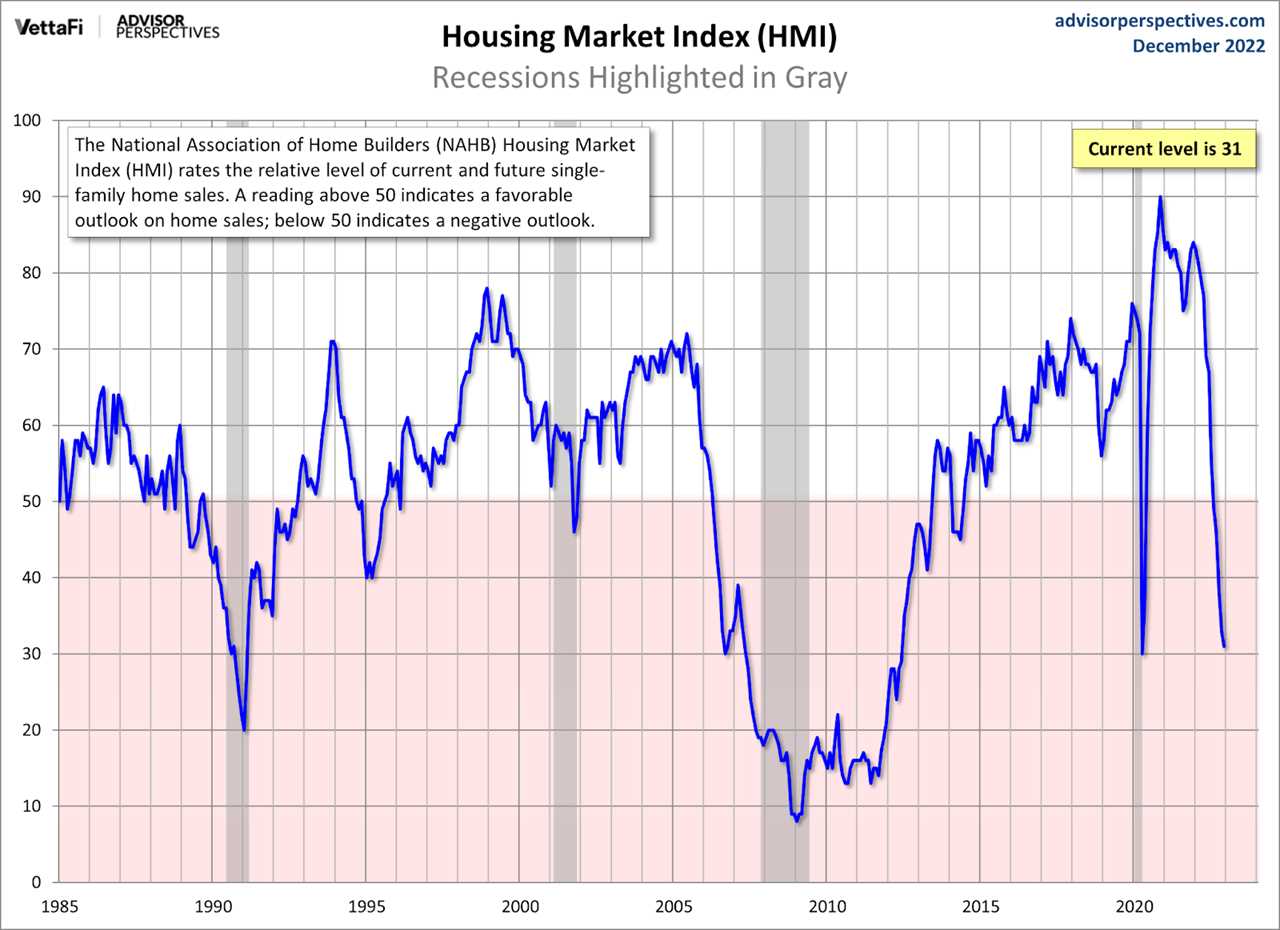

While new home sales did beat estimates in the latest Census report, with sales just floating around near the lows of the year, we can see with the monthly supply data that the builders still have way too much backlog of homes they need to build to raise their confidence.

One of the realities of COVID-19 has been the lag to build homes in a business that requires stable mortgage rates because of the traditional time to complete a home. It didn’t help the builders that they had a global pandemic and we still have many new homes either in construction or that haven’t been started yet.

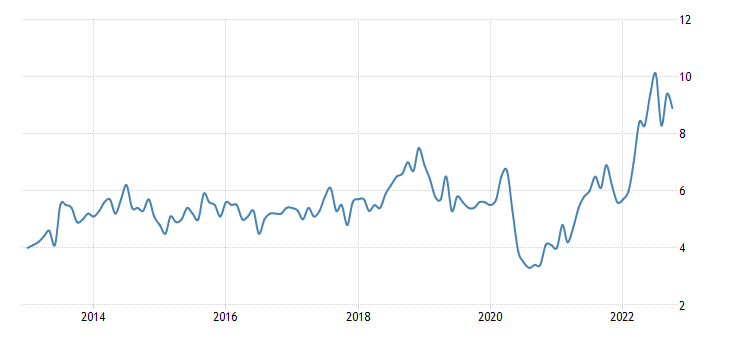

Here is the breakdown of the 8.6 months of supply in the report:

- 64,000 new homes are completed and ready for sale, about 1.2 months

- 290,000 new homes are still under construction, about 5.5 months

- 107,000 new homes haven’t even been started yet, 2.0 months

So, you can see why we aren’t issuing new permits in a more significant fashion anytime soon. Based on my monthly supply model, it’s simply too high for the builders.

Cancelation rates are exploding on them. Mortgage rates jumped from 3% to 7.375% this year. This has led to the monthly supply data rocketing out of control, which has created a waterfall dive in the builders confidence. All these new home sales reports don’t even account for current cancelation rates in the sales data. This means the headline numbers we are seeing aren’t correct.

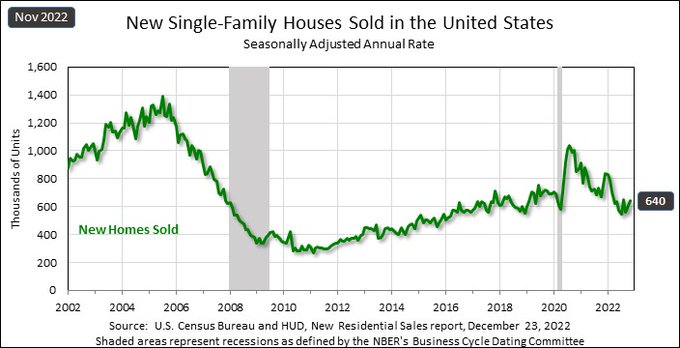

However, even if I adjust for that, sales trends have bounced off the lows for a while. The truth here that nobody wants to talk about is that we didn’t have a massive sales credit boom in housing from 2020-2021 like we saw from 2002-2005. The purchase application data always showed this to be the case, as well as the sales data. This means currently, the new home sales data is historically low already.

Today, new home sales are even lower if you adjust to the population. Remember that the population is still growing in America, we just got the recent report from Census that shows this to be the case. “The U.S. resident population increased by 0.4%, or 1,256,003, to 333,287,557 in 2022, according to the 2022 national and state population estimates.”

From Census: Sales of new single-family houses in November 2022 were at a seasonally adjusted annual rate of 640,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 5.8 percent (±22.7 percent)* above the revised October rate of 605,000, but is 15.3 percent (±13.0 percent) below the November 2021 estimate of 756,000.

The revisions were all negative, and I expect this trend to continue unless the recent fall in rates continues. That would reverse the problem the housing market has had selling homes with mortgage rates above 7%.

We must remember that the builders don’t operate like existing home sellers; they treat their products as commodities. This means they build it and try to sell it for as much money as possible and don’t want to see a significant backlog, which creates more deflationary problems for their profit margins.

Unlike an existing home seller who needs to find a home to live in after they sell, the new home sales market will never have that issue — or living in a house with a 3% mortgage rate that they don’t want to give up. You could have specific buyers that need to sell their current home in order to buy a new home and don’t want to bother with it now since rates are so much higher.

I believe more people simply don’t qualify, and the cancelation rate is something the builders have excellent data on.

Monthly supply of new homes still too high

My rule of thumb for anticipating builder behavior is based on the three-month supply average. This has nothing to do with the existing home sales market; this monthly supply data only applies to the new home sales market

- When supply is 4.3 months, and below, this is an excellent market for builders.

- When supply is 4.4 to 6.4 months, this is an OK market for the builders. They will build as long as new home sales are growing.

- The builders will pull back on construction when the supply is 6.5 months and above.

The monthly supply data did fall in this report to 8.6 months, but it is still simply too high for the builders to issue more permits; thus, the housing recession continues.

From Census: For Sale Inventory and Months’ Supply The seasonally‐adjusted estimate of new houses for sale at the end of November was 461,000. This represents a supply of 8.6 months at the current sales rate.

The median sales price of new homes doesn’t reflect reality

The median sales price looks strong year over year and slightly declines month to month. However, we always have to be skeptical of median sales prices, especially in the new home market. Selling bigger homes in a smaller sales lot can distort prices. This can also work in the opposite direction, as median sales prices can seem to fall significantly when smaller-priced homes are selling.

From Census: Sales Price The median sales price of new houses sold in November 2022 was $471,200. The average sales price was $543,600.

A lot of new homes left to build

With excess housing supply and so many homes left to build, you can see why the builder’s confidence has collapsed, as mortgage rates have risen so much this year.

We have seen that since mortgage rates have fallen, purchase application data has grown for over seven weeks, and the builder’s confidence looking out six months went positive, working from a shallow bar.

The housing market dynamic can undoubtedly change if mortgage rates can move down to 5% with duration and stick. If that doesn’t happen, the housing recession, which started in June of this year, will be hitting its first anniversary next year. The early Christmas present of lower mortgage rates did breathe some life into this sector, and we will keep our eye on that going forward.

------------Read More

By: Sarah Wheeler

Title: New home sales still show a historic backlog

Sourced From: www.housingwire.com/articles/new-home-sales-still-show-a-historic-backlog/

Published Date: Fri, 23 Dec 2022 21:25:11 +0000

.png)