As mortgage rates continue to retreat from 2022 highs, all eyes will be on the Federal Reserve this week as it wraps up its final meeting of the year Wednesday.

While the Fed is expected to slow the frenetic pace of short-term interest rate hikes, there’s another factor that could help mortgage rates continue trending down from October’s highs — an easing in the “spread” between 10-year Treasury yields and mortgage rates that brings it back closer to historical norms.

Over the last six years, the primary mortgage spread — the difference between the yield on 10-year Treasurys yields and rates for 30-year fixed-rate conforming mortgages — has averaged about 208 basis points (2.08 percentage points). But at times this year, the spread has exceeded 300 basis points (3 percentage points), as interest rate volatility leaves investors who fund most mortgages viewing them as increasingly risky. A basis point is one hundredth of a percentage point.

“Mortgage rates pulled back slightly in November based on what the market perceived as good inflation news,” Optimal Blue President Scott Happ said in a statement Monday. “The spread between mortgage rates and the 10-year Treasury yield narrowed by 13 basis points during the month to 283 basis points in a sign that investors and lenders may be seeking to accelerate the impact of falling rates. But, despite the improvement in rates, lock activity remained subdued.”

Black Knight’s Originations Market Monitor report, which taps daily rate lock data from the Optimal Blue Product and Pricing Engine (PPE), showed purchase mortgages locks were down 22 percent from October to November, and 48 percent from a year ago.

Looking at the raw number of purchase mortgage locks, which excludes the impact of record home price growth on mortgage origination volume, shows homebuyer demand for purchase mortgages was down by about 27 percent from pre-pandemic levels in 2019, Black Knight said.

Much of the pullback in homebuyer demand is due to the Federal Reserve’s ongoing campaign to fight inflation by raising the federal funds rate, which is the rate banks charge each other for short-term loans. With the Fed lacking direct control over yields on long-term investments like government bonds and mortgages, mortgage rates have been going up even faster than Treasury yields.

Primary mortgage spread above historical norms

At 2.87 percentage points as of Dec. 8, the primary mortgage spread was 79 basis points above the six-year average of 2.08 percentage points. Source: Black Knight and Federal Reserve data retrieved from FRED, Federal Reserve Bank of St. Louis.

Investors who buy mortgage bonds always expect to earn a somewhat higher return than they do for government bonds of a similar term since U.S. government bonds are seen as one of the safest bets around. But the spread between Treasury yields and mortgage rates has widened this year because mortgage investors have been demanding unusually high premiums compared to yields on government debt.

That’s not so much because investors are worried that mortgage borrowers are more likely to default — payments to investors in most mortgage-backed securities are guaranteed by Fannie Mae, Freddie Mac or Ginnie Mae — but because of fears that loans made today will be refinanced if rates drop.

Interest rate volatility and uncertainty about the trajectory of future Fed policy exposes mortgage investors to greater prepayment risk, according to a recent analysis by the Urban Institute’s Laurie Goodman and Michael Neal. The elevated risk of prepayment means mortgage investors expect higher yields, which translates into higher rates for borrowers.

Back in May 2021 — when homebuyers were taking out at mortgages at rates so low they may never have an opportunity to refinance at a better rate — the spread between 10-year Treasury rates and 30-year fixed-rate conforming mortgages was 147 basis points (1.47 percentage points), Black Knight data shows.

By the time rates for 30-year fixed-rate conforming mortgages hit a 2022 high of 7.16 percent on Oct. 24, the primary mortgage spread had doubled, to around 300 basis points (3 percentage points). If Treasury yields stabilize as the Fed slows its short-term rate hikes, the spread could shrink as mortgage investors’ fears about prepayment risk diminish.

Although the primary mortgage spread has already eased a bit, mortgage rates would be nearly 1 percent lower today if the spread was closer to the six-year average of 208 basis points (2.08 percentage points).

“Higher mortgage rates, which are the result of higher Treasury rates, and wider mortgage spreads have pushed affordability out of reach for so many so quickly,” Goodman and Neal wrote in their Urban Institute analysis. “If the mortgage spread were to decline to a more typical level, it wouldn’t totally reverse the effects of higher rates on affordability, but it would help more people pursue homebuying.”

In a Dec. 8 Weekly Market Outlook, Moody’s analyst Cristian Deritis said it’s likely the primary mortgage spread will keep shrinking, but that mortgage rates probably aren’t headed below 6 percent just yet.

“The mortgage rate spread should continue to narrow over time as investors step in to fill the void left by the end of the Federal Reserve’s quantitative-easing program,” Deritis wrote. “Though a narrow spread is supportive of demand, affordability will remain under pressure as rates are unlikely to fall much below 6 percent soon.”

Fed policymakers began raising the federal funds rate in March, after winding down a quantitative easing program that kept interest rates down by adding $40 billion a month in mortgages and $80 billion a month in Treasurys to the central bank’s balance sheet. The Fed began trimming its nearly $9 trillion balance sheet in June and is now letting $35 billion in mortgages and $60 billion in Treasurys roll off its books every month, another factor that makes it harder for long-term rates to fall.

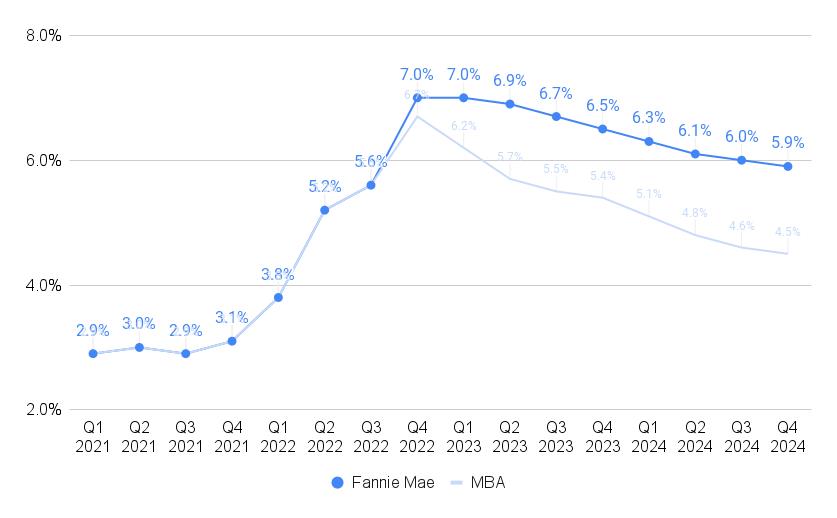

Mortgage rates may have peaked

Source: Fannie Mae housing forecast, November 2022.

While Fannie Mae economists don’t foresee mortgage dropping below 6 percent until late 2024, forecasters at the Mortgage Bankers Association envision a more dramatic decline in rates, with 30-year fixed-rate loans retreating well below 5 percent in 2024.

This article was written by Matt Carter from Inman News and was legally licensed through the Industry Dive Content Marketplace. Please direct all licensing questions to [email protected].

Read More

By: admin

Title: Reduced refi fears could help ease pressure on mortgage rates

Sourced From: www.pncrealestatenewsfeed.com/reduced-refi-fears-could-help-ease-pressure-on-mortgage-rates/

Published Date: Tue, 20 Dec 2022 03:32:50 +0000

.png)