Mortgage applications increased 14.1% from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) weekly mortgage applications survey for the week ending January 16, 2026.

On an unadjusted basis, the index increased 17% compared with the previous week.

Refinance activity continued to be elevated, with the refinance index increasing 20% from the previous week and being 183% higher than the same week one year ago. The refinance share of mortgage activity inched higher to 61.9% of total applications from 60.2% the week prior.

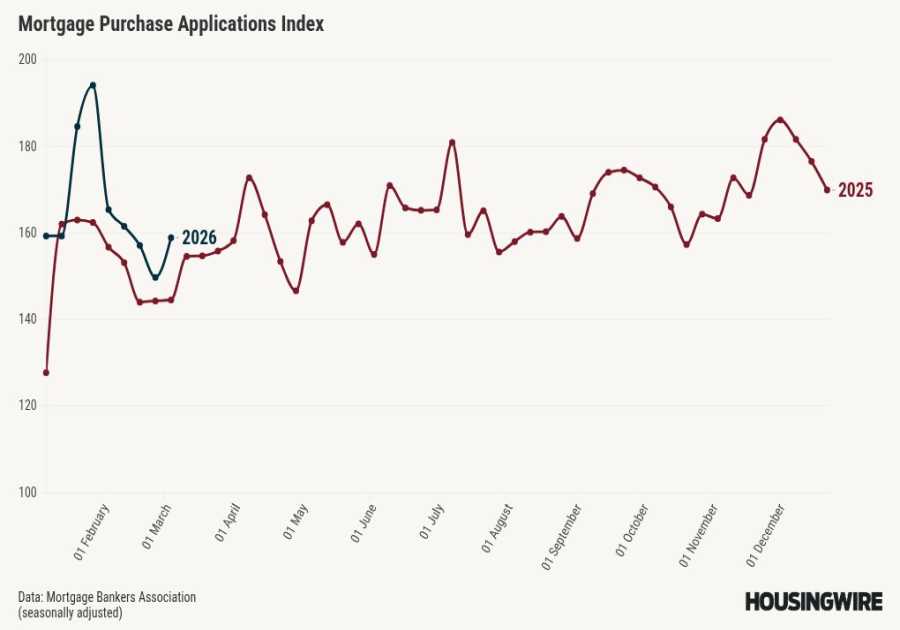

The seasonally adjusted purchase index increased 5% from one week earlier. The unadjusted purchase index increased 12% compared with the previous week and was 18% higher than the same week one year ago.

“Mortgage rates declined further last week, driving another big week for refinance applications, which saw the strongest level of activity since September 2025. The 30-year fixed rate averaged 6.16%, the lowest rate since September 2024,” said Joel Kan, MBA’s vice president and deputy chief economist. “These lower rates prompted greater refinance activity from conventional and VA refinance borrowers, with increases of 29% and 26%, respectively. Refinance applications accounted for more than 60% of applications, and the average loan size also moved higher.”

Purchase apps also up

Added Kan, “Purchase applications were also up over the week, fueled by an 8% increase in conventional loan activity, and were almost 18% higher than last year.”

The adjustable-rate mortgage (ARM) share of activity increased to 7.1% of total applications. By product, the Federal Housing Administration (FHA) share of total applications decreased to 15.9% from 19.2% the week prior. The U.S. Department of Veterans Affairs (VA) share of total applications increased to 16.2% from 16.1% the week prior, while the U.S. Department of Agriculture (USDA) share of total applications remained unchanged at 0.4%.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances decreased to 6.16% from 6.18%. Jumbo loan interest rates decreased to 6.39% from 6.42%.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA decreased to 6.04% from 6.08% and rates for 15-year fixed-rate mortgages decreased to 5.55% from 5.60%. The average contract interest rate for 5/1 ARMs remained unchanged at 5.42%.

------------Read More

By: Sarah Wolak

Title: Refinance demand soars 20% after rates dropped last week

Sourced From: www.housingwire.com/articles/refinance-activity-rate-drop/

Published Date: Wed, 21 Jan 2026 14:13:17 +0000

Did you miss our previous article...

https://trendinginbusiness.business/real-estate/vineyards-meet-vintage-furniture-at-one-of-ibizas-first-passive-houses

.png)